I began trading in 2015 and started coaching in 2019. Moreover, Gen Z represents the most digitally native generation in investment history. However, social media creates dangerous misinformation that destroys portfolios before they start. Therefore, this guide helps you separate viral content from legitimate wealth building strategies.

👉 In this guide, you will learn:

- 🚨 How to identify dangerous TikTok investment advice that costs money

- 📱 Technology tools that actually build wealth for Gen Z investors

- 💰 Real investment strategies that work beyond social media hype

- 🧠 Psychology of investing versus gambling mentality on apps

- 📊 Building diversified portfolios with limited starting capital

- 🎯 Long-term wealth building that beats day trading speculation

- 🔍 Fact-checking investment claims and avoiding costly mistakes

Gen Z enjoys unprecedented access to investment information and technology. Unfortunately, this access also enables scammers and entertainers to promote dangerous advice. Additionally, the consequences of following bad guidance can devastate your financial future permanently.

Table of Contents

The Gen Z Investment Revolution 📱

Social media transformed how young investors discover financial markets. Previously, investment education required expensive courses or professional advisors. Furthermore, complex strategies remained locked behind institutional barriers completely. Now, anyone can access global markets instantly through smartphone apps.

Positive changes technology created for Gen Z investors:

- 📚 Free access to world-class investment education and analysis

- 🌍 Global market access from any smartphone or device

- ⚡ Real-time market data and breaking financial news

- 💡 Creative explanations that simplify complex investment concepts

- 🤝 Online communities sharing legitimate investment experiences and strategies

However, social media also unleashed serious problems for young investors. Consequently, entertainment often masquerades as legitimate financial guidance. Moreover, viral content prioritizes engagement over accuracy consistently.

Serious risks that emerged for Gen Z:

- 🎭 Entertainers posing as qualified financial advisors and experts

- 💸 Get-rich-quick schemes targeting young, inexperienced investors

- 📈 Pump-and-dump scams disguised as trending stock tips

- 🎰 Day trading promoted as easy money rather than speculation

- 📊 Cherry-picked results that hide massive losses and failures

Smart Gen Z investors must learn to navigate this landscape carefully. Therefore, developing strong filtering skills becomes essential for financial protection.

Major Red Flags in TikTok Investment Content 🚨

Certain warning signs consistently appear in dangerous investment content targeting Gen Z. Meanwhile, legitimate educators rarely exhibit these problematic behaviors. Learning these red flags protects you from costly mistakes and financial disasters.

Show Image

Lifestyle-Based Red Flags

Excessive Wealth Displays Legitimate financial educators focus on education rather than lifestyle promotion exclusively. However, scammers constantly showcase expensive cars, designer clothes, and luxury apartments. Additionally, they claim these possessions result from their trading “secrets” and strategies.

Real educators understand that sustainable wealth building takes years of patience. Therefore, they avoid flashy displays that suggest overnight success stories. Instead, they emphasize discipline, research, and long-term thinking consistently.

Age-Inappropriate Success Claims Many TikTok “financial experts” claim massive wealth at unrealistic young ages. Furthermore, they rarely provide verifiable proof of their claimed success. Moreover, legitimate young investors focus on learning rather than teaching complex strategies.

Watch for suspicious claims like:

- “Made $100K by age 20 with this one trick”

- “Dropped out of college to become a millionaire trader”

- “Retired my parents with crypto gains”

- “Six-figure months from options trading”

Content-Based Red Flags

Oversimplified Complex Strategies Real investing involves nuanced strategies that require careful explanation and context. However, scammers oversimplify everything into viral, catchy soundbites. Furthermore, they ignore important risks and market complexities entirely.

Examples of dangerous oversimplification targeting Gen Z:

- “Just YOLO into meme stocks and hold forever”

- “Options trading is basically free money for everyone”

- “Crypto always recovers, so buy every dip”

- “Day trading beats boring index fund investing easily”

Gambling Language and Mentality Legitimate investment education emphasizes research, patience, and risk management consistently. However, dangerous content promotes gambling language and mentality. Additionally, they encourage all-or-nothing approaches that destroy portfolios.

