I remember when I first started trading in 2015, constantly obsessing over the “perfect” entry point for every stock purchase. I’d wait for weeks analyzing market conditions, reading financial news, and trying to time the absolute bottom before investing my hard-earned money.

That perfectionist approach nearly destroyed my investment returns. I’d miss incredible growth opportunities while waiting for ideal conditions that never came.

After six months of active trading, I was up only 3% while the S&P 500 gained 8% during the same period.

The game-changer came when I discovered dollar cost averaging in 2016. Since then, both my returns and peace of mind have improved dramatically. Over my six years of coaching investors since 2019, I’ve watched this simple strategy consistently outperform complex market timing attempts.

Understanding dollar cost averaging can transform your investment results without requiring you to become a market timing expert or spend hours analyzing perfect entry points.

Table of Contents

What Exactly Is Dollar Cost Averaging? 💰

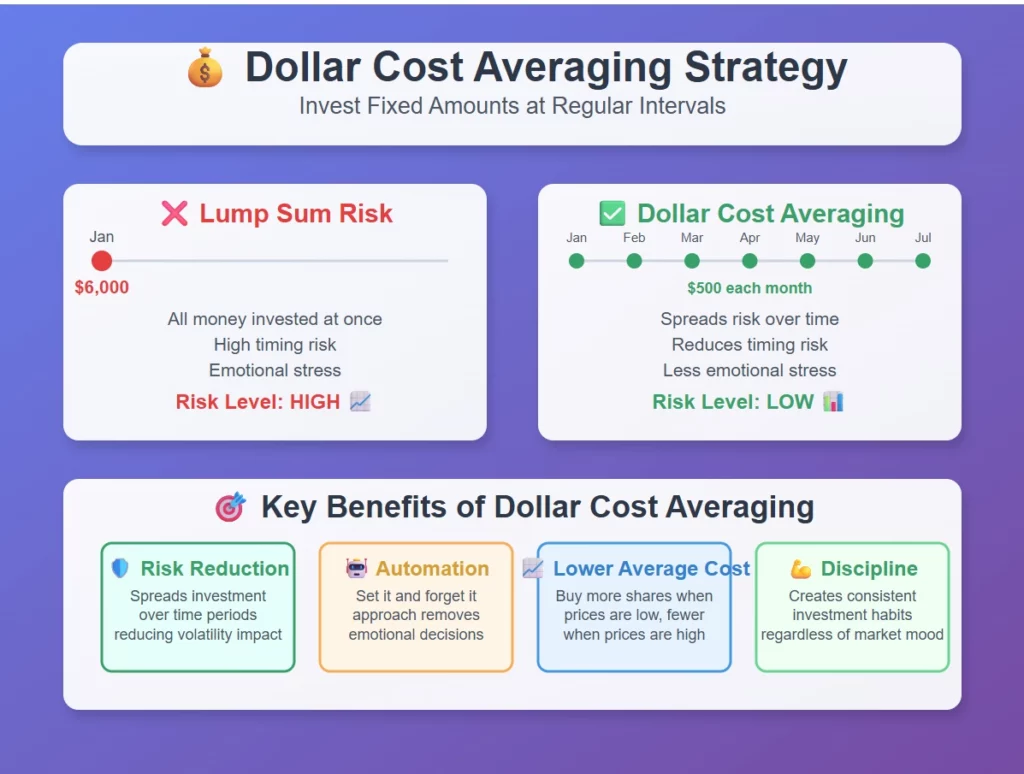

Dollar cost averaging means investing a fixed amount of money at regular intervals, regardless of market prices or economic conditions. Think of it as building wealth on autopilot – you invest the same amount monthly whether markets are up, down, or sideways.

The strategy operates on a brilliant principle: when prices are high, your fixed dollar amount buys fewer shares. When prices are low, that same amount buys more shares. Over time, this averages out your purchase price.

Core dollar cost averaging benefits:

- Lower average costs (smooth out market volatility)

- Reduced timing risk (eliminate guesswork from investing)

- Automatic discipline (remove emotional decision-making)

- Accessibility (start with as little as $25 monthly)

- Less stress (no daily market monitoring required)

I learned this lesson the hard way in 2017 when I waited three months for Apple stock to drop below $150.

