I began trading in 2015 and started coaching in 2019. The conventional wisdom says eliminate all debt before investing. However, this approach often costs people decades of compound growth. Therefore, this guide helps you understand when investing while carrying debt creates wealth faster than debt elimination alone.

👉 In this guide, you will learn:

- 💰 The mathematical framework for debt vs. investing decisions

- 📊 Which types of debt allow simultaneous investing strategies

- 🎯 How to balance debt payments with wealth building effectively

- 🧾 Tax implications that change the debt vs. investing equation

- 📈 Portfolio strategies specifically designed for debt carriers

- ⚖️ Risk management when leveraging debt for investments

- 🔍 Red flags that indicate you should pay debt first

Traditional financial advice treats all debt equally and demands elimination before investing. Unfortunately, this one-size-fits-all approach ignores mathematical realities and opportunity costs. Additionally, it fails to account for different debt types, interest rates, and tax implications.

Table of Contents

The Debt vs. Investing Decision Matrix 📊

Not all debt is created equal when making investment decisions. Furthermore, the interest rate, tax deductibility, and loan terms dramatically affect optimal strategies. Therefore, understanding this decision matrix prevents costly mistakes in either direction.

The Interest Rate Threshold Framework

High-Interest Debt (Above 8% APR) Credit cards, payday loans, and personal loans typically demand immediate elimination. Moreover, guaranteed 15-25% returns from debt reduction exceed expected investment returns consistently. Additionally, the psychological burden of high-interest debt often undermines investment discipline.

High-interest debt elimination priorities:

- 💳 Credit card debt averaging 18-25% interest rates

- 🏦 Personal loans with rates above 10%

- 🚗 Auto loans exceeding 8% (especially for luxury vehicles)

- 🏠 Hard money loans and other expensive financing

Medium-Interest Debt (4-8% APR) This range creates the most complex decisions requiring individual analysis. However, several factors can tip the balance toward investing or debt reduction. Furthermore, your risk tolerance and job security influence optimal strategies significantly.

Factors favoring debt reduction in medium range:

- 🧠 High stress from debt payments affecting sleep or relationships

- 💼 Unstable job security or irregular income streams

- 📉 Conservative risk tolerance preferring guaranteed returns

- 🏠 Plans to refinance or sell property soon

Factors favoring investing in medium range:

- 💰 Stable, high income with strong emergency fund

- 🧾 Tax-deductible interest reducing effective rates

- ⏰ Long investment time horizon (10+ years)

- 🏢 Access to employer 401k matching programs

Low-Interest Debt (Below 4% APR) Low-interest debt almost always justifies aggressive investing strategies. Furthermore, inflation often exceeds these rates, making debt payments cheaper over time. Additionally, tax deductions frequently reduce effective rates even further.

Low-interest debt types typically worth keeping:

- 🏠 Mortgages, especially those below 4% rates

- 🎓 Federal student loans with rates under 4%

- 🚗 Auto loans from credit unions or promotional rates

- 💼 Business loans for cash flow or expansion

Tax Considerations That Change Everything

Tax deductibility transforms debt mathematics significantly. Therefore, always calculate after-tax costs when comparing debt to investment returns. Furthermore, tax-advantaged investing provides additional benefits beyond market returns.

Mortgage Interest Deduction Impact For taxpayers who itemize, mortgage interest becomes tax-deductible. Moreover, this deduction reduces the effective interest rate by your marginal tax rate. Additionally, the standard deduction increase has reduced this benefit for many taxpayers.

Mortgage deduction calculation example:

- 🏠 $400,000 mortgage at 6% = $24,000 annual interest

- 🧾 24% tax bracket reduces effective rate to 4.56%

- 📊 After-tax cost makes investing more attractive

Student Loan Interest Deduction Student loan interest provides above-the-line deductions up to $2,500 annually. Furthermore, this benefit phases out at higher income levels. Additionally, the deduction applies regardless of itemizing status.

Student loan tax benefits:

- 🎓 Up to $2,500 deduction reduces taxable income

- 🎓 Available for modified AGI up to $85,000 (single)

- 🎓 Reduces effective interest rate by marginal tax rate

- 🎓 No itemization requirement unlike mortgage interest

Emergency Fund: The Non-Negotiable Foundation 🛡️

Before considering any debt vs. investing decisions, establish adequate emergency reserves. Furthermore, insufficient emergency funds force liquidation of investments during market downturns. Additionally, emergency funds prevent additional debt accumulation during crises.

