I began trading in 2015 and started coaching in 2019. Your first $1,000 investment represents the foundation of lifelong wealth building. However, many beginners waste this opportunity on high-risk speculation or paralysis by analysis. Therefore, this guide provides a systematic approach to deploy your first investment dollars strategically.

👉 In this guide, you will learn:

- 💰 The optimal account sequence for your first $1,000 investment

- 🎯 How to avoid beginner mistakes that destroy initial capital

- 📊 Simple portfolio allocation that maximizes long-term growth

- 🛡️ Emergency fund strategies before investing your first dollar

- 🔄 Systematic approaches to scale from $1,000 to $10,000+

- 💡 Technology platforms that minimize costs for small investors

- 📈 Tax-efficient strategies that compound your early gains

Starting with $1,000 creates enormous psychological pressure to make perfect decisions. Unfortunately, this pressure often leads to inaction or costly mistakes. Additionally, social media promotes dangerous shortcuts that can eliminate your entire starting capital.

Table of Contents

The Psychology of Your First $1,000 Investment 🧠

Your first investment dollar carries more emotional weight than your thousandth. Furthermore, beginners often alternate between excessive caution and reckless gambling. Additionally, the desire for quick gains can override logical decision-making processes.

Why first investments feel overwhelming:

- 🎯 Fear of losing everything creates analysis paralysis

- 📱 Social media influence promotes unrealistic expectations

- 💰 Limited capital makes every decision feel crucial

- 🤔 Information overload prevents action entirely

- 🎰 Get-rich-quick temptation leads to speculation

However, successful investors understand that your first $1,000 teaches crucial lessons. Moreover, mistakes at this level cost much less than errors with larger amounts. Therefore, focus on building systems rather than maximizing immediate returns.

The three phases of first-time investor psychology: Phase 1: Research Paralysis (Weeks 1-4) New investors often spend months researching without investing anything. However, perfect knowledge doesn’t exist in investing. Moreover, practical experience teaches more than theoretical research.

Phase 2: Overconfidence (Months 2-6) Early gains often create false confidence leading to speculation. Furthermore, beginners may abandon proven strategies for exciting alternatives. Additionally, success bias makes risky behavior seem smart.

Phase 3: Strategic Discipline (Month 6+) Experienced investors develop systematic approaches that remove emotion. Therefore, they focus on process over outcomes consistently. Moreover, they understand that wealth building requires patience and consistency.

