I began trading in 2015 and started coaching in 2019. Conservative investors face a critical challenge: savings accounts offer safety but destroy purchasing power through inflation. However, conservative investing strategies can provide both capital preservation and meaningful growth. Therefore, this guide shows you how to build wealth without excessive risk.

👉 In this guide, you will learn:

- 💰 Why savings accounts actually lose money over time through inflation

- 🏛️ Conservative investment strategies that outpace inflation safely

- 📊 How to build a low-risk portfolio that grows wealth systematically

- 🛡️ Risk management techniques that protect capital while enabling growth

- 📈 Bond and dividend strategies specifically for conservative investors

- 🎯 How to balance safety with the growth needed for long-term goals

- 💡 Common mistakes conservative investors make that limit returns

Conservative investors often prioritize safety over growth completely. Unfortunately, this approach virtually guarantees losing purchasing power to inflation. Additionally, the fear of market volatility keeps many people in investments that cannot meet long-term financial goals.

Table of Contents

The Conservative Investor’s Dilemma 💭

Traditional savings approaches create a false sense of security. Furthermore, money sitting in savings accounts loses value daily through inflation. Meanwhile, conservative investors watch their purchasing power erode while avoiding investments that could protect them.

Why Savings Accounts Fail Conservative Investors

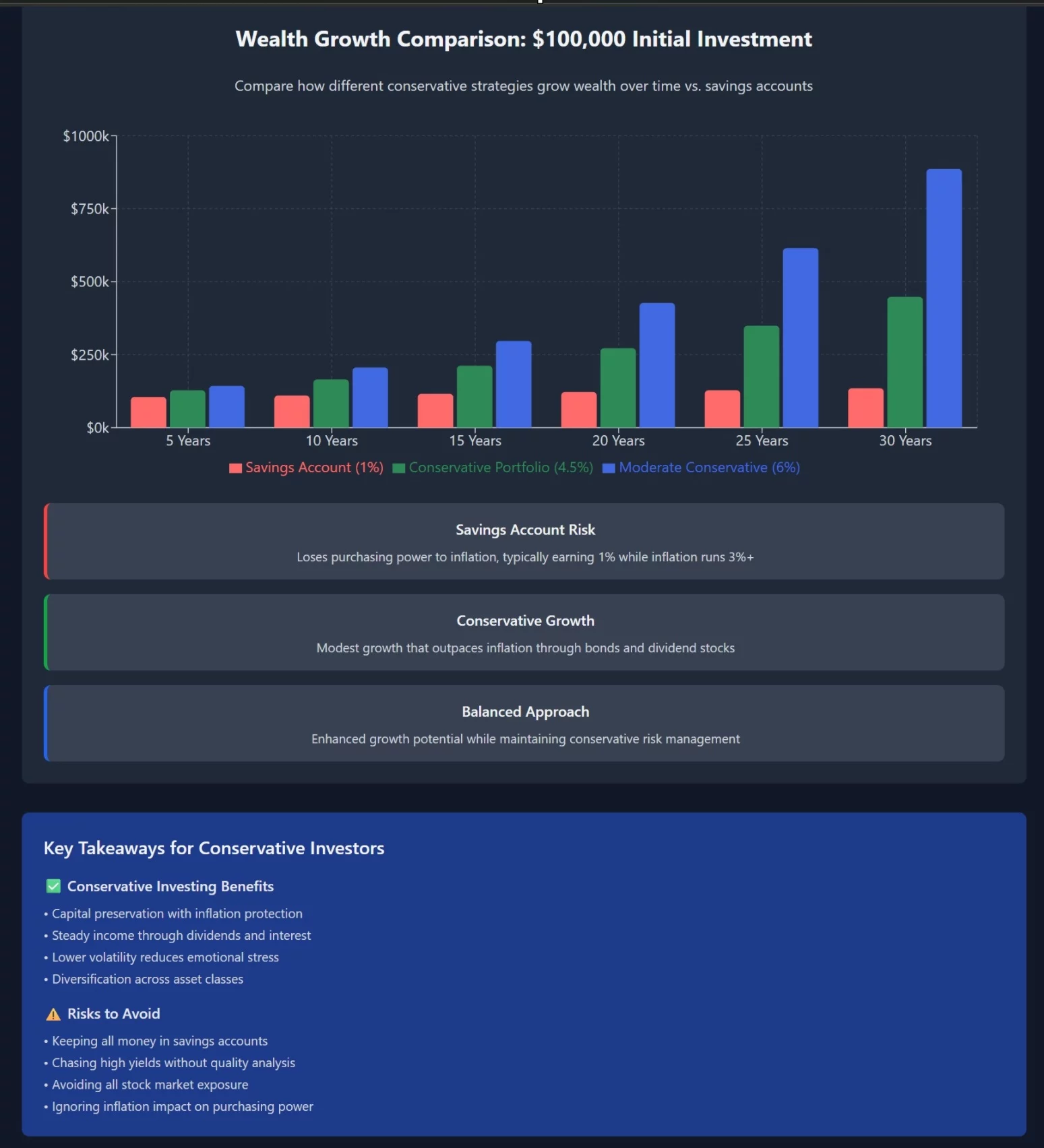

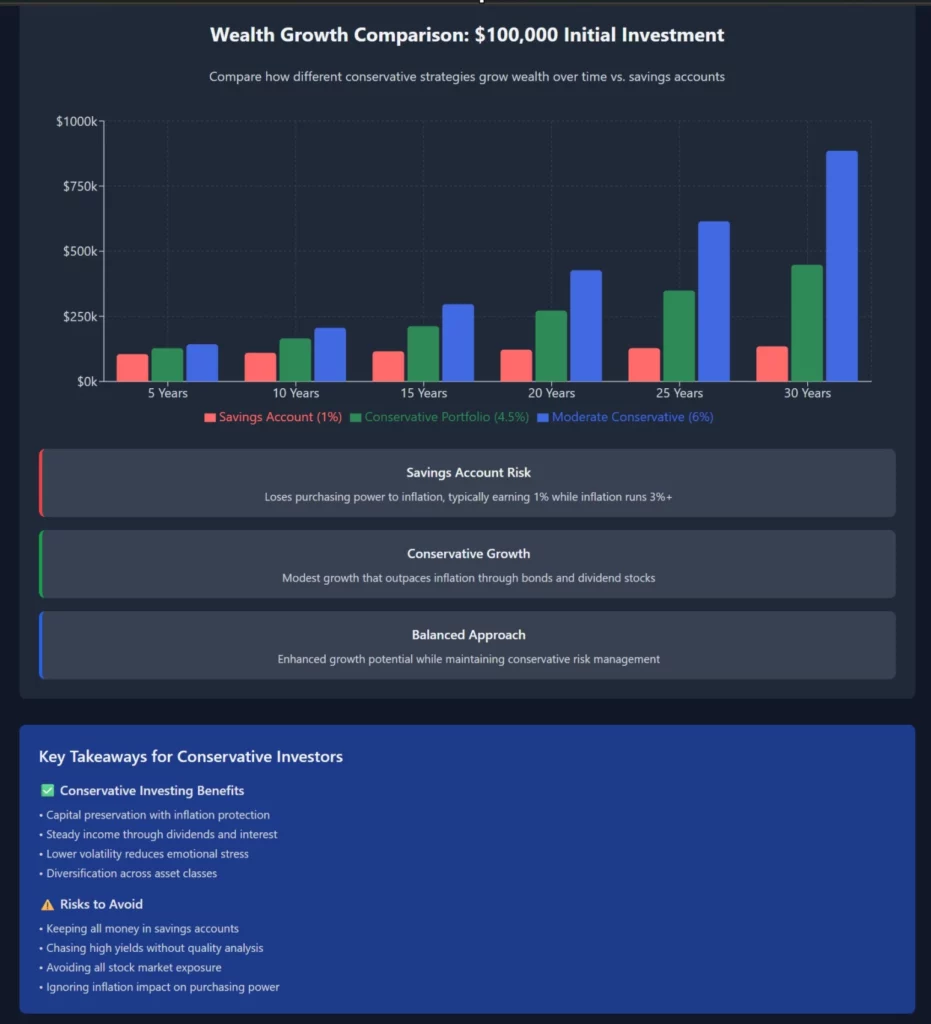

Inflation Destroys Purchasing Power Current inflation rates of 3-4% annually mean savings accounts losing 2-3% of purchasing power yearly. Moreover, compound inflation effects become devastating over decades. Additionally, savings account interest rarely keeps pace with rising costs.

