I began trading in 2015 and started coaching in 2019. Millennials face unprecedented financial challenges that require strategic prioritization. Furthermore, traditional financial advice fails to address their unique economic reality. Therefore, this guide helps you navigate competing priorities while building long-term wealth systematically.

👉 In this guide, you will learn:

- 💰 How to prioritize student loans versus investing decisions

- 🏠 Strategic approaches to homeownership without derailing retirement

- 📊 Investment allocation strategies for competing financial goals

- 🎯 The optimal order for tackling multiple financial priorities

- 💡 How to accelerate wealth building despite financial headwinds

- 📈 Portfolio construction for millennial-specific challenges

- ⚖️ Balancing immediate needs with long-term wealth building

Millennials inherited an economy vastly different from previous generations. Additionally, student debt, housing costs, and retirement uncertainty create complex trade-offs. What’s more, traditional advice often ignores these realities completely.

Table of Contents

The Millennial Financial Reality Check 📊

Millennials face economic challenges no previous generation has encountered. First, student loan debt has exploded to unprecedented levels. Moreover, housing costs consume larger portions of income than ever before. Meanwhile, traditional pensions disappeared while Social Security becomes increasingly uncertain.

Unique financial challenges millennials face:

- 💸 Average student loan debt exceeding $30,000 per graduate

- 🏠 Home prices requiring 20-30% more income than previous generations

- 📉 Stagnant wages compared to inflation and cost increases

- 🏢 Gig economy reducing traditional employment benefits

- 📈 Increased responsibility for retirement funding without pensions

However, millennials also possess significant advantages often overlooked. Additionally, technology provides investment access previous generations lacked. Furthermore, longer time horizons enable aggressive growth strategies when implemented correctly.

Millennial financial advantages to leverage:

- ⏰ 30-40 years until retirement allows compound growth

- 📱 Low-cost investment platforms and robo-advisors

- 💡 Access to financial education and tools online

- 🌍 Global investment opportunities through technology

- 📊 Real-time portfolio tracking and optimization tools

Smart millennials recognize both challenges and opportunities. Therefore, they develop strategic approaches that address multiple priorities simultaneously rather than postponing wealth building indefinitely.