Emergency Fund Size for Debt Holders

Standard Emergency Fund Guidelines Most debt holders need 3-6 months of essential expenses in liquid savings. However, debt payments increase monthly obligations requiring larger reserves. Moreover, job loss becomes more problematic when debt payments continue.

Emergency fund calculation for debt holders:

- 🏠 Monthly housing costs (rent/mortgage, utilities, insurance)

- 🍽️ Essential food and transportation expenses

- 💳 Minimum debt payments across all obligations

- 🏥 Basic healthcare and insurance premiums

- 📱 Critical communication and basic living expenses

Enhanced Emergency Funds for High Debt Loads Individuals carrying significant debt may need 6-9 months of expenses saved. Furthermore, variable income earners should lean toward higher reserves. Additionally, single-income households face greater risks requiring enhanced protection.

Situations requiring larger emergency funds:

- 💼 Self-employment or commission-based income

- 🏠 High debt-to-income ratios above 40%

- 👨👩👧👦 Single-income households with dependents

- 🏥 Chronic health conditions requiring ongoing treatment

Where to Keep Emergency Funds

High-yield savings accounts provide optimal emergency fund storage. Moreover, FDIC insurance protects against bank failures up to $250,000. Furthermore, online banks typically offer higher yields than traditional institutions.

Emergency fund storage options:

- 🏦 High-yield savings accounts earning 4-5% currently

- 💰 Money market accounts with check-writing privileges

- 📄 Short-term CDs for portion of emergency fund

- 🚫 Avoid investment accounts for emergency funds

When Investing While in Debt Makes Mathematical Sense 📈

Specific situations create clear mathematical advantages for investing while carrying debt. Furthermore, these scenarios often involve tax-advantaged accounts or exceptionally low interest rates. Additionally, employer matching programs provide immediate returns exceeding most debt costs.

Employer 401k Matching: The Ultimate Priority

Employer matching represents immediate 100% returns on investment. Therefore, it takes priority over all debt payments except basic survival needs. Furthermore, missing matches means forfeiting free money permanently.

401k matching optimization strategies:

- 🏢 Contribute minimum required for full employer match

- 🏢 Prioritize matching over all non-survival debt payments

- 🏢 Understand vesting schedules and job change implications

- 🏢 Increase contributions gradually as debt decreases

Real-World Matching Example Consider an employee earning $75,000 with 50% employer matching up to 6% of salary:

- Employee contributes: $4,500 (6% of $75,000)

- Employer contributes: $2,250 (50% match)

- Total annual contribution: $6,750

- Immediate return: 50% guaranteed

This 50% immediate return exceeds any debt interest rate. Moreover, the investment grows tax-deferred for decades. Therefore, maxing employer match should precede aggressive debt reduction.

Federal Student Loans Under 4%

Federal student loans with interest rates below 4% often justify investment strategies. Furthermore, federal loans offer protections unavailable with private debt. Additionally, income-driven repayment plans can reduce required payments significantly.

Federal student loan advantages supporting investment approach:

- 🎓 Income-driven repayment plans cap payments

- 🎓 Public Service Loan Forgiveness potential

- 🎓 Forbearance and deferment options during hardship

- 🎓 Death and disability discharge provisions

Student Loan vs. Roth IRA Strategy Young professionals with federal loans below 4% should often prioritize Roth IRA contributions. Moreover, Roth IRA contributions can be withdrawn penalty-free for emergencies. Furthermore, tax-free growth for decades provides enormous value.

Roth IRA advantages for student loan holders:

- 💰 $7,000 annual contribution limit (2025)

- 💰 Tax-free growth and qualified withdrawals

- 💰 Contribution withdrawals available penalty-free

- 💰 No required minimum distributions

Low-Rate Mortgages and Investment Opportunities

Homeowners with mortgages below 4% face compelling investment opportunities. Furthermore, mortgage interest remains tax-deductible for many borrowers. Additionally, real estate typically appreciates alongside stock market growth.