It never happened – the stock climbed to $175 while I sat on the sidelines.

Meanwhile, my automated DCA into an S&P 500 index fund captured the entire rally with zero effort on my part.

The Four Pillars of Dollar Cost Averaging Success 🏛️

After coaching hundreds of investors since 2019, I’ve identified four principles that separate successful DCA investors from those who struggle with consistency.

Market Timing Elimination

Markets move unpredictably in short timeframes, making perfect timing nearly impossible even for professionals. DCA removes timing decisions entirely by investing consistently regardless of market conditions.

Volatility Advantage

Market ups and downs become your friend rather than your enemy. When markets decline, you’re buying more shares at lower prices. When markets rise, your previous purchases gain value.

Here’s what shocked one of my clients last year:

Real Client Example:

- 📉 Market crash month: $500 bought 25 shares at $20 each

- 📈 Market recovery month: $500 bought 12.5 shares at $40 each

- 🎯 Average cost: $26.67 per share across both months

- 💰 Result: Better cost basis than lump sum investing

Emotional Discipline Builder

DCA forces consistent behavior during both market euphoria and panic. You invest the same amount whether headlines scream “MARKET CRASH” or “ALL-TIME HIGHS.”

Compound Growth Maximizer

Regular investing ensures you’re always participating in market growth. Missing even short periods can dramatically impact long-term wealth building.

Essential Investment Vehicles for Dollar Cost Averaging 🛠️

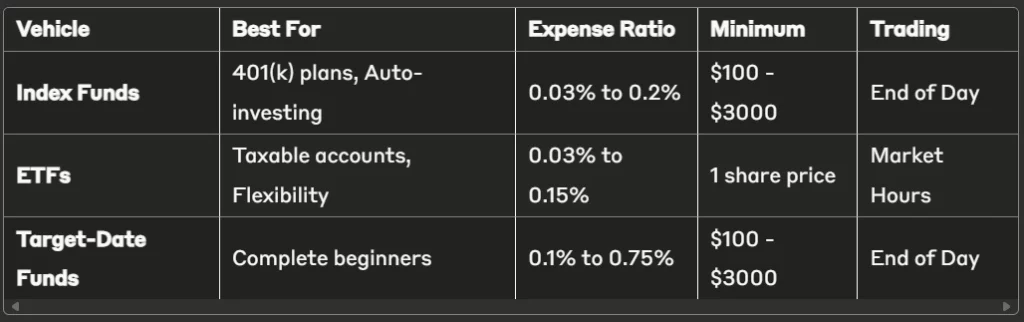

Three main vehicles work perfectly with DCA strategies. Each serves different investor needs and account types.

Index Funds: The DCA Champion

These mutual funds automatically track market indices like the S&P 500. They handle dividend reinvestment and provide seamless automation for dollar cost averaging strategies.

One of my coaching clients, Maria, has used the same total stock market index fund for seven years. She’s never changed her allocation, never tried to time entries, and her account has grown from $8,000 to over $45,000 through consistent $400 monthly contributions.

ETFs: Maximum Flexibility

Exchange-Traded Funds provide index exposure with typically lower costs than mutual funds. They’re perfect for taxable accounts where tax efficiency matters most.

Target-Date Funds: Complete Autopilot

These funds automatically adjust stock/bond allocation based on retirement timeline. They provide complete portfolio solutions for truly hands-off DCA investors.

I typically recommend target-date funds for beginners overwhelmed by asset allocation decisions. They handle everything automatically while you focus on consistent contributions.

How Dollar Cost Averaging Works in Practice ⚙️

Building a DCA strategy involves four straightforward steps that anyone can implement, regardless of investment experience or account size.

Step 1: Choose Your Investment Amount

Start with an amount you can invest consistently without affecting your emergency fund or essential expenses. Most successful DCA investors begin with 10-15% of monthly take-home income.

Example calculation:

- Monthly income after taxes: $3,500

- Essential expenses: $2,400

- Emergency fund contribution: $150

- Available for DCA: $950

- Conservative DCA amount: $300-500

Step 2: Select Your Investment Frequency

Most successful DCA strategies use monthly investments because they align with salary payments. However, you can also invest bi-weekly or weekly for enhanced averaging benefits.