Red flag language includes:

- “YOLO trades” and “diamond hands” without context

- “To the moon” predictions without analysis

- “This will definitely 10x your money”

- “You’re either rich or broke, no middle ground”

Building Real Wealth: Beyond Social Media Hype ✅

Quality wealth building requires fundamentally different approaches than viral content suggests. Furthermore, legitimate strategies focus on consistency over excitement. Additionally, real investors prioritize education and research over entertainment value.

Starting with Emergency Funds

Emergency funds provide the foundation for all other investment activities safely. Furthermore, having 3-6 months of expenses saved prevents forced investment liquidations. Additionally, this safety net allows for more aggressive investment strategies. Meanwhile, high-yield savings accounts preserve emergency fund purchasing power.

I learned about emergency fund importance during the 2020 market crash personally. Moreover, having adequate cash prevented panic selling at market lows. Furthermore, I could continue investing during the downturn systematically. Therefore, preparation made the difference between fear and opportunity.

Emergency Fund Guidelines for Gen Z:

- 💰 Start with $1,000 minimum for basic emergencies

- 🏦 Build to 3 months expenses in high-yield savings

- 💸 Separate account from checking to prevent casual spending

- 📈 Only for true emergencies, not planned purchases

Index Fund Foundation Building

Index funds offer the best combination of low costs and broad diversification. Moreover, they consistently outperform actively managed funds over long periods. Additionally, they require minimal research and ongoing monitoring from investors. Therefore, I recommend index funds for most Gen Z investment accounts.

Core Index Fund Portfolio for Beginners:

- 📊 Total Stock Market Index: 70% allocation for growth

- 🌍 International Stock Index: 20% allocation for diversification

- 🏛️ Bond Market Index: 10% allocation for stability

This simple portfolio provides global diversification across asset classes effectively. Furthermore, automatic rebalancing maintains target allocations over time. Additionally, low expense ratios maximize long-term returns through reduced fees.