Mortgage vs. investing considerations:

- 🏠 Mortgage interest tax deductibility reduces effective rates

- 🏠 Forced savings through principal payments

- 🏠 Leverage amplifies real estate appreciation

- 🏠 Stable housing costs versus rent increases

The Opportunity Cost of Mortgage Prepayment Consider a $300,000 mortgage at 3.5% versus investing extra payments:

- Mortgage savings: 3.5% guaranteed return (pre-tax)

- Investment opportunity: 7-8% expected return (pre-tax)

- Opportunity cost: 3.5-4.5% annually on prepayments

Over 15-20 years, investing extra payments typically generates $50,000-$150,000 more wealth than mortgage prepayment.

Strategic Asset Allocation for Debt Holders ⚖️

Investors carrying debt need modified portfolio strategies. Therefore, asset allocation should account for debt interest rates and risk tolerance. Furthermore, debt payments affect cash flow requiring enhanced liquidity planning.

Conservative vs. Aggressive Approaches

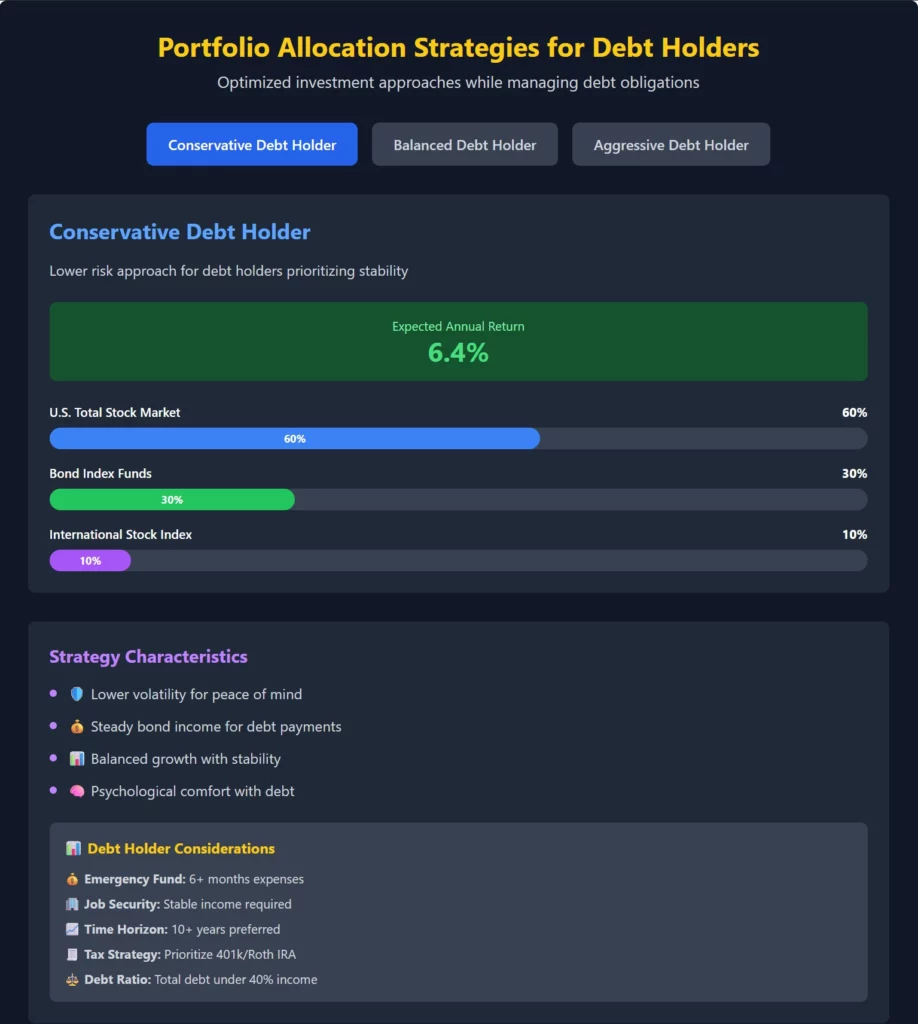

Conservative Debt Holder Strategy Risk-averse investors with debt should emphasize stable, income-producing investments. Moreover, bond allocations can provide steady returns while reducing volatility. Additionally, dividend-focused strategies generate cash flow for debt payments.