Frequency options:

- 📅 Monthly: Most common and practical approach

- 📅 Bi-weekly: Matches many pay schedules

- 📅 Weekly: Maximum averaging benefit (requires larger amounts)

My recommendation for beginners is monthly investing – it’s simple, sustainable, and highly effective.

Step 3: Choose Your Investments

The best DCA investments are diversified, low-cost, and aligned with long-term goals. Avoid individual stocks or sector-specific funds for core DCA strategies.

Excellent DCA options:

- 🎯 Total Stock Market Index (VTI, FZROX, SWTSX)

- 🌍 Target-Date Funds (Based on retirement year)

- 🌎 International Index Funds (VTIAX, FTIHX)

- 📊 S&P 500 Index Funds (VOO, FXAIX, SWPPX)

Poor DCA options:

- ❌ Individual stocks (too volatile)

- ❌ Sector ETFs (lack diversification)

- ❌ Actively managed funds (high fees)

- ❌ Cryptocurrency (extreme volatility)

Step 4: Automate Everything

Set up automatic transfers from your bank account to your investment account. Then arrange automatic investment purchases on consistent schedules.

Complete automation checklist:

- 🔄 Automatic bank transfers (monthly)

- 💰 Automatic fund purchases

- 📈 Dividend reinvestment enabled

- 📊 Annual rebalancing reminders

The biggest mistake I see new DCA investors make is manual investing rather than automation. Automation removes emotions and ensures consistency during volatile markets.