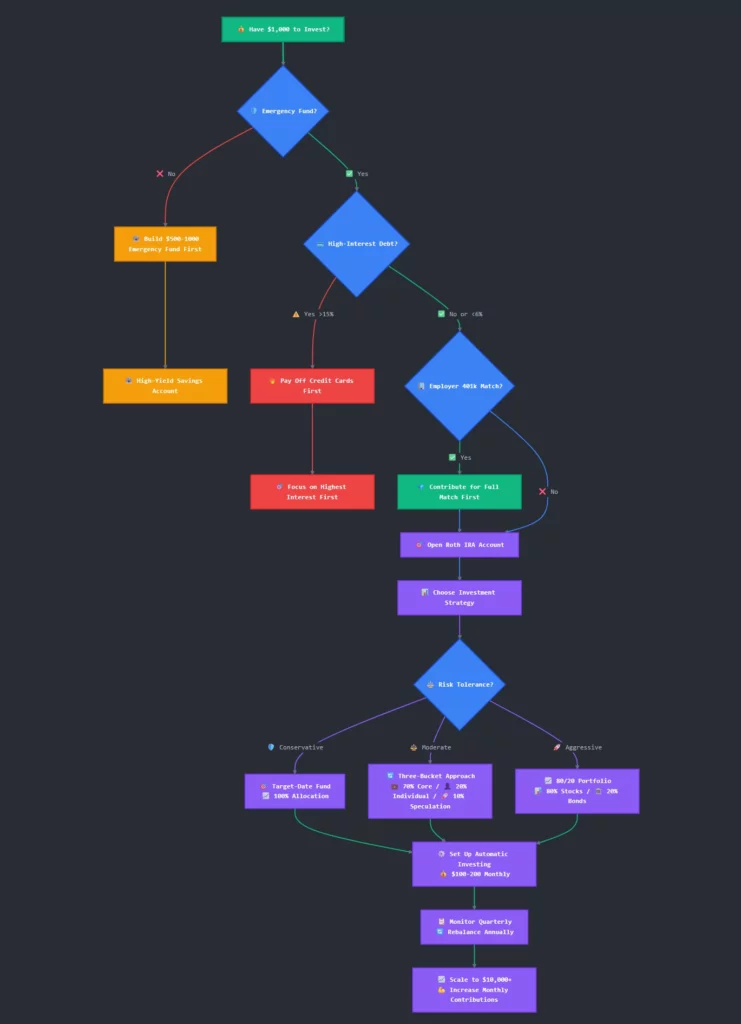

Before You Invest: The $1,000 Foundation Check ✅

Investing your first $1,000 requires completing essential financial preparations first. However, many beginners skip these steps and create financial instability. Therefore, systematic preparation prevents forced investment liquidations.

Emergency Fund Requirements

Never invest without basic emergency protection in place. Furthermore, even $500 in savings prevents minor emergencies from forcing investment sales. Additionally, emergency funds provide peace of mind that enables better investment decisions.

Minimum emergency fund levels before investing:

- 💰 $500 minimum for single person without dependents

- 💰 $1,000 minimum for families or homeowners

- 💰 $1,500 minimum if self-employed or commission-based income

- 💰 One month expenses as ultimate goal before aggressive investing

Emergency fund placement strategies:

- 🏦 High-yield savings account for easy access and growth

- 🏦 Separate from checking to prevent casual spending

- 🏦 Online banks typically offer higher interest rates

- 🏦 Money market accounts for slightly higher yields

Debt Evaluation Framework

High-interest debt can undermine investment returns significantly. Therefore, strategic debt elimination often beats investment returns. However, low-interest debt shouldn’t prevent investing entirely.

Debt vs. Investment Decision Matrix:

- 🚨 Pay debt first: Credit cards, payday loans (15%+ interest)

- ⚖️ Situational: Auto loans, student loans (4-8% interest)

- 💰 Invest while paying: Mortgages, low-rate loans (<4% interest)

- 🎯 Always invest: Employer 401(k) match regardless of debt

Exception: Always capture employer 401(k) matching regardless of debt levels. Furthermore, matching represents immediate 100% returns that no debt payment can beat. Additionally, this free money compounds over decades.

Your First $1,000 Investment Strategy 🎯

Systematic deployment prevents emotional decisions that destroy beginner portfolios.

Moreover, proven strategies work better than complex approaches for first-time investors.

Therefore, focus on simplicity and consistency over sophistication.