The Millennial Investment Priority Framework 🎯

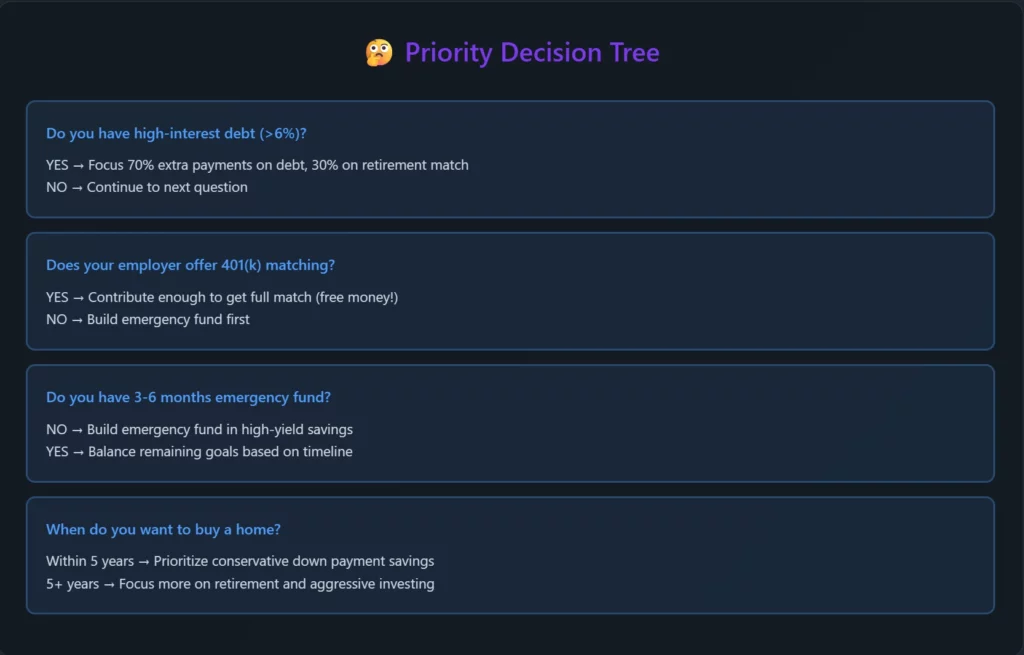

Traditional financial advice suggests tackling goals sequentially. However, millennials cannot afford to wait decades before investing. Instead, they need frameworks that address multiple priorities simultaneously while optimizing for long-term wealth.

The Balanced Priority Approach

Rather than choosing between student loans, homeownership, and retirement, successful millennials create balanced strategies. Furthermore, they understand that perfect optimization matters less than consistent progress. Additionally, they recognize that starting early trumps starting perfectly.

Core principles for millennial investing:

- 🎯 Address all priorities simultaneously rather than sequentially

- 💰 Prioritize tax-advantaged investing even with debt

- 🏠 Separate homeownership timing from investment strategy

- 📈 Emphasize automation to overcome decision fatigue

- ⚖️ Balance risk tolerance with time horizon advantages

The 50/30/20 Millennial Rule:

- 50% to immediate needs (rent, minimums, essentials)

- 30% to competing priorities (loans, home savings, investments)

- 20% to long-term wealth building (retirement, taxable investments)

This framework ensures progress on all fronts while maintaining financial flexibility. Moreover, it prevents the paralysis that stops many millennials from investing entirely.

Student Loan Strategy: Pay Off vs. Invest Decision Matrix 📚

The student loan versus investing debate dominates millennial financial discussions. However, the answer depends on specific circumstances rather than universal rules. Therefore, understanding decision factors enables optimal choices for individual situations.

Interest Rate Decision Threshold

Loans Above 6% Interest Rate High-interest student loans typically justify aggressive payoff strategies. Furthermore, guaranteed 6%+ returns through debt reduction often exceed investment expectations. Additionally, debt reduction provides psychological benefits that improve overall financial behavior.

Aggressive payoff strategies for high-interest loans:

- 💰 Direct all extra payments to highest-rate loans first

- 💰 Consider refinancing to lower rates when possible

- 💰 Use windfalls like tax refunds for loan reduction

- 💰 Maintain only minimum emergency fund during payoff

Loans Below 4% Interest Rate Low-interest loans often justify minimum payments while investing aggressively. Moreover, tax deductions for student loan interest improve the effective cost calculation. Additionally, long-term investment returns typically exceed low loan rates significantly.

Investment-focused strategies for low-interest loans:

- 📈 Make minimum payments while maximizing retirement contributions

- 📈 Invest extra money in tax-advantaged accounts first

- 📈 Consider taxable investments after maxing retirement accounts

- 📈 Maintain standard emergency fund while investing

Loans Between 4-6% Interest Rate Medium-interest loans create the most complex decisions. However, hybrid approaches often provide optimal outcomes. Furthermore, personal risk tolerance becomes the deciding factor in these situations.

Hybrid strategies for medium-interest loans:

- ⚖️ Split extra payments between loans and investments

- ⚖️ Prioritize employer 401k match before extra loan payments

- ⚖️ Consider loan refinancing to move into lower bracket

- ⚖️ Adjust strategy based on job security and income stability

Tax Considerations for Student Loans

Student loan interest deductions reduce effective interest rates for eligible borrowers. Furthermore, this deduction phases out at higher income levels. Additionally, tax-advantaged investing provides immediate benefits that compound over time.