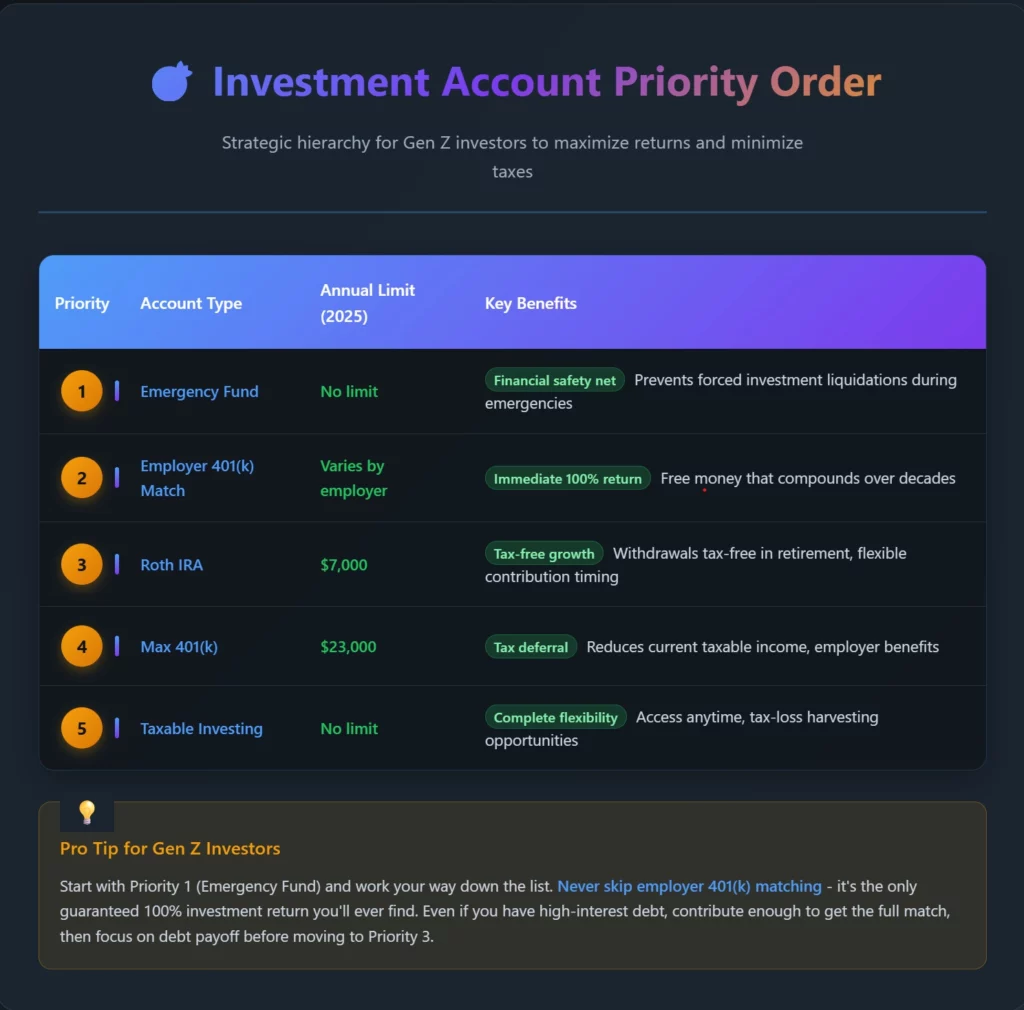

Table 1: Investment Account Priority Order for Gen Z

🎯 Investment Account Priority Order

Strategic hierarchy for Gen Z investors to maximize returns and minimize taxes

| Priority | Account Type | Annual Limit (2025) | Key Benefits |

|---|---|---|---|

|

1

|

Emergency Fund | No limit | Financial safety net Prevents forced investment liquidations during emergencies |

|

2

|

Employer 401(k) Match | Varies by employer | Immediate 100% return Free money that compounds over decades |

|

3

|

Roth IRA | $7,000 | Tax-free growth Withdrawals tax-free in retirement, flexible contribution timing |

|

4

|

Max 401(k) | $23,000 | Tax deferral Reduces current taxable income, employer benefits |

|

5

|

Taxable Investing | No limit | Complete flexibility Access anytime, tax-loss harvesting opportunities |

Technology Tools That Actually Build Wealth 💻

Gen Z has access to investment technology that previous generations never enjoyed. Furthermore, these tools democratize professional-grade investing at consumer prices. However, technology cannot replace fundamental investment knowledge and discipline. Therefore, combine technological advantages with solid education and strategy.

Robo-Advisors for Professional Management

Robo-advisors offer professional portfolio management at fraction of traditional advisor costs. Moreover, they provide automatic rebalancing and tax-loss harvesting services. Furthermore, many offer goal-based investing for specific objectives. Additionally, they typically require lower minimum investments than human advisors.

Popular Robo-Advisor Features for Gen Z:

- 🤖 Algorithm-based portfolio construction and ongoing management

- 🔄 Automatic rebalancing maintains target allocations consistently

- 📊 Tax-loss harvesting improves after-tax returns significantly

- 🎯 Goal-based investing for multiple financial objectives

- 📱 Mobile apps provide easy account access anywhere

However, robo-advisors cannot provide comprehensive financial planning advice. Therefore, complex situations may require human advisor consultation. Additionally, fees can accumulate over time as account balances grow.

Commission-Free Brokerages

Commission-free trading revolutionized investing accessibility for young investors with limited capital. Furthermore, fractional shares enable diversification with small account balances. However, free trading can encourage overtrading and speculation. Therefore, focus on long-term investing rather than frequent trading.