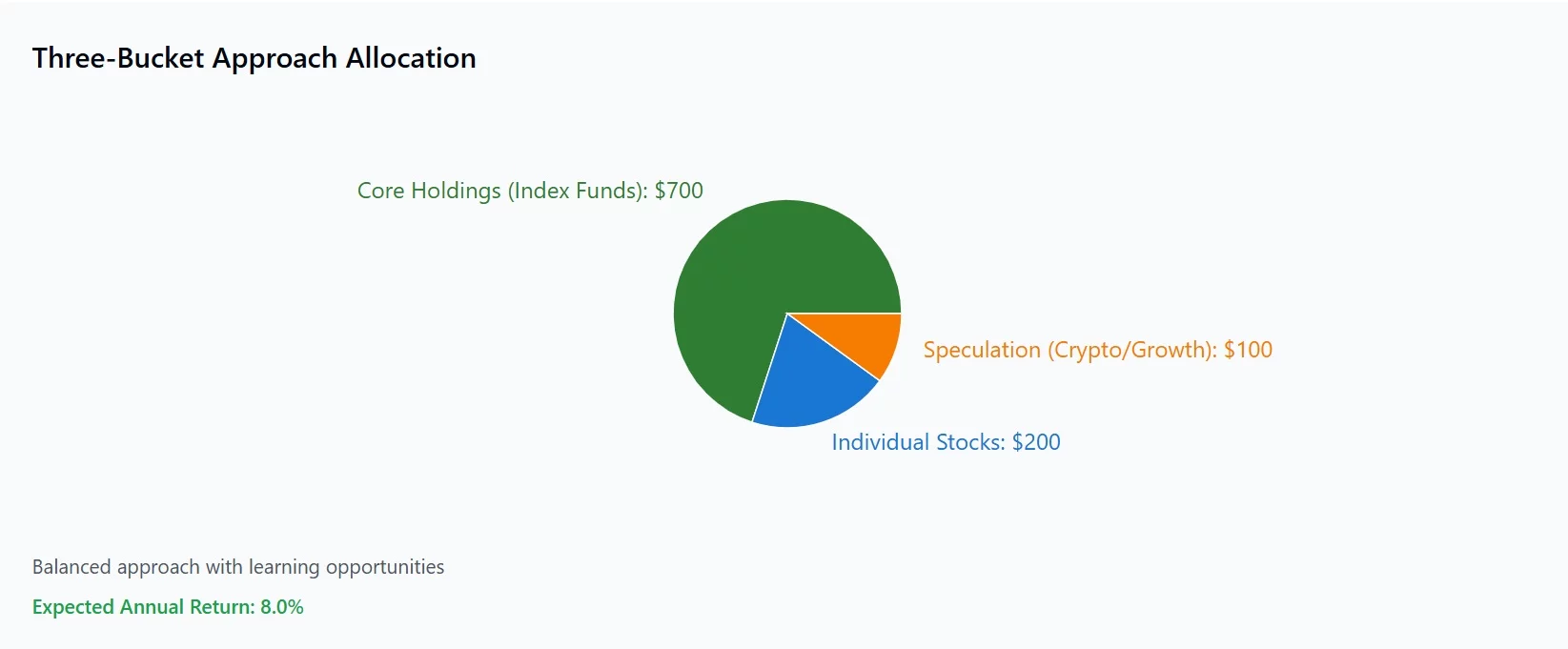

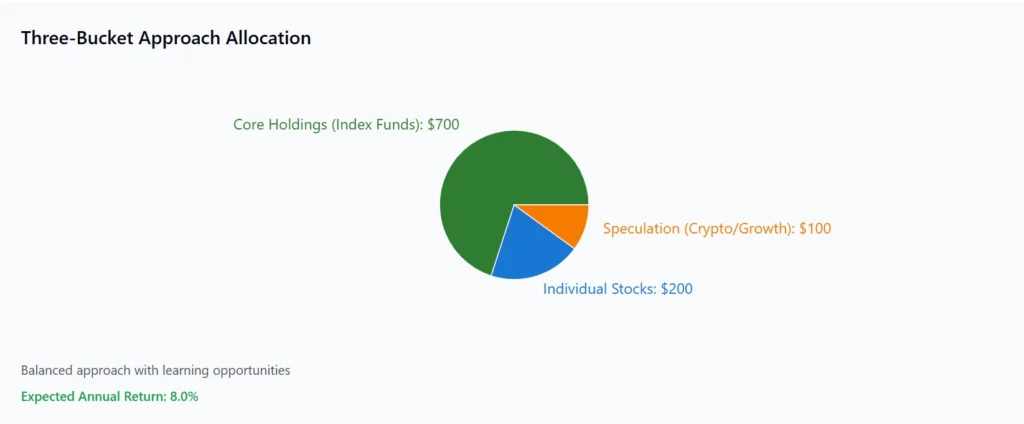

The Three-Bucket Approach

Divide your first $1,000 into strategic allocations that balance growth and learning. However, adjust percentages based on your specific situation and risk tolerance. Additionally, this framework scales as your investment capital grows.

Bucket 1: Core Holdings (70% – $700) Conservative, diversified investments that form your wealth-building foundation. Furthermore, these holdings require minimal monitoring and provide steady growth. Additionally, they teach important lessons about market volatility.

Core holding options for beginners:

- 📊 Target-date funds: Automatic diversification and rebalancing

- 📊 Total market index funds: Broad exposure with low fees

- 📊 Balanced funds: 60/40 stock/bond allocation with professional management

- 📊 Robo-advisor portfolios: Algorithm-based diversification

Bucket 2: Individual Learning (20% – $200) Individual stocks that teach research and analysis skills. However, limit this allocation to prevent speculation from overwhelming your portfolio. Moreover, focus on large, stable companies rather than volatile growth stocks.