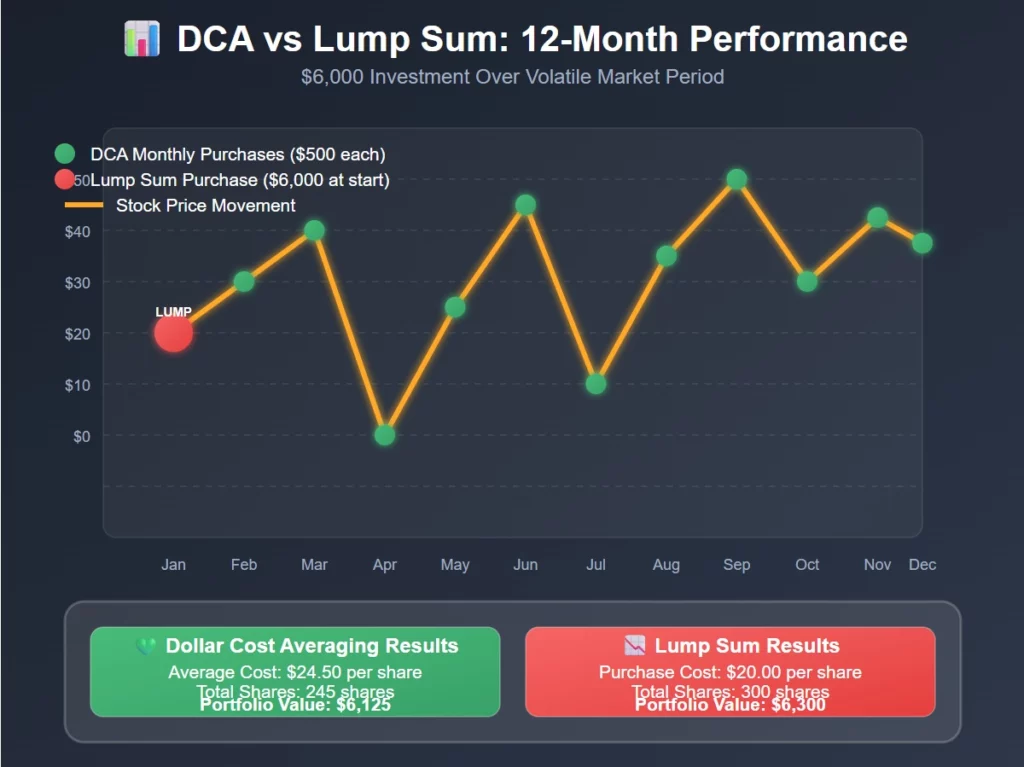

Real-World Dollar Cost Averaging Example 📊

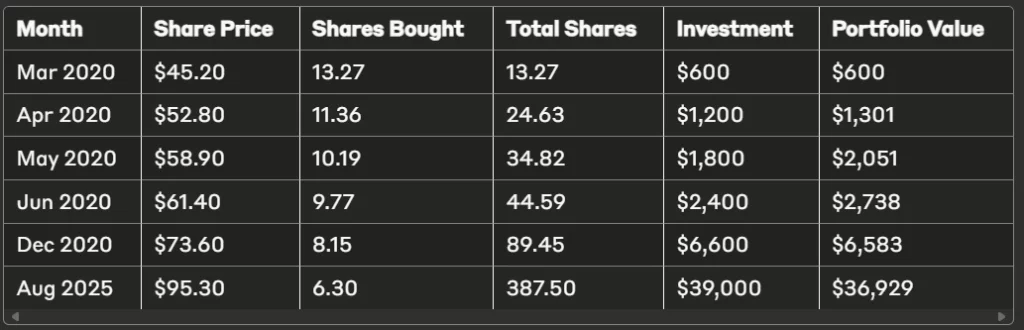

Let me share the exact DCA results from one of my coaching clients who started during the COVID market crash in March 2020.

Client Profile: Jennifer, 29-year-old nurse

Strategy: $600 monthly into total stock market index fund

Timeline: March 2020 – August 2025 (65 months)

Monthly Investment Results:

Final Results:

- 💰 Total invested: $39,000 over 65 months

- 📈 Portfolio value: $36,929 (August 2025)

- 📊 Average cost per share: $58.45

- 🎯 Current share price: $95.30

Even though Jennifer started investing during one of the most volatile periods in market history, her disciplined DCA approach delivered solid results. The key was never stopping contributions, even during scary market moments.

Why Investment Costs Matter for DCA Success 💸

Investment fees compound dramatically over long time periods, making cost minimization crucial for DCA success. Small differences in annual fees result in massive wealth differences over decades.

The Real Cost of High Fees

Let me share a calculation that convinced one client to switch from expensive mutual funds to low-cost index funds.

30-year DCA comparison starting with $500 monthly:

Show Image

- 🔴 High-cost fund (1.5% fee): $659,476 final value

- 🟢 Low-cost index fund (0.1% fee): $789,543 final value

- 💰 Difference: $130,067 more wealth with low costs

🎉 Bottom Line: That 1.4% fee difference cost over $130,000 in retirement wealth!

When I showed him this calculation, he moved his entire portfolio to low-cost index funds within a week. Cost minimization is one of the few guaranteed ways to improve investment returns.

Transaction Cost Benefits

DCA strategies involve frequent purchases, making transaction costs crucial. Many brokers now offer commission-free index fund and ETF investing, eliminating this barrier completely.

Top zero-commission platforms:

- Fidelity (zero-fee index funds)

- Charles Schwab (commission-free ETFs)

- Vanguard (no-fee Vanguard funds)

Setting Realistic DCA Performance Expectations 📊

Dollar cost averaging aims to capture broad market returns while reducing volatility stress. Understanding historical data helps maintain realistic expectations and prevents costly emotional decisions.

Historical Market Performance

The S&P 500 has averaged approximately 10% annual returns over the past century, though individual years vary dramatically. DCA helps smooth out this year-to-year variation.

Key market statistics:

- Average annual return: ~10% (including dividends)

- Best year: +37.6% (1995)

- Worst year: -37.0% (2008)

- Positive return years: About 75% of all years

- Bear market frequency: Every 3-5 years

Understanding Normal Volatility

Markets regularly experience corrections and bear markets. This is completely normal, not a sign something is wrong with your DCA strategy.

What to expect:

- 📉 10%+ drops: Happen every 1-2 years

- 📉 20%+ drops: Happen every 3-5 years

- ⏰ Recovery time: Usually takes 6-18 months

- 📈 Long-term direction: Markets always recover to new highs

I learned about volatility benefits firsthand during March 2020. The COVID crash was terrifying – markets dropped 35% in weeks. My active trading clients panicked and sold near the bottom. My DCA clients who stayed disciplined bought shares at incredible discounts and saw full account recovery within eight months.

🧘 Key mindset: Volatility is the price you pay for long-term growth, and DCA helps you profit from it.

Asset Allocation Strategies for DCA Investors 🎯

Successful dollar cost averaging requires appropriate asset allocation between stocks and bonds based on individual circumstances and investment timelines.