Conservative allocation for debt holders:

- 📊 60% U.S. Total Stock Market Index

- 📊 30% Bond Index Funds

- 📊 10% International Stock Index

- 💰 Focus on low-cost index funds

Aggressive Debt Holder Strategy Risk-tolerant investors with secure income can maintain aggressive allocations. Furthermore, longer time horizons justify equity-heavy portfolios despite debt obligations. Additionally, higher returns help accelerate both wealth building and debt reduction.

Aggressive allocation for debt holders:

- 📊 80% U.S. Total Stock Market Index

- 📊 15% International Stock Index

- 📊 5% Emerging Markets

- 💰 Minimal bond allocation for young investors

Tax-Efficient Investing with Debt

Tax efficiency becomes crucial when balancing debt payments and investments. Therefore, prioritize tax-advantaged accounts before taxable investing. Furthermore, tax-loss harvesting can offset ordinary income including debt interest.

Tax-advantaged account prioritization:

- 🏢 Employer 401k match (immediate 100% return)

- 💰 Health Savings Account if eligible (triple tax advantage)

- 💰 Roth IRA for young investors (tax-free growth)

- 🏢 Additional 401k contributions (tax deferral)

- 💼 Taxable accounts for excess savings

Geographic and Sector Diversification

Debt holders need enhanced diversification to protect against job loss or economic downturns. Therefore, avoid concentration in your employer’s stock or industry. Furthermore, international exposure reduces correlation with domestic debt obligations.

Diversification strategies for debt holders:

- 🌍 25-30% international stock exposure

- 🏢 Avoid over-concentration in employer stock

- 💼 Diversify across sectors and company sizes

- 🏠 Consider REITs for real estate exposure

Risk Management Strategies 🛡️

Investing while carrying debt increases financial complexity requiring enhanced risk management. Therefore, stress testing and scenario planning become essential. Furthermore, insurance protection becomes more critical with leverage.

Stress Testing Your Strategy

Job Loss Scenario Analysis Calculate how long your emergency fund and investments could cover debt payments during unemployment. Moreover, consider which investments could be liquidated without significant losses.

Additionally, understand unemployment benefits and debt forbearance options.

Job loss preparation checklist:

- 💰 Emergency fund covering 6+ months of debt payments

- 📊 Conservative portion of portfolio for liquidity

- 🏦 Understanding of debt modification options

- 💼 Professional network and skills for job search

Market Downturn Impact Assessment Determine how market declines would affect your investment strategy and debt capacity. Furthermore, consider whether you could continue investing during bear markets. Additionally, evaluate psychological comfort with portfolio volatility.

Market downturn considerations:

- 📉 Portfolio impact of 20-40% market decline

- 💰 Ability to continue investments during downturns

- 🧠 Psychological comfort with debt and volatility

- 🔄 Rebalancing opportunities during market stress

Insurance Protection for Leveraged Investors

Adequate insurance becomes crucial when carrying debt and investments simultaneously. Therefore, disability and life insurance protect against income loss. Furthermore, proper coverage prevents forced investment liquidation.

Essential insurance for debt holders:

- 💼 Disability insurance replacing 60-70% of income

- 👨👩👧👦 Life insurance covering debt obligations

- 🏥 Health insurance with adequate emergency coverage

- 🏠 Property insurance protecting major assets

Red Flags: When to Pay Debt First 🚨

Certain situations clearly indicate debt reduction should precede investing. Therefore, recognizing these red flags prevents financial disasters. Furthermore, debt elimination may be necessary for psychological peace of mind.

Financial Red Flags

High Debt-to-Income Ratios Total debt payments exceeding 40% of gross income indicate overextension. Moreover, this level leaves insufficient margin for emergencies or investment. Additionally, loan qualification becomes difficult at high debt ratios.

Variable Rate Debt in Rising Rate Environment Variable rate debt becomes increasingly dangerous as rates rise. Furthermore, payment increases can strain budgets forcing investment liquidation. Additionally, rate caps may not provide adequate protection.

Unstable Income or Employment Irregular income makes debt payments risky during lean periods. Moreover, commission-based or seasonal work creates cash flow uncertainty. Therefore, stable employment should precede leveraged investment strategies.