Individual stock criteria for beginners:

- 🏢 Large-cap companies with established business models

- 💰 Dividend-paying stocks that provide income and stability

- 📈 Companies you understand and use their products regularly

- 🔍 Simple business models that don’t require complex analysis

Bucket 3: Speculation Buffer (10% – $100) High-risk investments that satisfy curiosity without endangering your foundation. Furthermore, this allocation prevents FOMO from undermining your core strategy. Additionally, it provides hands-on experience with volatile investments.

Speculation options for beginners:

- 🪙 Single cryptocurrency like Bitcoin or Ethereum

- 🚀 Growth stocks in emerging industries

- 📊 Sector ETFs for concentrated exposure

- 🎯 International markets through regional funds

Platform Selection for Small Investors

Commission-free trading revolutionized investing for small accounts. However, platform features matter more than zero commissions alone. Therefore, evaluate research tools, education resources, and user experience carefully.

Best platform features for first-time investors:

- 💰 Zero commission on stocks and ETFs

- 📊 Fractional shares enable diversification with small amounts

- 📚 Educational content and research tools

- 📱 User-friendly mobile apps with intuitive interfaces

- 🎯 Automatic investing features for consistency

Top beginner-friendly platforms comparison:

- Fidelity: Excellent research, no account minimums, superior customer service

- Schwab: Low fees, good education, strong mutual fund selection

- Vanguard: Low-cost index funds, investor-owned structure, long-term focus

- Betterment: Robo-advisor simplicity, automatic rebalancing, goal-based investing

Tax-Efficient Account Selection 🏦

Account choice affects your investment returns more than security selection. Furthermore, tax-advantaged accounts provide immediate benefits that compound over time. However, account selection depends on income level and employer benefits.

The Investment Account Hierarchy

Follow this priority order to maximize tax benefits and investment growth. Moreover, skipping levels often costs money through missed opportunities. Additionally, this hierarchy adapts as your income and situation change.

Priority 1: Employer 401(k) Match Capture free money before considering other options. Furthermore, employer matching provides immediate 100% returns on contributions. However, contribute only enough to receive maximum matching initially.

Priority 2: Roth IRA Foundation Tax-free growth benefits young investors significantly. Moreover, Roth contributions can be withdrawn penalty-free if needed. Additionally, no required distributions preserve tax-free growth longer.

Roth IRA advantages for beginners:

- 🎯 $7,000 annual contribution limit (2025)

- 💰 Tax-free growth and withdrawals in retirement

- 🔄 Contribution withdrawals available penalty-free anytime

- 📈 No required distributions preserve tax-free compounding

Priority 3: Taxable Investment Account Complete flexibility for accessing invested funds. However, tax implications require strategic investment selection. Moreover, taxable accounts enable tax-loss harvesting opportunities.

Priority 4: Additional 401(k) Contributions Maximize tax-deferred space after establishing other foundations. Furthermore, higher contribution limits accelerate wealth building. Additionally, catch-up contributions become available after age 50.

Account Selection for Your First $1,000

Most beginners should start with Roth IRA accounts for maximum flexibility. However, employer matching takes absolute priority regardless of amount. Therefore, evaluate your specific situation before choosing.

Decision framework for first-time investors:

- 🎯 Employer match available: Contribute minimum for full match first

- 🎯 No employer match: Start with Roth IRA for flexibility

- 🎯 High income earner: Consider traditional 401(k) for tax deduction

- 🎯 Uncertain timeline: Use Roth IRA for contribution withdrawal options

Portfolio Construction for Beginners 📊

Simple portfolios often outperform complex strategies over long periods. Furthermore, beginners should prioritize learning over optimization initially. Therefore, start with basic allocation and evolve as knowledge grows.

The 80/20 Starter Portfolio

Aggressive allocation maximizes growth potential for young investors. However, include bonds for volatility reduction and diversification. Moreover, this allocation teaches important lessons about market cycles.

Simple 80/20 allocation breakdown:

- 📈 80% Stocks: Total market index fund or target-date fund

- 🏛️ 20% Bonds: Bond index fund or stable value option

- 🔄 Rebalance annually: Maintain target allocation through additions

Three-Fund Portfolio for Advanced Beginners

Expand diversification while maintaining simplicity and low costs. Furthermore, this portfolio provides global exposure across asset classes. Additionally, it scales effectively as investment amounts grow.