Best Features for Gen Z Investors:

- 💰 Zero commission stock and ETF trades

- 📊 Fractional shares for expensive stocks like Amazon

- 📱 User-friendly mobile apps with research tools

- 📚 Educational content and investment guidance

- 🎯 Automatic investing features for consistency

Chart: Investment Platform Cost Comparison Over 10 Years

[Visual showing total costs across different platforms including robo-advisors, discount brokers, and full-service advisors with various account sizes]

Avoiding Common Gen Z Investment Mistakes ⚠️

Understanding common mistakes helps Gen Z investors avoid costly errors early. Moreover, these mistakes often result from social media misinformation. Furthermore, recognizing these patterns prevents significant financial setbacks. Therefore, learning from others’ mistakes accelerates your wealth building progress.

FOMO and Meme Stock Speculation

Social media creates intense pressure to chase trending investments and meme stocks. However, consistent investing in diversified portfolios outperforms speculation over time. Therefore, I recommend allocating small amounts for speculative investments separately. Moreover, this approach satisfies curiosity while protecting core wealth building.

FOMO Management Strategies:

- 🎯 Limit speculative investments to maximum 5% of portfolio

- 📊 Separate speculation from core investment strategy completely

- 📚 Treat speculation as entertainment, not wealth building

- 🔄 Rebalance regularly to maintain target allocations

- 📈 Focus on long-term goals over short-term excitement

Day Trading and Options Speculation

Day trading appears easy and profitable on social media platforms. However, studies show that 90% of day traders lose money consistently. Furthermore, options trading requires advanced knowledge that most beginners lack. Additionally, these strategies often result in tax complications and losses.

Why Day Trading Fails for Most People:

- 📊 Transaction costs erode profits from frequent trading

- 🧠 Emotional decision-making leads to poor timing

- ⏰ Requires full-time attention during market hours

- 📈 Tax implications from short-term capital gains

- 💰 Most successful traders are institutional professionals

Creating Your Investment Strategy 🎯

Building wealth requires systematic approaches that address your specific situation. Moreover, trying to perfect your strategy prevents you from starting entirely. Therefore, I recommend beginning with basic allocations and improving over time. Furthermore, consistency matters more than perfection in wealth building.

The 70/20/10 Gen Z Framework

Traditional budget frameworks need modification for Gen Z financial realities. Furthermore, lower starting incomes and student debt require adjusted approaches. Therefore, I created a modified framework that addresses our generation’s challenges.

Modified Gen Z Budget Framework:

- 70% Essential expenses (rent, food, minimums, transportation)

- 20% Investing and wealth building (retirement, stocks, emergency fund)

- 10% Lifestyle and discretionary spending (entertainment, hobbies, travel)

However, this framework requires adjustment based on your income level. Moreover, higher earners can allocate more toward investing and savings. Additionally, those with significant debt may need temporary lifestyle reductions.

Goal-Based Investment Allocation

Different financial goals require different investment approaches and timeframes. Furthermore, short-term goals need conservative, liquid investments. Meanwhile, long-term goals can handle volatile, growth-oriented investments. Additionally, this approach optimizes returns while managing appropriate risk levels.

Short-Term Goals (1-3 years): Conservative investments protect principal while providing modest returns safely. Moreover, high-yield savings accounts and CDs ensure money availability when needed. Furthermore, these investments prevent market volatility from derailing important purchases.

Medium-Term Goals (3-10 years): Balanced portfolios can include moderate equity exposure for growth potential. Additionally, target-date funds or balanced funds provide appropriate risk levels. However, maintain some conservative allocation to reduce volatility risk.

Long-Term Goals (10+ years): Aggressive growth portfolios maximize compound interest over extended periods effectively. Furthermore, equity-heavy allocations can weather short-term market volatility. Additionally, tax-advantaged accounts should prioritize growth over income generation.