Real purchasing power loss examples:

- 💸 $100,000 in savings becomes $67,000 in purchasing power after 10 years (3% inflation)

- 💸 Fixed-income retirees see their lifestyle decline yearly without growth investments

- 💸 Emergency funds require constant replenishment to maintain real value

- 💸 College and retirement goals become increasingly unattainable with savings alone

Opportunity Cost of Ultra-Conservative Approaches Money in savings accounts misses decades of potential compound growth. Furthermore, the difference between 1% savings and 5% conservative investing compounds dramatically. Additionally, ultra-conservative approaches often fail to meet basic financial goals.

Opportunity cost illustration:

- 📊 $500 monthly in savings at 1% = $647,000 after 30 years

- 📊 $500 monthly in conservative portfolio at 5% = $1,247,000 after 30 years

- 📊 Conservative investing provides nearly double the wealth with minimal additional risk

However, conservative investors can achieve growth while maintaining capital preservation focus. Therefore, strategic approaches balance safety with necessary growth for financial security.

The Conservative Growth Framework 🏗️

Successful conservative investing requires frameworks that prioritize capital preservation while enabling meaningful growth. Moreover, these strategies focus on steady, predictable returns rather than volatile growth spurts. Additionally, they emphasize diversification and risk management consistently.

Core Principles for Conservative Growth

Capital Preservation First Conservative portfolios protect principal while generating income and modest appreciation. Furthermore, they avoid investments with significant loss potential. Additionally, they maintain liquidity for emergency needs and opportunities.

Conservative investment characteristics:

- 🛡️ Low volatility that reduces emotional stress and poor decisions

- 💰 Regular income through dividends and interest payments

- 📊 Steady appreciation that compounds over time reliably

- 🏦 High-quality investments with strong track records

Inflation Protection Strategy Conservative portfolios must grow faster than inflation to preserve purchasing power. Therefore, they include inflation-protected securities and dividend-growing investments. Furthermore, they avoid fixed-income investments that lose value during inflationary periods.

Inflation protection components:

- 📈 Treasury Inflation-Protected Securities (TIPS) for direct inflation hedging

- 💎 Dividend-growing stocks that increase payments over time

- 🏠 Real estate investments that appreciate with inflation

- 💰 I-Bonds that adjust with inflation automatically

Risk Management for Conservative Investors

Diversification Beyond Asset Classes Conservative portfolios require diversification across multiple dimensions. Moreover, they spread risk across time horizons, geographic regions, and economic sectors. Additionally, they include both growth and income components strategically.

Multi-dimensional diversification:

- 🌍 Geographic diversification reduces single-country risk

- ⏰ Time diversification through dollar-cost averaging

- 🏢 Sector diversification avoids industry concentration

- 💰 Asset class diversification includes stocks, bonds, and alternatives

Quality Over Yield Chasing Conservative investors should prioritize investment quality over maximum yields. Furthermore, sustainable yields indicate healthier long-term performance. Additionally, quality investments provide more predictable income streams.

Quality indicators for conservative investments:

- 📊 Strong credit ratings for bonds and bond funds

- 💰 Consistent dividend payment histories for stocks

- 🏢 Established companies with competitive advantages

- 📈 Growing earnings that support dividend increases

Building Your Conservative Growth Portfolio 📊

Conservative portfolios require strategic construction that balances multiple objectives simultaneously. Therefore, they include various asset classes with different risk and return profiles. Furthermore, they emphasize low-cost, well-diversified investments over complex strategies.

The Conservative Asset Allocation Model

Core Holdings: 60% Bonds and Fixed Income Bonds provide stability, income, and diversification for conservative portfolios. However, bond selection matters significantly for long-term success. Moreover, different bond types serve different purposes within conservative strategies.