Three-fund portfolio allocation:

- 🇺🇸 60% US Total Market: Broad domestic stock exposure

- 🌍 20% International: Developed and emerging market exposure

- 🏛️ 20% Bonds: Government and corporate bond diversification

Recommended fund examples:

- Vanguard: VTI (US), VTIAX (International), BND (Bonds)

- Fidelity: FZROX (US), FTIHX (International), FXNAX (Bonds)

- Schwab: SWTSX (US), SWISX (International), SWAGX (Bonds)

Scaling Your Investment Strategy 🚀

Your first $1,000 investment teaches lessons that inform larger amounts. Moreover, successful scaling requires systematic approaches rather than ad-hoc additions. Therefore, establish processes that work with $10,000+ accounts.

The $1,000 to $10,000 Roadmap

Systematic growth prevents lifestyle inflation from consuming investment capacity. Furthermore, automated systems remove emotions from investment decisions. Additionally, percentage-based contributions scale automatically with income growth.

Monthly investment scaling strategy:

- 💰 Months 1-6: Focus on consistency with $100-200 monthly additions

- 💰 Months 7-12: Increase to $300-500 monthly as habits develop

- 💰 Year 2+: Scale to 15-20% of gross income systematically

Automatic investment setup:

- 🔄 Direct deposit splits: Automatically allocate raises to investments

- 🔄 Dollar-cost averaging: Regular purchases reduce timing risk

- 🔄 Rebalancing schedules: Quarterly or annual portfolio adjustments

- 🔄 Contribution increases: Annual bumps aligned with salary growth

Advanced Strategies After $5,000

Larger account balances justify more sophisticated approaches. However, complexity should improve returns, not just appear impressive. Moreover, advanced strategies require additional education and monitoring.

Advanced considerations for growing accounts:

- 📊 Asset location optimization: Tax-efficient fund placement

- 🌍 International diversification: Emerging markets and developed countries

- 🏠 REIT exposure: Real estate investment trust allocation

- 💎 Alternative investments: Commodities or other asset classes

Common First-Time Investor Mistakes 🚨

Learning from others’ mistakes saves money and time significantly. Furthermore, these errors often result from emotional decision-making. Therefore, awareness and systematic approaches prevent costly beginner errors.

Mistake 1: Analysis Paralysis

Waiting for perfect knowledge prevents investment entirely. However, time in market beats timing the market consistently. Moreover, practical experience teaches more than theoretical research alone.

Paralysis prevention strategies:

- ⏰ Set decision deadlines: Choose investments within 30 days

- 📚 Start simple: Use target-date funds or robo-advisors initially

- 💰 Invest gradually: Start with partial amounts while learning

- 🎯 Focus on starting: Perfect optimization comes with experience

Mistake 2: Chasing Performance

Recent winners often become future losers in investing. Furthermore, performance chasing typically results in buying high and selling low. Additionally, consistent strategies outperform trendy approaches over time.

Performance chasing warning signs:

- 📈 Buying funds with exceptional recent returns

- 📱 Following social media stock recommendations blindly

- 🔄 Frequent trading based on news or market movements

- 🎯 Abandoning strategies after short periods of underperformance

Mistake 3: Inadequate Diversification

Putting all money in single stocks or sectors creates unnecessary risk. However, diversification requires understanding rather than just buying multiple investments. Moreover, proper diversification includes asset classes and geographic regions.

Diversification guidelines for beginners:

- 📊 No single stock over 5% of portfolio

- 🌍 Include international exposure for geographic diversification

- 🏢 Multiple sectors represented in stock holdings

- 📈 Different asset classes including stocks and bonds

Technology Tools for First-Time Investors 💻

Modern technology democratizes professional-grade investing for small accounts. However, tools should simplify rather than complicate investment decisions. Therefore, focus on platforms that educate and automate effectively.

Robo-Advisors for Automation

Robo-advisors provide professional portfolio management for small accounts. Furthermore, they automate rebalancing and tax optimization tasks. Additionally, most offer goal-based investing features.