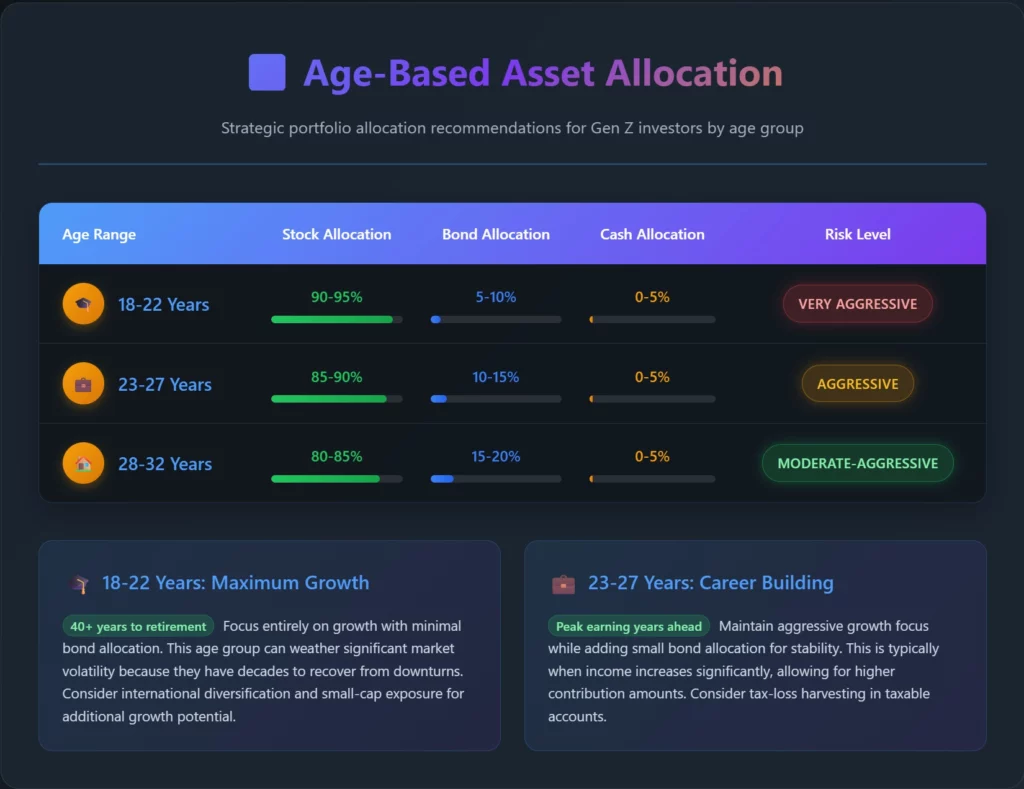

Table 2: Age-Based Asset Allocation for Gen Z

Cryptocurrency: Separating Hype from Reality 🪙

Cryptocurrency generates enormous excitement among Gen Z investors worldwide. Furthermore, social media promotes crypto as guaranteed wealth building. However, cryptocurrency markets remain extremely volatile and speculative. Therefore, strategic approaches prevent devastating losses while allowing participation.

Understanding Crypto Risks

Cryptocurrency investing involves risks that traditional investments do not carry. Moreover, regulatory uncertainty creates additional volatility and potential losses. Furthermore, most crypto projects fail despite initial excitement and promotion. Additionally, scams and fraud remain prevalent throughout crypto markets.

Major Cryptocurrency Risks:

- 🎢 Extreme price volatility that can eliminate portfolios

- 🏛️ Regulatory uncertainty affecting future legality

- 💻 Technology risks including hacks and failures

- 🔍 Limited fundamental analysis tools and metrics

- 🎭 Widespread scams and fraudulent projects

Strategic Crypto Allocation

Responsible crypto investing limits exposure to amounts you can afford losing. Furthermore, cryptocurrency should represent speculative allocation, not core holdings. Additionally, focus on established cryptocurrencies rather than new projects. Meanwhile, never invest money needed for essential expenses.

