Table of Contents

Getting Started With Dividend Growth Investing in 2026

Dividend growth investing has become pretty popular in 2026, especially among beginners looking to build reliable income streams. The idea is simple: you invest in companies that pay dividends and tend to increase those dividends year after year. Unlike speculative trading, dividend growth investing focuses on steady, long-term results. It’s not about chasing the highest yields; it’s about growing your income steadily over time. Dividend growth stocks usually belong to stable, established businesses, so they can provide both regular income and the potential for your payout to grow.

How Dividend Growth Investing Works

Most dividend growth investors look for companies that have a strong record of raising their dividends regularly.

These increases can help protect your income against inflation.

A growing dividend typically means the underlying business is healthy and generating enough free cash flow to reward shareholders.

You’ll see investors track dividend growth rates along with the payout ratio, which is the portion of earnings paid out as dividends.

A healthy payout ratio can mean the dividend is sustainable and likely to increase in the future.

Why Choose Dividend Growth Investing?

One of the main perks of this strategy is its reliability. Even though stock prices can bounce up and down, regular dividend payments offer stability. Compounding also works in your favor; many investors reinvest their dividends, which helps your portfolio grow faster. Plus, the focus on stable, dividend-raising companies can mean a bit less stress compared to more volatile investment ideas. Over time, dividend growth investing can help you reach goals like retirement or supplement your paycheck with less worry.

Building a Dividend Growth Portfolio for 2026

For beginners in 2026, technology and consumer staples remain big themes, and plenty of solid companies sit in these spaces. Start with research on sectors and companies with a strong dividend track record. Tools like stock screeners can help you filter by dividend growth history, yield, market cap, and payout ratio. Balance is really important; diversify across sectors so you don’t get caught out if one industry takes a hit. Some investors also like to add international stocks or ETFs for extra diversification. It’s also a good idea to read earnings reports and company news regularly so you can spot any red flags early.