Student Loan Interest Deduction Benefits:

- 🧾 Up to $2,500 annual deduction for student loan interest

- 🧾 Available for modified adjusted gross income up to $85,000 (single)

- 🧾 Reduces effective interest rate by marginal tax rate

- 🧾 No itemization required for this above-the-line deduction

Tax-Advantaged Investment Benefits:

- 🧾 401k contributions reduce current taxable income

- 🧾 Roth IRA provides tax-free growth for decades

- 🧾 HSA offers triple tax advantage when available

- 🧾 Tax-loss harvesting in taxable accounts

Smart millennials factor these tax implications into their decision matrix. Therefore, they often prioritize tax-advantaged investing even with moderate student debt levels.

Homeownership Strategy: Timing and Trade-offs 🏠

Homeownership represents a major financial and lifestyle decision for millennials. However, treating it as an investment often leads to poor financial outcomes. Instead, viewing it as a lifestyle choice with financial implications enables better decision-making.

Rent vs. Buy Analysis Framework

True Cost of Homeownership Many millennials underestimate total homeownership costs. Furthermore, they focus only on mortgage payments rather than comprehensive expenses. Additionally, they ignore opportunity costs of down payments and maintenance time.

Complete homeownership cost analysis:

- 🏠 Mortgage principal and interest payments

- 🏠 Property taxes and homeowners insurance

- 🏠 Maintenance, repairs, and improvement costs

- 🏠 HOA fees and special assessments

- 🏠 Opportunity cost of down payment investment returns

Rental Advantages for Millennials Renting provides flexibility that aligns with millennial career patterns. Moreover, it eliminates maintenance responsibilities and large upfront costs. Additionally, it enables geographic mobility for career advancement.

Strategic renting benefits:

- 📍 Geographic flexibility for career opportunities

- 💰 Lower upfront costs enable earlier investing

- ⚖️ Predictable monthly housing expenses

- 🔧 No maintenance responsibilities or unexpected repairs

When Homeownership Makes Sense Homeownership becomes attractive when specific conditions align. However, these conditions vary by individual circumstances and local markets. Furthermore, timing matters more than perfect market analysis.

Homeownership green lights:

- 🎯 Plan to stay in area for 7+ years

- 💰 Can afford 20% down payment without depleting emergency fund

- 📊 Total housing costs under 28% of gross income

- 🏠 Monthly payment comparable to quality rental options

Down Payment Strategy

The 20% Down Payment Myth Many millennials delay homeownership waiting for 20% down payments. However, numerous programs enable homeownership with lower down payments. Furthermore, private mortgage insurance costs often justify earlier purchases with smaller down payments.

Alternative down payment strategies:

- 🏦 FHA loans requiring only 3.5% down payment

- 🏦 Conventional loans with 5-10% down payment options

- 🏦 VA loans for eligible veterans with zero down payment

- 🏦 State and local first-time buyer assistance programs

Down Payment vs. Investment Trade-off Large down payments reduce monthly payments but eliminate investment opportunities. Therefore, opportunity cost analysis becomes crucial for optimization. Additionally, leverage can amplify returns when used responsibly.

Down payment optimization considerations:

- 📈 Compare mortgage interest rates to investment return expectations

- 💰 Factor in mortgage interest tax deductions

- 📊 Consider PMI costs versus additional investment returns

- ⚖️ Evaluate job security and income stability

Smart millennials often choose smaller down payments to maintain investment capacity. However, they ensure adequate emergency funds and stable income before leveraging.

Retirement Investment Strategy for Millennials 🚀

Millennials possess the greatest asset for retirement investing: time. Therefore, they can employ aggressive strategies that older investors cannot risk. Furthermore, starting early enables lower contribution requirements while achieving superior outcomes.

The Millennial Retirement Advantage

Compound Growth Power Millennials have 30-40 years for compound growth before retirement. Moreover, this time horizon enables recovery from market downturns. Additionally, it justifies aggressive growth allocations that maximize long-term returns.