Crypto Investment Guidelines:

- 🎯 Maximum 5-10% of total investment portfolio

- 📊 Focus on Bitcoin and Ethereum for stability

- 🔄 Avoid leverage and margin trading completely

- 📚 Research projects thoroughly before investing

- 💰 Only invest money you can afford to lose

Chart: Traditional vs Crypto Portfolio Performance Comparison

[Visual showing risk-adjusted returns of portfolios with 0%, 5%, 10%, and 20% crypto allocations over various time periods]

Video Recommendation 🎥

🎬 For detailed guidance on Gen Z investment strategies, watch my Successful Tradings video about building wealth beyond social media hype. The video demonstrates real portfolio construction and risk management. Furthermore, it shows how to separate entertainment from education effectively.

Watch it here: https://www.youtube.com/@SuccessfulTradings and search for “Gen Z Investing: Beyond TikTok to Real Wealth.”

You will learn specific techniques for evaluating investment advice and building sustainable wealth.

Advanced Strategies for High-Income Gen Z 💼

High-earning Gen Z professionals face unique opportunities in financial planning. Furthermore, earlier career starts enable longer compound growth periods. Additionally, technology careers often provide stock compensation requiring strategic management. Therefore, advanced planning becomes essential for optimizing wealth building.

Tax-Advantaged Account Maximization

High earners should prioritize tax-advantaged accounts to reduce current burdens. Moreover, traditional 401(k) contributions provide immediate tax deductions. Furthermore, Roth IRA conversions during low-income years optimize tax strategies. Additionally, Health Savings Accounts offer triple tax advantages.

High Earner Tax Strategy:

- 📊 Maximize traditional 401(k) for current tax reduction

- 🔄 Backdoor Roth IRA for high-income situations

- 🏥 HSA maximization for healthcare and retirement

- 💼 Stock option planning for equity compensation

- 🏢 Tax-loss harvesting in taxable accounts

Stock Option and Equity Compensation

Many Gen Z professionals receive stock options or equity compensation packages. However, these require careful planning to avoid concentration risk. Furthermore, tax implications vary significantly between option types. Additionally, diversification strategies protect against company-specific risks.

Equity Compensation Management:

- 🎯 Diversify away from company stock systematically

- 📊 Understand vesting schedules and tax implications

- 🔄 Exercise options strategically for tax optimization

- 💰 Use proceeds for diversified portfolio building

- 📈 Avoid emotional attachment to company stock

Real Estate Considerations for Gen Z 🏠

Real estate investing attracts many Gen Z investors seeking diversification. Furthermore, rental properties can provide income streams and appreciation. However, direct property ownership requires significant capital and management. Meanwhile, REITs offer real estate exposure with stock-like liquidity.

House Hacking Strategies

House hacking allows Gen Z investors to live in investment properties. Moreover, rental income from other units helps cover mortgage payments. Furthermore, this strategy combines housing needs with investment goals. Additionally, tax benefits include depreciation and expense deductions.

House Hacking Benefits:

- 💰 Rental income reduces housing costs significantly

- 📊 Build equity while living in the property

- 🏛️ Tax advantages including depreciation

- 📈 Learn real estate investing with lower risk

- 🎯 Scale to additional properties over time

However, house hacking requires landlord responsibilities and tenant management. Therefore, consider your comfort level with property management. Additionally, location selection critically affects success and returns.

Chart: Wealth Building Strategies Comparison Over 20 Years

Common Scams Targeting Gen Z Investors 💸

Understanding prevalent scam types helps you recognize and avoid them effectively. Additionally, scammers continuously evolve tactics to target young investors. Therefore, staying informed protects your financial future from fraudulent schemes.

Fake Guru Courses and Mentoring

Scammers target Gen Z with expensive trading courses promising guaranteed success. However, these courses contain basic information available free elsewhere. Furthermore, many focus on high-risk strategies inappropriate for beginners. Additionally, success stories are often fabricated or exaggerated.