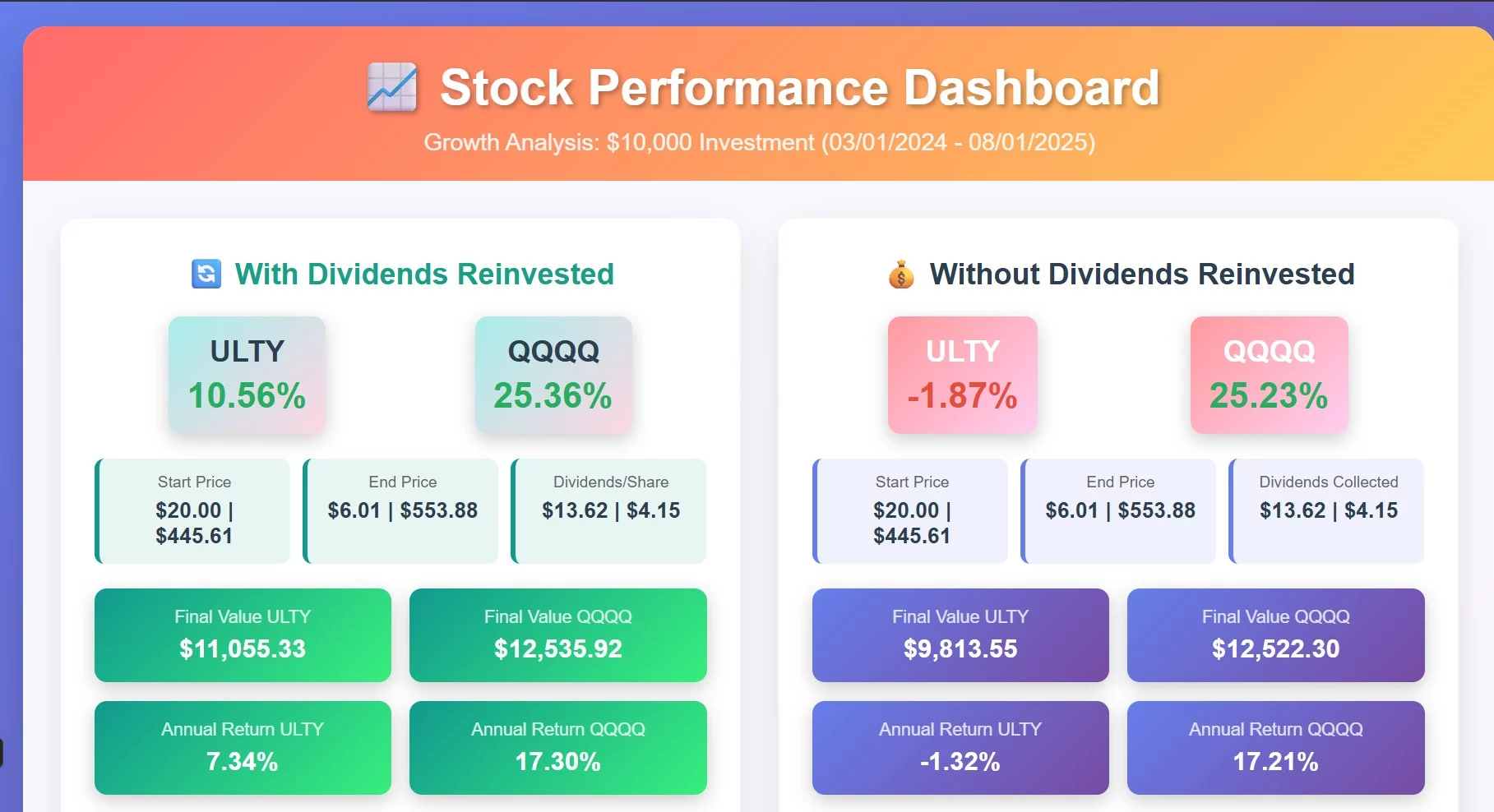

Investing Through ETFs: Spotlight on HighYieldMax ETFs

HighYieldMax ETFs have gained traction for folks wanting to get started quickly. These funds bundle multiple dividend growth stocks so you benefit from built-in diversification and expert management.

Instead of picking individual stocks, you can buy shares in HighYieldMax ETFs and get exposure to a basket of growing dividend payers.

This approach saves time and is pretty handy if you’re just starting out. Plus, these ETFs often get rebalanced regularly, so you don’t have to worry about managing every detail yourself. The management fees for HighYieldMax ETFs have remained competitive, making them attractive for long-term investors aiming to grow their dividend streams in 2026.

Risks and What to Watch For

Dividend growth investing isn’t risk-free, even though it’s seen as stable. Companies might cut their dividends due to earnings drops or tougher economic periods.

It’s important to avoid chasing the highest yields since very high payouts can signal trouble.

Also, overconcentration in one sector can hurt if that area struggles. Carefully keeping an eye on dividend increase histories is a must.

Checking up on companies regularly helps reduce these risks and keeps your portfolio on track.

Remember to review your holdings at least once a year and stay updated on any significant changes in the businesses you own.

Actionable Tips for Beginners

Start small and focus on companies or ETFs with a decade or more of rising dividends.

Regularly reinvest dividends to help your income snowball over time. Many brokers have automated DRIP (Dividend Re-Investment Program) you can set up once.

Keep some flexibility; sometimes it pays to switch things up if a company’s outlook changes.

Don’t get discouraged by short-term price changes, as the focus is on accumulating more shares and letting dividend growth do the heavy lifting.

Drip is Your Friend

Consider using automatic investment plans to stay consistent, and always pay attention to fees, which can eat into your returns if you’re not careful. Over time, being patient and sticking to your plan can set you up for financial freedom.

Educate yourself on tax implications, especially if you plan to invest substantial amounts; dividend income might be taxed differently depending on your country or the specific retirement account you use.

Talking with experienced investors or consulting a financial advisor can provide extra confidence as you build your portfolio.

FAQs About Dividend Growth Investing in 2026

How much money do I need to start?

Many brokerages have dropped their account minimums, so you can begin with just a few bucks.

ETFs like HighYieldMax are beginner friendly since you can buy a single share and get broad exposure immediately.

You can begin with $500. However, $1,000 allows diversification. Moreover, add monthly if you can.

