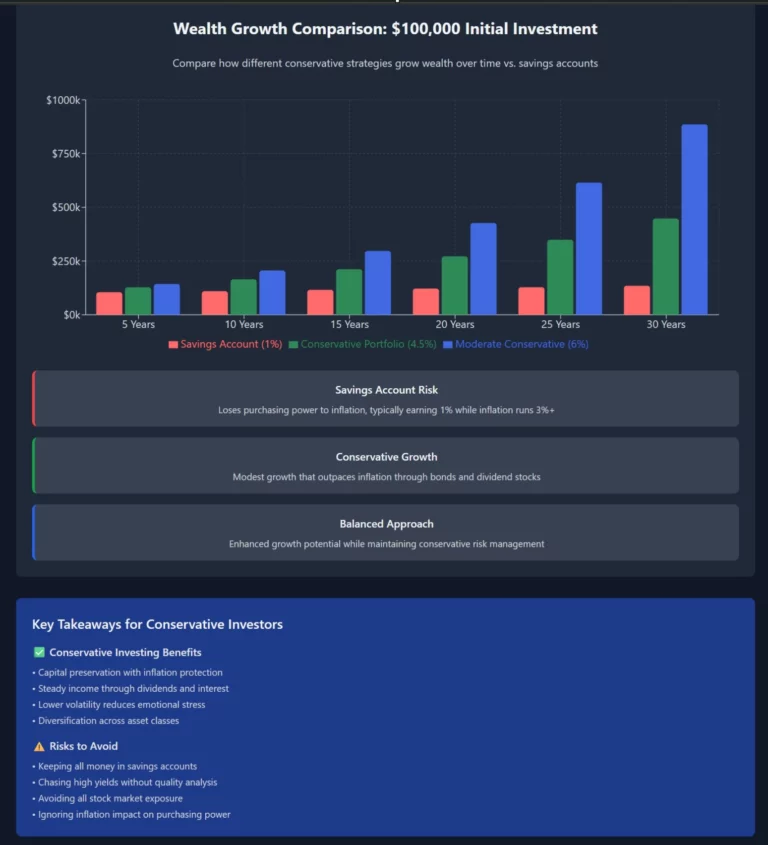

Conservative Investing That will Grow: Not Savings Accounts

I began trading in 2015 and started coaching in 2019. Conservative investors face a critical challenge: savings accounts offer safety but destroy purchasing power through inflation. However, conservative investing strategies can provide both capital preservation and meaningful growth. Therefore, this guide shows you how to build wealth without excessive risk. 👉 In this guide, you will learn: Conservative investors often prioritize safety over growth completely. Unfortunately, this approach virtually guarantees losing purchasing power to inflation. Additionally, the fear of market …