Strategic bond allocation:

- 🏛️ 30% Treasury bonds for safety and government backing

- 🏢 20% Investment-grade corporate bonds for additional yield

- 🌍 10% International bonds for geographic diversification

- 📈 Consider inflation-protected bonds (TIPS) for purchasing power protection

Growth Component: 30% Conservative Stocks Stocks provide the growth necessary to outpace inflation over time. Furthermore, conservative stock selection focuses on quality companies with sustainable business models. Additionally, dividend-paying stocks offer income while growth potential.

Conservative stock characteristics:

- 💎 Large-cap companies with established market positions

- 💰 Consistent dividend payment and growth histories

- 🛡️ Defensive sectors like utilities, consumer staples, and healthcare

- 📊 Low volatility relative to broader market indices

Alternatives: 10% for Enhanced Diversification Alternative investments can enhance conservative portfolio performance. However, they should complement rather than replace core holdings. Moreover, liquid alternatives work better for conservative investors than illiquid investments.

Conservative alternative options:

- 🏠 Real Estate Investment Trusts (REITs) for inflation protection

- 💎 Commodity funds for diversification and inflation hedging

- 💰 Conservative balanced funds that adjust allocation automatically

- 🏦 High-yield savings or CDs for near-term liquidity needs

Implementation Through Low-Cost Funds

Index Fund Strategy for Conservative Investors Conservative investors benefit from low-cost index funds that provide broad diversification. Furthermore, these funds eliminate individual security selection risk. Additionally, they offer predictable performance that tracks market segments.

Recommended fund approach:

- 📊 Total Bond Market Index for comprehensive fixed income exposure

- 📊 Dividend Stock Index for conservative equity exposure

- 📊 TIPS Index for inflation protection automatically

- 📊 International Bond Index for geographic diversification

Target-Date Fund Considerations Target-date funds automatically adjust allocation as investors age. However, they may be too aggressive for truly conservative investors. Therefore, choosing target dates further in the future can create more conservative allocations.

Target-date fund optimization:

- 🎯 Choose target date 10-15 years beyond actual retirement for conservative allocation

- 🎯 Understand the fund’s glide path and allocation changes

- 🎯 Consider costs and underlying fund quality before selecting

- 🎯 Monitor allocation changes and adjust if necessary

Advanced Conservative Strategies 🎯

Sophisticated conservative investors can employ additional strategies that enhance returns while maintaining risk management focus. Therefore, these approaches require more knowledge but offer improved outcomes. Furthermore, they often involve tax optimization and income enhancement techniques.

Bond Laddering Strategy

Creating Predictable Income Streams Bond ladders provide predictable income and principal repayment schedules. Moreover, they protect against interest rate risk through diversified maturities. Additionally, they enable reinvestment opportunities as bonds mature.

Bond ladder construction:

- 📅 Purchase bonds with staggered maturity dates (1, 2, 3, 4, 5 years)

- 💰 Reinvest maturing bonds at current interest rates

- 🔄 Maintain constant average maturity through ongoing purchases

- 📊 Use Treasury or high-grade corporate bonds for safety

Interest Rate Risk Management Bond ladders reduce interest rate sensitivity compared to bond funds. Furthermore, they provide principal protection at maturity regardless of rate changes. Additionally, they enable strategic positioning for changing rate environments.

Dividend Growth Investing

Building Income That Grows Over Time Dividend growth stocks provide rising income that outpaces inflation. Moreover, companies that consistently increase dividends demonstrate financial strength. Additionally, dividend growth investing combines income with capital appreciation potential.

Dividend growth criteria:

- 📈 10+ year history of consecutive dividend increases

- 💰 Payout ratios under 60% of earnings for sustainability

- 🏢 Strong competitive positions in growing markets

- 📊 Consistent earnings growth supporting dividend increases

Dividend Aristocrats and Kings Dividend Aristocrats have increased dividends for 25+ consecutive years. Furthermore, Dividend Kings have increased dividends for 50+ consecutive years. Additionally, these companies provide proven track records of shareholder-friendly management.