Robo-advisor benefits for beginners:

- 🤖 Automatic diversification across asset classes and geographies

- 🔄 Systematic rebalancing maintains target allocations

- 💰 Low minimum investments often $0-500 to start

- 📊 Tax-loss harvesting improves after-tax returns

- 📱 Mobile access enables easy monitoring and contributions

Top robo-advisor options:

- Betterment: Goal-based investing, low fees, excellent interface

- Wealthfront: Advanced tax optimization, high-yield cash account

- Schwab Intelligent: No advisory fees, Schwab fund selection

- Vanguard Digital: Low-cost Vanguard funds, minimal fees

Investment Apps and Platforms

Commission-free investing revolutionized small account accessibility. However, app features vary significantly beyond zero commissions. Therefore, evaluate research tools, education quality, and user experience.

Essential app features for beginners:

- 📊 Educational content and investment guidance

- 💰 Fractional shares for expensive stock diversification

- 🔍 Research tools and company analysis

- 📈 Portfolio tracking and performance reporting

- 🎯 Goal setting and progress monitoring

Building Your Investment Mindset 🧠

Successful investing requires mental discipline more than market knowledge. Furthermore, emotional control prevents costly mistakes that destroy portfolios. Therefore, develop systematic thinking that removes emotions from decisions.

Long-Term Thinking Development

Wealth building happens over decades, not months or years. However, modern culture promotes instant gratification over patience. Moreover, social media amplifies short-term thinking and speculation.

Long-term mindset characteristics:

- 📈 Focus on time in market rather than timing market

- 🎯 Ignore daily fluctuations and focus on yearly progress

- 💰 Reinvest dividends rather than spending investment income

- 📊 Measure progress in years rather than months

- 🔄 Stay consistent regardless of market conditions

Risk Management Psychology

Understanding risk prevents panic decisions during market downturns. Furthermore, appropriate risk levels enable better long-term results. Additionally, risk tolerance often differs from risk capacity significantly.

Risk management principles:

- 🛡️ Only invest money you won’t need for 5+ years

- 📉 Expect volatility and prepare emotionally for declines

- 💰 Diversify investments across assets and geographies

- ⏰ Have patience during temporary market downturns

- 🎯 Stay disciplined when emotions run high

FAQs 🤔

Q: Should I invest my first $1,000 all at once or gradually? A: Gradual investment (dollar-cost averaging) often feels more comfortable for beginners. However, lump-sum investing typically produces better long-term returns. Choose based on your comfort level and learning preferences.

Q: What’s the biggest mistake first-time investors make? A: Analysis paralysis prevents many people from starting entirely. Perfect knowledge doesn’t exist in investing, so start with simple strategies and improve over time through experience.

Q: Should I use a robo-advisor or pick my own investments? A: Robo-advisors work well for beginners who want professional management with minimal effort. However, self-directed investing teaches valuable skills if you enjoy research and want lower fees.

Q: How much should I keep in emergency funds before investing? A: Minimum $500-1000 before investing your first dollar. However, build toward 3-6 months of expenses in high-yield savings for complete financial security.

Q: Is $1,000 enough to start investing seriously? A: Absolutely. Modern platforms enable proper diversification with $1,000 through fractional shares and low minimums. Focus on starting and building consistent habits.

Q: Should I invest in individual stocks or index funds first? A: Index funds provide better diversification and lower risk for beginners. However, allocating 10-20% to individual stocks satisfies curiosity while teaching stock analysis skills.

Q: What investment account should I open first? A: Roth IRA for most beginners due to flexibility and tax-free growth. However, capture any employer 401(k) matching first regardless of other priorities.

Q: How often should I check my investment account? A: Monthly is sufficient for beginners to monitor progress and learn. Daily checking often leads to emotional decisions and unnecessary stress about normal volatility.

Conclusion

Your first $1,000 investment represents the beginning of lifelong wealth building rather than a destination. Therefore, focus on building systematic habits that scale with larger amounts.

Furthermore, simple strategies often outperform complex approaches for beginning investors.

Success requires patience, consistency, and emotional discipline more than market knowledge. Additionally, avoiding common mistakes matters more than perfect optimization initially.

Finally, starting with basic strategies while continuing education creates the foundation for long-term financial success.

Hold a Master Degree in Electrical engineering from Texas A&M University.

African born – French Raised and US matured who speak 5 languages.

Active Stock Options Trader and Coach since 2014.

Most Swing Trade weekly Options and Specialize in 10-Baggers !

YouTube Channel: https://www.youtube.com/c/SuccessfulTradings

Other Website: https://237answersblog.com/