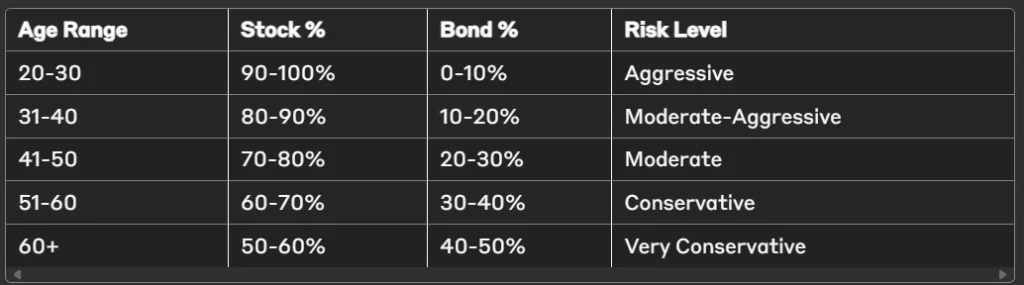

Age-Based Allocation Guidelines

Traditional rule: Hold your age in bonds (30-year-old = 30% bonds, 70% stocks)

Modern approach: More aggressive due to longer lifespans and low bond yields

Personal Comfort Level Adjustments

Age guidelines are starting points. Your comfort with market fluctuations should drive final allocation decisions.

I learned this with a client who had the “perfect” 90/10 stock/bond allocation for his age. But he couldn’t sleep when his account dropped 15% during 2018’s market volatility. We adjusted to 75/25, and he’s been much more consistent with his DCA contributions since then.

💡 Remember: The best allocation is one you can maintain during market downturns.

Advanced Dollar Cost Averaging Strategies 🚀

After years of refinement, I’ve developed advanced techniques that enhance DCA returns while maintaining core simplicity benefits.

Value Averaging Enhancement

Instead of investing fixed dollar amounts, adjust contributions to reach specific portfolio value targets. If your portfolio underperforms, invest more. If it outperforms, invest less.

Example implementation:

- Target: $6,000 annual portfolio growth ($500 monthly)

- Month 3 actual value: $1,200 (vs $1,500 target)

- Month 4 contribution: $800 (vs normal $500) to catch up

Dynamic Frequency Adjustment

Increase DCA frequency during high volatility periods to capture more price fluctuations.

Volatility-based frequency:

- Normal markets (VIX <20): Monthly investing

- Moderate volatility (VIX 20-30): Bi-weekly investing

- High volatility (VIX >30): Weekly investing

This technique generated exceptional results during the 2020 volatility spike and 2022 bear market for clients who implemented it.

Sector Rotation DCA

While maintaining core broad market DCA, allocate 10-20% to systematically underperforming sectors or asset classes.

Example rotation schedule:

- 70% Total Stock Market (consistent DCA)

- 20% International Developed Markets

- 10% Emerging Markets or Small-Cap Value

Recommended Platforms for Dollar Cost Averaging 🏦

Platform selection dramatically impacts DCA success through fees, automation capabilities, and available investment options.

Best Overall: Fidelity

- Zero-fee index funds (FZROX, FXAIX, FTIHX)

- Robust automation features

- Excellent mobile app

- Outstanding research tools

Best for Beginners: Charles Schwab

- User-friendly interface

- Comprehensive educational resources

- Low-cost index funds

- Excellent customer service

Best for Automation: Vanguard

- Industry-leading low-cost funds

- Strong automation capabilities

- Investor-owned structure (returns profits to fund shareholders)

- Excellent long-term track record

Best for Fractional Shares: M1 Finance

- Automated rebalancing with “pie charts”

- Commission-free fractional share investing

- Customizable portfolio allocation

- Modern, intuitive interface

Platform selection criteria: Prioritize low fees, strong automation features, and broad investment selection. Ensure the platform offers specific index funds you want to purchase regularly.

Video Recommendation 📺

For a deeper dive into implementing dollar cost averaging strategies, I highly recommend my YouTube video: “Dollar Cost Averaging Strategy: How I Build Wealth in Any Market” on the Successful Tradings YouTube Channel.