Tax-Efficient Conservative Investing

Municipal Bond Strategies Municipal bonds offer tax-free income for investors in higher tax brackets. Furthermore, they provide steady income with generally low default risk. Additionally, state-specific municipal bonds can avoid both federal and state taxes.

Municipal bond considerations:

- 🧾 Compare after-tax yields to taxable alternatives

- 🏛️ Evaluate credit quality and insurance backing

- 📍 Consider state-specific bonds for additional tax benefits

- 💰 Use municipal bond funds for diversification and professional management

Tax-Loss Harvesting for Conservative Portfolios Conservative investors can optimize taxes through strategic loss harvesting. However, they must balance tax benefits with portfolio allocation goals. Moreover, wash sale rules require careful timing and security selection.

Conservative Investing Mistakes to Avoid 🚨

Understanding common conservative investing mistakes helps optimize long-term outcomes. Furthermore, these mistakes often result from emotional decision-making rather than strategic planning. Therefore, awareness and prevention prove crucial for conservative investment success.

Over-Emphasis on Safety

The Safety Trap Extreme conservatism often undermines long-term financial security. Furthermore, avoiding all volatility typically means accepting purchasing power erosion. Additionally, ultra-conservative approaches may fail to meet basic retirement and education goals.

Safety trap indicators:

- 💸 Keeping more than 6 months expenses in savings accounts

- 📉 Avoiding all stock market exposure despite long time horizons

- 🏦 Accepting negative real returns for perceived safety

- 🎯 Failing to adjust strategies based on changing needs

Interest Rate Risk Misunderstanding

Long-Term Bond Risks Many conservative investors assume all bonds are safe. However, long-term bonds experience significant price volatility with interest rate changes. Moreover, bond funds with long average maturities can lose substantial value during rising rate periods.

Interest rate risk management:

- ⏰ Focus on intermediate-term bonds (3-7 years) for balance

- 📊 Understand duration risk and its impact on bond prices

- 🔄 Consider bond ladders instead of long-term bond funds

- 📈 Maintain some floating rate exposure for rising rate protection

Yield Chasing Behavior

High Yield Red Flags Conservative investors sometimes chase high yields without considering underlying risks. However, abnormally high yields often indicate higher default risk or unsustainable dividend policies. Therefore, quality analysis becomes essential for conservative investors.

High yield warning signs:

- 💰 Yields significantly above market averages without clear reasons

- 📉 Declining credit ratings or financial deterioration

- 🔴 Dividend cuts or inconsistent payment histories

- 🏢 Companies in declining industries or facing secular challenges

Technology Tools for Conservative Investors 💻

Modern technology provides conservative investors with professional-grade tools at consumer prices. Furthermore, these platforms offer automated rebalancing and tax optimization services. Additionally, they enable sophisticated strategies previously available only to institutional investors.

Robo-Advisors for Conservative Portfolios

Automated Conservative Portfolio Management Robo-advisors can create and manage conservative portfolios automatically. Moreover, they provide professional allocation models at low costs. Additionally, they offer tax-loss harvesting and automatic rebalancing services.

Conservative robo-advisor features:

- 🤖 Goal-based investing aligned with conservative objectives

- 📊 Automatic rebalancing maintains target allocations

- 🧾 Tax-loss harvesting optimizes after-tax returns

- 📱 Mobile access enables easy monitoring and adjustments

Customization for Conservative Preferences Many robo-advisors allow customization for conservative investors. Therefore, they can emphasize income, reduce volatility, or exclude certain sectors. Furthermore, they enable conservative tilts while maintaining diversification benefits.

Direct Indexing for Enhanced Control

Individual Bond and Stock Ownership Direct indexing enables owning individual securities while maintaining index-like diversification. Moreover, it provides enhanced tax-loss harvesting opportunities. Additionally, it allows customization for values-based or sector preferences.