Compound growth illustration for millennials:

- 💰 $500 monthly starting at age 25 = $1.37 million at 65 (7% returns)

- 💰 $1,000 monthly starting at age 35 = $1.22 million at 65 (7% returns)

- 💰 Early start with half the contribution beats late start with double

Market Volatility as Opportunity Young investors benefit from market volatility through dollar-cost averaging. Furthermore, market downturns enable accumulation at lower prices. Additionally, long time horizons smooth out short-term fluctuations completely.

Volatility advantages for millennials:

- 📉 Market drops provide buying opportunities

- 📈 Dollar-cost averaging reduces average purchase prices

- ⏰ Multiple market cycles enable full recovery

- 🎯 Emotional discipline easier with distant retirement

Optimal Account Prioritization

Employer 401k Match (Priority #1) Employer matching represents immediate 100% returns on investment. Therefore, it takes priority over all other financial goals including high-interest debt. Furthermore, missing matches means forfeiting free money permanently.

401k match optimization:

- 🏢 Contribute minimum required for full employer match

- 🏢 Understand vesting schedules and job change implications

- 🏢 Consider Roth 401k options for tax diversification

- 🏢 Increase contributions with salary raises automatically

Roth IRA Maximum (Priority #2) Roth IRAs provide unmatched flexibility for millennials. Moreover, contributions can be withdrawn penalty-free for emergencies. Additionally, tax-free growth for decades provides enormous value.

Roth IRA advantages for millennials:

- 💰 $7,000 annual contribution limit (2025)

- 💰 Tax-free growth and qualified withdrawals

- 💰 No required minimum distributions

- 💰 Contribution withdrawals available penalty-free

Additional 401k Contributions (Priority #3) After maximizing Roth IRA, additional 401k contributions provide tax deferral benefits. Furthermore, higher contribution limits enable aggressive retirement savings. Additionally, automated payroll deductions ensure consistency.

Taxable Investment Accounts (Priority #4) Taxable accounts provide flexibility for multiple goals simultaneously. Moreover, they enable tax-loss harvesting strategies. Additionally, they avoid withdrawal restrictions of retirement accounts.

Asset Allocation for Millennials

Aggressive Growth Allocation Millennials can maintain 90-100% stock allocation during accumulation years. Furthermore, international diversification reduces overall portfolio risk. Additionally, small-cap exposure enhances long-term growth potential.

Suggested millennial allocation:

- 📊 70% U.S. Total Stock Market

- 📊 20% International Developed Markets

- 📊 10% Emerging Markets

- 📊 0-10% Bonds (optional for stability)

Geographic and Sector Diversification Global diversification reduces dependence on U.S. market performance. Moreover, different regions experience varying economic cycles. Additionally, emerging markets provide higher growth potential despite increased volatility.

Low-Cost Index Fund Strategy Expense ratios dramatically impact long-term returns due to compounding. Therefore, millennials should prioritize low-cost index funds. Furthermore, simplicity often beats complexity in investment management.

Recommended index fund approach:

- 🔍 Target expense ratios under 0.20% annually

- 🔍 Prefer total market funds over individual sectors

- 🔍 Use three-fund portfolios for simplicity

- 🔍 Automate investments and rebalancing

Managing Multiple Priorities Simultaneously ⚖️

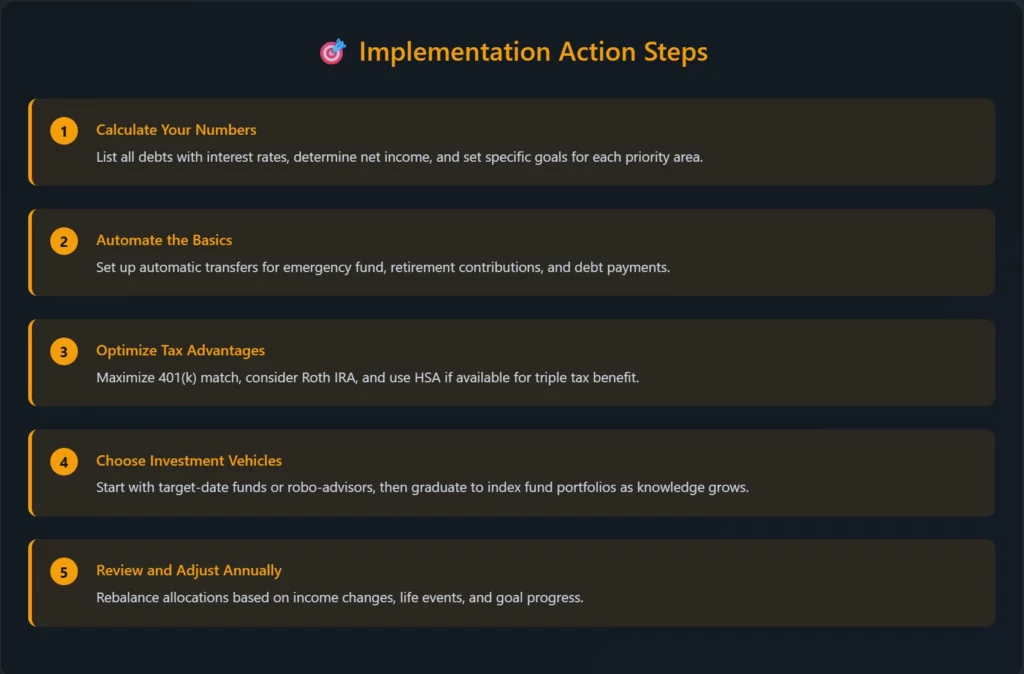

Successful millennials avoid the trap of sequential goal achievement. Instead, they develop systems that address multiple priorities simultaneously. Furthermore, they understand that perfect optimization matters less than consistent progress.

The Simultaneous Progress Strategy

Monthly Cash Flow Allocation Rather than choosing between competing goals, allocate monthly cash flow across all priorities. Moreover, adjust percentages based on interest rates and personal circumstances. Additionally, automate allocations to ensure consistency.

Sample monthly allocation for $5,000 take-home pay:

- 🏠 $1,500 rent and utilities (30%)

- 💰 $500 student loan payments (10%)

- 🏦 $750 retirement contributions (15%)

- 💳 $500 emergency fund building (10%)

- 🏠 $250 home down payment savings (5%)

- 🍽️ $1,500 remaining for food, transport, discretionary (30%)

Flexible Reallocation Strategy Life circumstances change requiring allocation adjustments. Therefore, build flexibility into your system. Furthermore, major events like job changes justify temporary reallocation.

Reallocation triggers:

- 📈 Salary increases enable higher savings rates

- 🚨 Job loss requires emergency fund focus

- 🏠 Home purchase shifts priorities temporarily

- 💰 Debt payoff frees up cash flow for investing

Automation Systems for Millennials

Set-and-Forget Investing Automation overcomes the behavioral challenges that derail financial progress. Moreover, it ensures consistent investing regardless of market conditions. Additionally, it reduces decision fatigue that leads to analysis paralysis.

Essential automation systems:

- 🤖 Automatic 401k contributions from payroll

- 🤖 Monthly Roth IRA contributions from checking

- 🤖 Automatic student loan payments for interest rate reductions

- 🤖 Emergency fund transfers on payday

Robo-Advisor Integration Robo-advisors provide professional portfolio management at low costs. Furthermore, they offer tax-loss harvesting and automatic rebalancing. Additionally, they prevent emotional investment decisions during market volatility.

Robo-advisor benefits for millennials:

- 📊 Professional asset allocation and rebalancing

- 🧾 Automated tax-loss harvesting in taxable accounts

- 💰 Low management fees compared to human advisors

- 📱 Mobile app integration for easy monitoring

Video Recommendation 🎥

🎬 For practical guidance on millennial investment strategies, watch my Successful Tradings video about balancing multiple financial priorities. The video demonstrates real allocation strategies and decision frameworks. Moreover, it shows how to optimize for long-term wealth while addressing immediate needs.