Psychological Red Flags

Debt-Related Stress and Anxiety Debt causing sleep loss, relationship strain, or anxiety typically requires elimination first. Furthermore, investment volatility compounds stress when debt looms. Additionally, psychological well-being affects decision-making quality.

Compulsive Spending Behaviors Individuals with spending control issues should eliminate debt before investing. Moreover, easy investment account access can enable further overspending. Therefore, addressing underlying behaviors takes priority.

Case Studies: Real-World Applications 💡

Understanding how debt vs. investing decisions work in practice helps clarify optimal strategies. Furthermore, these examples demonstrate the mathematical and psychological factors involved.

Case Study 1: The Medical Resident

Situation: Medical resident earning $55,000 with $200,000 in federal student loans at 3.5% interest.

Analysis: Federal loans offer income-driven repayment capping payments at 10% of discretionary income. Furthermore, Public Service Loan Forgiveness potential after 10 years. Additionally, future physician income justifies current investment.

Recommendation: Minimize loan payments through income-driven plans while maximizing Roth IRA contributions. Moreover, resident stipend often qualifies for retirement account contributions.

Case Study 2: The Young Professional

Situation: Software engineer earning $95,000 with $35,000 auto loan at 2.9% and $15,000 credit card debt at 18%.

Analysis: Credit card debt demands immediate elimination due to high rates. However, auto loan at 2.9% allows simultaneous investing. Furthermore, stable tech income supports aggressive investment strategy.

Recommendation: Aggressively eliminate credit card debt while making minimum auto payments.

Simultaneously maximize 401k match and Roth IRA contributions.