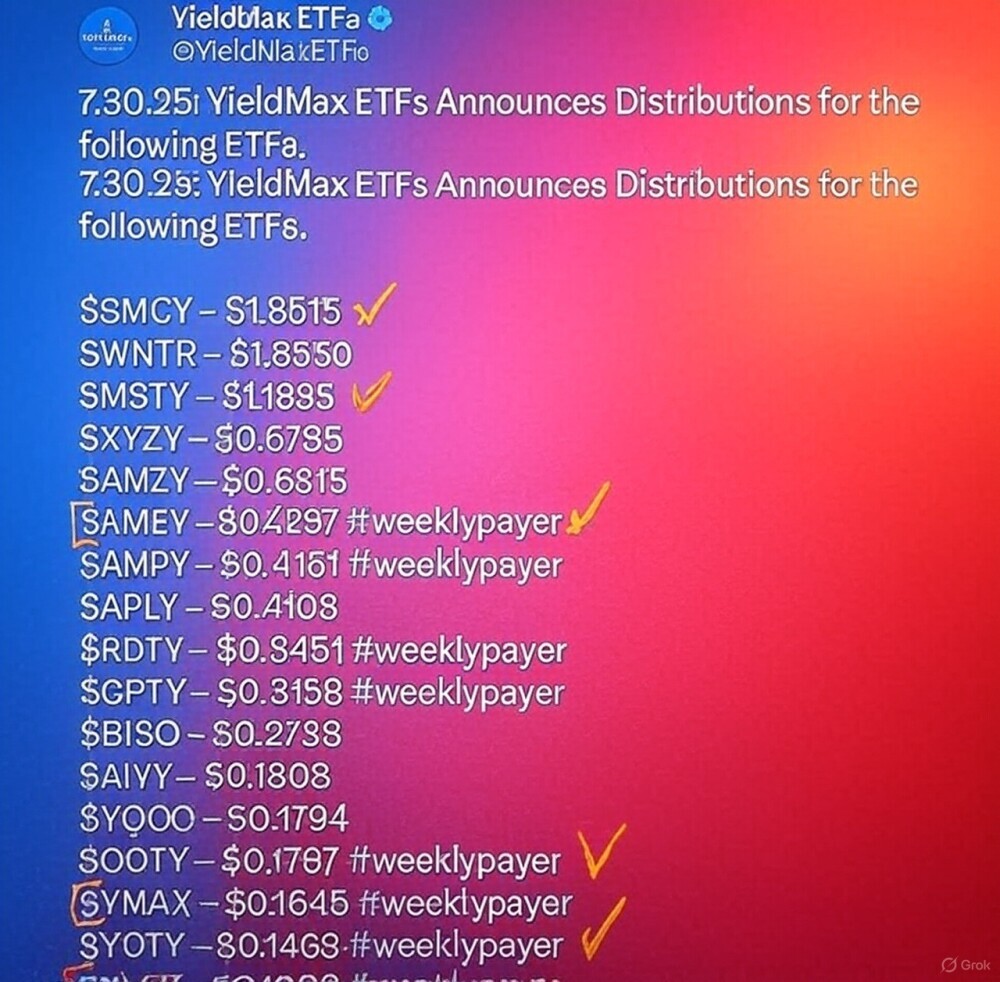

How often are dividends paid?

Most US companies pay dividends quarterly, but some pay monthly or even once a year.

HighYieldMax ETFs usually pay monthly and weekly (ULTY, LFGY, YMAX for instance), which many investors find convenient for reinvestment.

If you want steady cash flow, look for funds or stocks that pay more regularly.

Can I lose money with dividend growth investing?

Stock prices can drop, and companies can cut dividends.

However, focusing on businesses with strong histories and staying diversified reduces risk over time.

Keep in mind, all investing involves risk, but steady and informed choices help manage those risks.

Is dividend growth investing suitable for young investors?

It works for all ages. Starting young gives you more time for your dividends (and their growth) to compound.

Even with smaller amounts, a long time horizon boosts results, so it’s definitely worth checking out if you’re in your 20s or 30s.

Building a habit of investing early makes a big difference down the line.

How do I track my dividend growth investments?

You can use free portfolio trackers or even your brokerage app. Keep an eye on income growth year by year to monitor your progress.

Many brokerages now offer performance and dividend reports that make tracking easier than ever.

Some investors even use spreadsheets to visualize their progress and spot trends over time.

Are dividends taxable?

Yes, but qualified ones tax lower. In brokerage accounts, plan accordingly.

What’s the difference between dividend growth and high yield?

Growth focuses on increases over time. High yield seeks immediate income. However, growth often outperforms long-term.

Can I use HighYieldMax ETFs for growth?

Yes, they provide high monthly payouts via options. But they’re more volatile.

Additionally, blend with traditional low-risk dividend growers.

Hold a Master Degree in Electrical engineering from Texas A&M University.

African born – French Raised and US matured who speak 5 languages.

Active Stock Options Trader and Coach since 2014.

Most Swing Trade weekly Options and Specialize in 10-Baggers !

YouTube Channel: https://www.youtube.com/c/SuccessfulTradings

Other Website: https://237answersblog.com/