Direct indexing benefits:

- 🎯 Customization for conservative preferences and values

- 🧾 Enhanced tax-loss harvesting at individual security level

- 💰 Dividend capture strategies for income optimization

- 📊 Transparency in individual holdings and performance

Conservative Investing Action Plan 📋

Implementing conservative investing strategies requires systematic approaches and ongoing monitoring. Therefore, successful conservative investors develop clear action plans with specific steps and timelines. Furthermore, they establish review processes that ensure strategies remain aligned with goals.

Getting Started Framework

Step 1: Financial Foundation Assessment Before implementing conservative investing strategies, assess your current financial foundation. Moreover, ensure adequate emergency funds and insurance coverage. Additionally, clarify your investment timeline and risk tolerance clearly.

Foundation checklist:

- 💰 Emergency fund covering 6-12 months of expenses

- 🛡️ Adequate insurance coverage for major risks

- 🎯 Clear investment goals and timeline definition

- 📊 Current asset allocation and performance analysis

Step 2: Account Optimization Strategy Maximize tax-advantaged accounts before taxable investing. Furthermore, understand contribution limits and withdrawal rules clearly. Additionally, consider account types that align with conservative investing goals.

Account prioritization:

- 🏢 Employer 401(k) match for immediate 100% return

- 🧾 Traditional or Roth IRA based on current tax situation

- 🏥 HSA for triple tax advantage when available

- 💰 Taxable accounts for additional conservative investments

Step 3: Portfolio Implementation Start with simple, low-cost index funds before adding complexity. Moreover, automate investments to ensure consistency over time. Additionally, begin with conservative allocations and adjust as comfort levels increase.

Implementation sequence:

- 📊 Begin with target-date funds or balanced funds for simplicity

- 🔄 Add individual index funds for enhanced control gradually

- 💎 Consider alternative investments after establishing core holdings

- 📈 Implement tax optimization strategies as portfolio grows

Ongoing Management and Review

Quarterly Portfolio Review Process Regular portfolio reviews ensure conservative strategies remain on track. However, avoid excessive trading that increases costs and taxes. Moreover, focus on rebalancing and goal progress rather than short-term performance.

Review checklist:

- 📊 Compare actual allocation to target allocation

- 🎯 Assess progress toward specific financial goals

- 💰 Evaluate fee drag and consider lower-cost alternatives

- 📈 Rebalance if allocations drift beyond tolerance bands

Annual Strategy Assessment Annual reviews provide opportunities for strategic adjustments based on changing circumstances. Furthermore, they enable evaluation of new investment options and strategies. Additionally, they ensure conservative strategies evolve with life changes.

Annual assessment areas:

- 🎯 Goal updates based on life changes or market conditions

- 📊 Risk tolerance reassessment and allocation adjustments

- 💰 Tax situation changes requiring strategy modifications

- 🔄 New investment options or platform improvements

Conservative Investing FAQs 🤔

Q: How much should I keep in savings versus conservative investments? A: Maintain 3-6 months of expenses in high-yield savings for emergencies. Additionally, keep money needed within 2 years in savings or short-term bonds. However, money for longer-term goals should go into conservative growth investments.

Q: Are bond funds or individual bonds better for conservative investors? A: Bond funds provide diversification and professional management but have no maturity date. Individual bonds or bond ladders provide principal protection at maturity but require larger investments for diversification. Choose based on your investment size and management preferences.

Q: How do I protect against inflation with conservative investing? A: Include Treasury Inflation-Protected Securities (TIPS), dividend-growing stocks, and real estate investments (REITs) in your portfolio. Additionally, maintain some exposure to stocks for long-term inflation protection.

Q: What percentage should I allocate to stocks in a conservative portfolio? A: Conservative portfolios typically include 20-40% stocks depending on timeline and risk tolerance. Younger conservative investors can maintain higher stock allocations, while near-retirees may prefer lower allocations.

Q: Should I use a robo-advisor or manage conservative investments myself? A: Robo-advisors work well for conservative investors who prefer automated management and lack time for portfolio oversight. However, self-management works for those comfortable with index fund selection and rebalancing.

Q: How do I evaluate if a conservative investment is too risky? A: Evaluate investment quality through credit ratings, financial strength, and track record. Additionally, avoid investments promising yields significantly above market rates. Focus on established companies and funds with long performance histories.