Course Scam Warning Signs:

- 💰 Unrealistic profit promises from course completion

- ⏰ High-pressure sales tactics and false scarcity

- 📚 Lack of detailed curriculum information provided

- 🚫 No refund policies or money-back guarantees

- 🎭 Lifestyle displays without verifiable track records

Social Media Pump Schemes

Social media enables coordinated pump-and-dump schemes targeting young investors. Furthermore, influencers promote stocks while secretly selling their holdings. Additionally, Discord groups coordinate buying to artificially inflate prices. Meanwhile, followers lose money when promotion ends.

Pump Scheme Protection:

- 🔍 Research any stock promoted heavily on social media

- 📊 Verify claims through independent financial sources

- 🚨 Avoid stocks with sudden, unexplained price increases

- 💬 Be suspicious of coordinated promotion campaigns

- 📈 Focus on fundamental analysis over social sentiment

FAQs 🤔

Q: How much money do I need to start investing as Gen Z?

A: You can start investing with as little as $1 through fractional shares. Furthermore, many brokerages offer commission-free trading for small accounts. However, I recommend starting with at least $100-500 for meaningful diversification. Additionally, focus on consistent contributions rather than large initial amounts.

Q: Should I trust investment advice from TikTok and Instagram?

A: Use social media for inspiration and education only, never investment decisions. Furthermore, verify all claims through independent, credible sources before acting. Additionally, focus on licensed professionals who provide educational content. Moreover, remember that entertainment often masquerades as advice.

Q: Is cryptocurrency a good investment for young people?

A: Cryptocurrency can be part of a diversified portfolio but should remain speculative allocation. Furthermore, limit crypto to maximum 5-10% of total investments. Additionally, focus on established cryptocurrencies like Bitcoin and Ethereum. However, never invest money you cannot afford to lose completely.

Q: What’s the biggest mistake Gen Z investors make?

A: The biggest mistake is treating investing like gambling or entertainment. Furthermore, many focus on get-rich-quick schemes instead of wealth building. Additionally, following social media advice without research leads to losses. Therefore, prioritize education and long-term strategies over excitement.

Q: How do I know if an investment opportunity is legitimate?

A: Legitimate investments provide detailed information about risks and potential returns. Furthermore, they never guarantee specific profits or use pressure tactics. Additionally, verify credentials through official regulatory databases. Moreover, seek multiple independent sources before making decisions.

Q: Should I pay for investment courses or coaching?

A: Many excellent free resources provide quality investment education initially. Furthermore, expensive courses rarely justify their cost for beginners. Additionally, focus on books, reputable websites, and broker educational content. However, consider professional advice for complex situations after building foundational knowledge.

Q: How do I balance investing with student loan payments?

A: Your loan interest rates determine the optimal strategy completely. Furthermore, loans above 6% deserve aggressive repayment before investing. However, always capture employer 401(k) matching regardless of debt. Additionally, loans below 4% allow simultaneous investing strategies.

Q: What apps should I use for investing?

A: Popular commission-free brokerages include Fidelity, Schwab, and Vanguard for serious investing. Furthermore, robo-advisors like Betterment offer automated portfolio management. However, avoid day trading apps that encourage speculation. Additionally, focus on platforms with educational resources and research tools.

Conclusion

Gen Z enjoys unprecedented access to investment information and technology tools. However, this access also creates exposure to dangerous misinformation and social media scams.

Therefore, developing strong filtering skills becomes essential for financial success. Furthermore, real wealth building requires patience, education, and systematic approaches.

Quality investment education emphasizes research, diversification, and long-term thinking over viral content. Additionally, legitimate strategies focus on consistency rather than excitement or entertainment. Finally, remember that sustainable wealth building takes time and discipline regardless of generation.

Hold a Master Degree in Electrical engineering from Texas A&M University.

African born – French Raised and US matured who speak 5 languages.

Active Stock Options Trader and Coach since 2014.

Most Swing Trade weekly Options and Specialize in 10-Baggers !

YouTube Channel: https://www.youtube.com/c/SuccessfulTradings

Other Website: https://237answersblog.com/