Watch it here: https://www.youtube.com/@SuccessfulTradings and search for “Millennial Investment Priority Framework.”

You will learn specific techniques that help millennials build wealth despite competing financial pressures.

Millennial Investment Mistakes to Avoid 🚨

Understanding common mistakes helps millennials optimize their financial strategies. Furthermore, these mistakes can derail long-term wealth building despite good intentions. Therefore, awareness and prevention prove crucial for financial success.

Analysis Paralysis

Perfectionism Over Progress Many millennials research endlessly without taking action. However, starting imperfectly beats never starting at all. Moreover, investment strategies can be adjusted as knowledge and circumstances evolve.

Overcoming analysis paralysis:

- 🎯 Set deadlines for financial decisions

- 📈 Start with simple index fund portfolios

- 🔄 Plan to improve strategy over time

- 💰 Begin with small amounts to build confidence

Timing the Market Market timing appeals to millennials but consistently fails. Furthermore, missing the best market days dramatically reduces returns. Additionally, time in market beats timing the market consistently.

Lifestyle Inflation

Salary Increase Spending Many millennials increase spending with every salary raise. However, directing raises to investments creates automatic wealth building. Moreover, maintaining lifestyle while income grows enables aggressive savings rates.

Salary increase optimization:

- 📈 Direct 50% of raises to investments automatically

- 🏠 Avoid lifestyle inflation with income growth

- 💰 Increase retirement contributions with promotions

- 🎯 Set savings rate targets rather than dollar amounts

Social Media Investment Mistakes

FOMO-Driven Decisions Social media creates investment FOMO that leads to poor decisions. Furthermore, individual stock tips rarely provide consistent returns. Additionally, entertainment often masquerades as investment advice.

Social media investment protection:

- 📱 Follow credentialed financial educators only

- 🚫 Avoid individual stock tips and day trading

- 📊 Focus on systematic investing over viral trends

- 🧠 Remember that overnight success stories are outliers

FAQs 🤔

Should I pay off student loans or invest first? Prioritize employer 401k match, then focus on loans above 6% interest. For loans below 4%, invest aggressively while making minimum payments.

How much should I save for a house down payment? Aim for 10-20% down payment while maintaining emergency fund and retirement contributions. Consider lower down payment programs if available.

What’s the best investment account for millennials? Start with employer 401k match, then max Roth IRA, then additional 401k contributions, finally taxable accounts for flexibility.

How aggressive should my investment allocation be? Millennials can maintain 90-100% stocks during accumulation years. Add small bond allocation only if needed for emotional comfort.

Should I prioritize retirement over emergency fund? Build basic emergency fund first, then prioritize retirement accounts with employer matches and tax advantages.

How do I balance multiple financial goals? Allocate monthly income across all priorities simultaneously rather than tackling them sequentially. Automate everything possible.

What’s the biggest mistake millennials make with money? Analysis paralysis that prevents starting. Imperfect action beats perfect inaction for long-term wealth building.

How much should millennials save for retirement? Aim for 15-20% of gross income including employer match. Start with whatever possible and increase with salary growth.

Conclusion

Millennials face unprecedented financial challenges requiring strategic prioritization and systematic approaches. Therefore, successful wealth building demands addressing multiple goals simultaneously rather than sequentially. Furthermore, automation and long-term thinking overcome the behavioral challenges that derail financial progress.

Smart millennials leverage their greatest advantage – time – through aggressive growth strategies and consistent passive investing.

Additionally, they understand that starting early with imperfect strategies beats waiting for perfect conditions.

Finally, they recognize that compound growth over decades creates wealth despite current financial pressures and competing priorities.

Hold a Master Degree in Electrical engineering from Texas A&M University.

African born – French Raised and US matured who speak 5 languages.

Active Stock Options Trader and Coach since 2014.

Most Swing Trade weekly Options and Specialize in 10-Baggers !

YouTube Channel: https://www.youtube.com/c/SuccessfulTradings

Other Website: https://237answersblog.com/