Q: What’s the biggest mistake conservative investors make? A: Being too conservative and failing to grow wealth faster than inflation. Additionally, many conservative investors avoid all stock market exposure despite needing growth for long-term goals.

Q: How often should I rebalance a conservative portfolio? A: Rebalance quarterly or when allocations drift more than 5% from targets. However, avoid excessive rebalancing that increases costs and taxes unnecessarily.

Table 2: Conservative Investment Implementation Checklist

🎯 Step-by-Step Action Items for Conservative Investors Essential steps to build and maintain a conservative growth portfolio

Common Conservative Investing Scams to Avoid 💸

Conservative investors often become targets for financial scams precisely because they seek safety and guaranteed returns. However, understanding these common schemes protects your wealth while maintaining conservative investment principles. Therefore, recognizing red flags becomes essential for conservative investment success.

High-Yield “Guaranteed” Investment Scams

Too-Good-to-Be-True Promises Scammers target conservative investors with promises of high, guaranteed returns without risk. Furthermore, they exploit the desire for safety by claiming government backing or insurance protection. Additionally, they pressure investors to act quickly before “limited opportunities” disappear.

Red flags for conservative investors:

- 🚨 Promises of 8-12% guaranteed returns with no risk

- 🚨 Claims of government backing or FDIC insurance on non-bank products

- 🚨 High-pressure tactics demanding immediate decisions

- 🚨 Unsolicited investment offers via phone, email, or social media

Ponzi Schemes Targeting Conservative Investors Ponzi schemes often disguise themselves as conservative investments offering steady, predictable returns. Moreover, they use early investor payouts to create legitimacy. Additionally, they target communities where word-of-mouth recommendations carry weight.

Protection strategies:

- 🔍 Verify all investment claims through independent sources

- 📊 Research company registration with SEC and state regulators

- 💰 Never invest based solely on friend or family recommendations

- 🧾 Demand detailed written documentation before investing

Certificate of Deposit and Bond Scams

Fake Bank Products Scammers create fake certificates of deposit or bonds claiming FDIC insurance protection. However, these products typically offer unrealistic interest rates to attract conservative investors. Furthermore, they disappear with investor money before any returns are paid.

Verification requirements:

- 🏦 Confirm FDIC insurance directly with FDIC website

- 📋 Verify bank charter and regulatory standing

- 📞 Call bank directly using published phone numbers

- 💳 Ensure deposits go directly to insured institution

Conservative Investing for Different Life Stages 👨👩👧👦

Conservative investing strategies should evolve based on life circumstances and financial responsibilities. Therefore, young conservatives face different challenges than pre-retirees. Furthermore, family obligations often require modified conservative approaches.

Conservative Investing for Young Adults (20s-30s)

Balancing Safety with Growth Needs Young conservative investors must balance natural risk aversion with long-term growth requirements. Moreover, they need strategies that build wealth over decades without excessive volatility. Additionally, they should maintain flexibility for career changes and major purchases.

Young adult conservative strategy:

- 📊 70% stocks (dividend-focused), 30% bonds for growth with stability

- 💰 Emergency fund priority before aggressive investing

- 🏠 Separate savings for home down payment in conservative investments

- 📈 Automatic investing to overcome decision paralysis

Building Financial Confidence Through Conservative Success Starting with conservative investments builds confidence in market investing. Furthermore, positive early experiences encourage continued investing behavior. Additionally, conservative approaches teach fundamental investment principles without emotional stress.

Conservative Investing for Families (30s-40s)

Managing Multiple Financial Priorities Families face competing demands from children’s education, housing costs, and retirement savings. Therefore, conservative strategies must address multiple goals simultaneously. Furthermore, they require flexibility for unexpected family expenses.

Family conservative priorities:

- 👨👩👧👦 Emergency fund covering family expenses for 6-12 months

- 🎓 529 education savings with conservative investment options

- 🏠 Home equity building through mortgage payments

- 🔄 Balanced retirement contributions despite competing priorities

Teaching Children About Conservative Money Management Conservative investing provides excellent teaching opportunities for children. Moreover, it demonstrates patience, discipline, and long-term thinking. Additionally, it shows how money grows through compound interest rather than speculation.