Case Study 3: The Homeowner

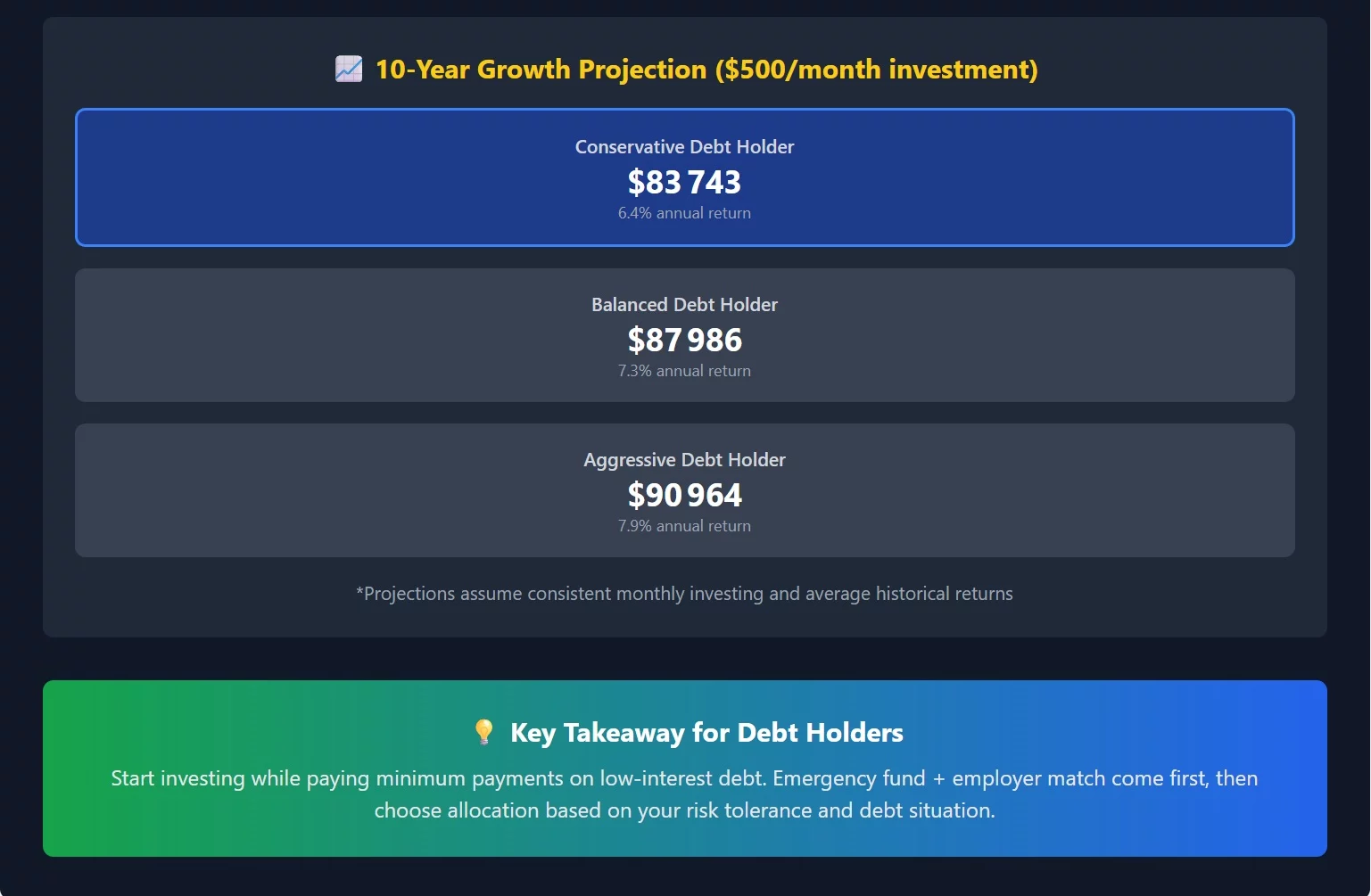

Situation: Family earning $120,000 with $350,000 mortgage at 3.25% and $500 monthly payment capacity for debt reduction or investing.

Analysis: Mortgage interest partially tax-deductible reducing effective rate. Furthermore, long-term investment returns likely exceed mortgage cost. Additionally, young family has 25+ year investment horizon.

Recommendation: Make minimum mortgage payments while investing $500 monthly in tax-advantaged accounts.

Focus on 401k maximization and children’s 529 plans.

Implementation Action Steps 🎯

Converting debt vs. investing analysis into action requires systematic implementation.

Therefore, follow these steps to optimize your financial strategy. Furthermore, automation ensures consistency despite behavioral challenges.

Step 1: Complete Financial Inventory

Calculate exact debt balances, interest rates, and minimum payments. Moreover, determine monthly cash flow available for debt reduction or investing. Additionally, assess emergency fund adequacy.

Financial inventory components:

- 📊 Complete debt listing with rates and minimums

- 💰 Monthly income and essential expense calculation

- 🏦 Emergency fund balance and target assessment

- 📈 Current investment account balances and allocation

Step 2: Apply Decision Framework

Use interest rate thresholds and personal factors to determine optimal strategy.

Furthermore, calculate after-tax costs including deductibility benefits. Additionally, stress test your plan against job loss scenarios.

Decision framework application:

- 🔍 Categorize debt by interest rate ranges

- 🧾 Calculate after-tax debt costs and investment returns

- ⚖️ Assess personal risk tolerance and job security

- 📊 Model different allocation scenarios

Step 3: Implement Systematic Automation

Automate debt payments and investments to ensure consistency. Moreover, automation prevents emotional decision-making during market volatility. Furthermore, systematic approaches often outperform active management.

Automation implementation:

- 🤖 Automatic minimum debt payments on all obligations

- 🤖 Automated investment contributions to retirement accounts

- 🤖 Systematic rebalancing of investment portfolios

- 🤖 Regular strategy review and adjustment schedule

Conclusion

Investing while carrying debt can accelerate wealth building when implemented strategically.

Therefore, blanket advice to eliminate all debt first often costs decades of compound growth.

Furthermore, mathematical analysis should drive decisions rather than emotional reactions.

Success requires understanding interest rate thresholds, tax implications, and personal risk factors.

Additionally, adequate emergency funds provide the foundation for any leveraged strategy. Finally, automation and systematic approaches overcome behavioral challenges that derail financial progress.

The key is recognizing that different debt types require different strategies, while employer matching and low-interest debt often justify simultaneous passive investing approaches.

Hold a Master Degree in Electrical engineering from Texas A&M University.

African born – French Raised and US matured who speak 5 languages.

Active Stock Options Trader and Coach since 2014.

Most Swing Trade weekly Options and Specialize in 10-Baggers !

YouTube Channel: https://www.youtube.com/c/SuccessfulTradings

Other Website: https://237answersblog.com/