This video covers real portfolio examples and demonstrates exactly how I set up automated DCA systems for maximum effectiveness with minimal effort.

Dollar Cost Averaging Success Stories 🌟

Real success stories from my coaching clients demonstrate how ordinary people build extraordinary wealth through consistent DCA execution.

Sarah’s Retirement Transformation

Background: 28-year-old teacher with $45,000 annual income

Strategy: $300 monthly DCA into S&P 500 index fund through 403(b)

Timeline: January 2019 – August 2025 (6.5 years)

Results:

- Total contributions: $23,400

- Portfolio value: $31,850

- Gain: $8,450 (36% total return)

- Survived 2020 crash and 2022 bear market with discipline

Sarah initially worried about starting during market uncertainty in 2019. However, her disciplined approach paid off tremendously. Even through the 2020 market crash and 2022 bear market, she never paused contributions.

Key lesson: Consistency beats market timing every single time.

Mike’s Accelerated Wealth Building

Background: 35-year-old engineer seeking aggressive wealth building

Strategy: $1,200 monthly DCA split between US Total Market (70%) and International (30%)

Timeline: March 2020 – August 2025 (5.5 years)

Results:

- Total contributions: $79,200

- Portfolio value: $108,750

- Gain: $29,550 (37% total return)

- Built substantial wealth despite starting during COVID uncertainty

Mike’s success demonstrates how scaling contribution amounts dramatically accelerates wealth building. He started with $800 monthly but increased to $1,200 after receiving promotions.

Key lesson: Higher contributions amplify DCA benefits while maintaining consistent habits.

Common Dollar Cost Averaging Mistakes ⚠️

Even simple DCA strategies can be derailed by behavioral mistakes that reduce long-term returns. Avoiding these pitfalls dramatically improves success probability.

Mistake #1: Stopping During Market Downturns

The error: Pausing DCA when markets decline, precisely when it provides maximum benefit.

Why it happens: Fear overwhelms logic during market crashes.

The solution: Automate everything and avoid checking account balances during volatile periods. I personally stopped looking at my portfolio daily in 2018 – my returns improved significantly.

Mistake #2: Frequently Changing Investments

The error: Switching between different funds based on recent performance rather than sticking with chosen strategy.

Why it happens: Performance chasing and financial media influence.

The solution: Choose quality, diversified investments and maintain them for years. I’ve used the same core index funds since 2016 across all market conditions.

Mistake #3: Inconsistent Investment Amounts

The error: Investing more during good months and less during difficult months.

Why it happens: Lifestyle inflation and poor budgeting discipline.

The solution: Treat DCA investments as non-negotiable bills. Pay your investments before discretionary spending every month.

Mistake #4: Insufficient Diversification

The error: Using DCA with individual stocks or narrow sector funds.

Why it happens: Overconfidence in specific companies or sectors.

The solution: Stick to broad market index funds for core DCA strategy. Individual positions should represent less than 5% of total portfolio.

Dollar Cost Averaging in Different Market Conditions 📈📉

My decade of experience includes multiple market cycles: the 2015-2016 correction, 2018 volatility, 2020 COVID crash, and 2022 bear market. Each cycle reinforced DCA’s effectiveness across different environments.

Bull Markets (Rising Prices)

During sustained uptrends like 2016-2021, DCA underperforms lump sum investing mathematically. However, it still provides solid returns while maintaining emotional comfort.

Performance: Slightly lower returns than lump sum

Benefit: Risk reduction and peace of mind

Strategy: Continue consistent investing, resist urge to increase amounts dramatically

Bear Markets (Falling Prices)

Bear markets showcase where DCA truly shines. The 2020 COVID crash perfectly demonstrated this – DCA investors who stayed disciplined generated exceptional returns.

Performance: Superior to lump sum investing

Benefit: Lower average costs and reduced emotional stress

Strategy: Maintain discipline, potentially increase frequency if financially possible

Sideways Markets (Range-Bound)

Volatile, range-bound markets provide ideal DCA conditions. The 2015-2016 period exemplified this scenario perfectly.

Performance: Significantly outperforms lump sum

Benefit: Captures volatility for profit

Strategy: Standard DCA approach works excellently

Frequently Asked Questions About Dollar Cost Averaging 🤔

How much should I invest using dollar cost averaging?