Conservative Investing for Pre-Retirees (50s-60s)

Capital Preservation with Growth Pre-retirees need strategies that protect accumulated wealth while enabling continued growth. Furthermore, they cannot afford major portfolio losses near retirement. Additionally, they should begin transitioning toward income-generating investments.

Pre-retirement conservative approach:

- 📊 60% bonds, 30% dividend stocks, 10% alternatives for stability

- 💰 Catch-up contributions to retirement accounts when possible

- 🧾 Tax-loss harvesting to optimize portfolio efficiency

- 📈 Gradual shift toward income investments over pure growth

Conservative Investing Psychology and Behavior 🧠

Understanding the psychological aspects of conservative investing helps maintain successful long-term strategies. Moreover, emotional reactions often undermine even the best conservative plans. Therefore, behavioral awareness becomes crucial for conservative investment success.

Overcoming Conservative Investor Fears

Market Volatility Anxiety Many conservative investors avoid all market exposure due to volatility fears. However, this approach guarantees losing purchasing power to inflation. Therefore, gradual exposure combined with education helps overcome these fears.

Fear management strategies:

- 📊 Start with target-date funds for professional management

- 💰 Begin with small amounts to build comfort gradually

- 📈 Focus on long-term goals rather than daily fluctuations

- 🧠 Understand that volatility creates buying opportunities

Analysis Paralysis Prevention Conservative investors often research endlessly without taking action. Furthermore, the desire for perfect timing prevents starting entirely. Additionally, excessive analysis can lead to more complex strategies than necessary.

Action-oriented solutions:

- ⏰ Set decision deadlines to prevent endless research

- 📊 Start with simple, broad index funds

- 🔄 Plan to improve strategy over time rather than perfect immediately

- 💰 Begin investing small amounts while continuing education

Maintaining Discipline During Market Stress

Bear Market Behavior for Conservative Investors Conservative portfolios experience smaller declines during bear markets but still face volatility. However, conservative investors often have lower risk tolerance for any losses.

Therefore, preparation and perspective become essential.

Bear market strategies:

- 📉 Continue regular investing during market declines

- 💰 View market drops as buying opportunities for quality investments

- 📊 Rebalance portfolios when allocations drift significantly

- 🧠 Remember that bear markets are temporary while compound growth is permanent

Avoiding Emotional Investment Decisions Conservative investors may panic during market stress and sell at exactly the wrong time. Furthermore, they might chase yield during low interest rate periods.

Additionally, they could abandon strategies during short-term underperformance.

Emotional discipline techniques:

- 🤖 Automate investments to remove emotional decisions

- 📊 Review historical performance during similar periods

- 📞 Consult fee-only financial advisors during stressful periods

- 📈 Focus on progress toward goals rather than short-term performance

Conclusion

Conservative investing requires moving beyond the false safety of savings accounts toward strategies that actually protect and grow wealth over time. Therefore, successful conservative investors embrace moderate risk to achieve necessary returns for long-term financial security.

Smart conservative investors understand that inflation poses the greatest threat to their financial future. Additionally, they recognize that thoughtful risk management differs significantly from risk avoidance. Furthermore, they leverage modern investment tools and strategies to build substantial wealth while maintaining their conservative principles.

Technology, low-cost index funds, and professional portfolio management have democratized sophisticated conservative investment strategies previously available only to wealthy investors.

Moreover, conservative investors who embrace these tools while maintaining discipline can achieve their financial goals without sacrificing their sleep.

Finally, conservative investing success comes from consistent action over decades rather than perfect timing or complex strategies.

Therefore, starting with imperfect conservative approaches beats waiting for perfect conditions that never arrive.

Hold a Master Degree in Electrical engineering from Texas A&M University.

African born – French Raised and US matured who speak 5 languages.

Active Stock Options Trader and Coach since 2014.

Most Swing Trade weekly Options and Specialize in 10-Baggers !

YouTube Channel: https://www.youtube.com/c/SuccessfulTradings

Other Website: https://237answersblog.com/