Start with 10-15% of monthly take-home income that you can invest consistently without affecting emergency funds.

The key is sustainability – better to invest $200 consistently for years than $800 sporadically for months.

What’s the best frequency for dollar cost averaging?

Monthly investing works best for most people because it aligns with salary payments and provides adequate averaging benefits without excessive complexity. Weekly investing provides slightly better averaging but requires larger amounts to be practical.

Should I use dollar cost averaging with individual stocks?

No. I strongly recommend broad market index funds due to diversification benefits. Individual stocks carry company-specific risks that can lead to total losses, while broad market indexes historically recover from all downturns.

Can I use dollar cost averaging in a bear market?

Absolutely! Bear markets provide ideal DCA conditions because you’re purchasing shares at progressively lower prices. The key is maintaining discipline when fear dominates headlines. Some of my clients’ best returns came from continuing DCA during market downturns.

How long should I continue dollar cost averaging?

Continue until you’re within 5-10 years of needing the money for your intended goal.

For retirement investing, continue throughout your working career. For shorter-term goals, plan for at least 3-5 years of consistent investing.

Is dollar cost averaging better than lump sum investing?

DCA provides superior risk-adjusted returns when considering emotional factors that derail investment plans.

For most investors, especially beginners, DCA’s behavioral advantages outweigh lump sum’s mathematical edge.

What investments work best with dollar cost averaging?

Broad market index funds and ETFs work exceptionally well due to diversification and lower volatility compared to individual securities. Target-date funds also excel because they automatically adjust allocation over time.

Should I stop dollar cost averaging when markets seem expensive?

Never! Market timing defeats DCA’s primary purpose.

Markets often remain “expensive” for years during bull runs. Continue your strategy regardless of valuations – if concerned about high valuations, consider adding international diversification.

How do I automate my dollar cost averaging strategy?

Set up automatic bank transfers to your investment account and automatic purchases of your chosen funds. Most brokerages offer comprehensive automation that handles everything once configured properly.

Can I change my dollar cost averaging amount over time?

Yes, adjust amounts as your financial situation improves. Many successful DCA investors increase monthly contributions by 5-10% annually to combat lifestyle inflation and accelerate wealth building.

Your Path to Consistent Wealth Building 🎯

After nearly a decade of implementing dollar cost averaging strategies personally and coaching hundreds of investors, I’m convinced it’s the most reliable path to long-term wealth building for most people.

DCA’s true power isn’t in mathematical optimization – it’s in transforming investing from a stressful, emotion-driven activity into a calm, systematic wealth-building process. When you automate investments and commit to consistency, you eliminate psychological barriers that destroy most investment plans.

The strategy works because it addresses human nature rather than fighting it. Instead of timing markets perfectly, you embrace volatility as your friend. Instead of making complex decisions monthly, you simplify everything into a single, repeatable process.

Key principles for DCA success:

- 🌱 Start with whatever amount you can invest consistently

- 🔄 Automate everything to remove emotional decisions

- 💰 Choose low-cost, diversified index funds

- 🧘 Stay disciplined during market volatility

- 📈 Focus on long-term wealth building over short-term performance

CONCLUSION

My personal journey from stressed active trader to calm passive investor began with embracing DCA in 2016.

Since then, my returns improved while stress levels plummeted. The same transformation awaits anyone willing to commit to the process.

Remember, the best investment strategy is one you’ll actually follow consistently for years.

Dollar cost averaging provides that consistency while building substantial wealth over time.

The market will continue experiencing volatility, corrections, and bear markets.

However, disciplined DCA investors who stay the course historically emerge stronger and wealthier after every market cycle.

Start today with whatever amount you can invest consistently.

Your future self will thank you for beginning rather than waiting for “perfect” market conditions that never arrive.

👉 Next Step 1: Dividend Reinvestment Strategies

👉 Next Step 2: Optimal Asset Allocation

Hold a Master Degree in Electrical engineering from Texas A&M University.

African born – French Raised and US matured who speak 5 languages.

Active Stock Options Trader and Coach since 2014.

Most Swing Trade weekly Options and Specialize in 10-Baggers !

YouTube Channel: https://www.youtube.com/c/SuccessfulTradings

Other Website: https://237answersblog.com/