I began trading in 2015 and started coaching in 2019. Portfolio rebalancing separates successful long-term investors from those who underperform markets. However, most investors either rebalance too frequently or never rebalance at all. Therefore, this guide provides systematic approaches that maximize returns while controlling risk effectively.

👉 In this guide, you will learn:

- ⚖️ When portfolio rebalancing actually improves returns versus hurts them

- 📊 The optimal rebalancing frequencies for different investment strategies

- 💰 Tax-efficient rebalancing techniques that minimize unnecessary costs

- 🎯 How to determine if your portfolio needs rebalancing right now

- 📈 Advanced rebalancing strategies for volatile market conditions

- 🧠 Behavioral psychology that derails rebalancing discipline

- ⚡ Automated systems that remove emotion from rebalancing decisions

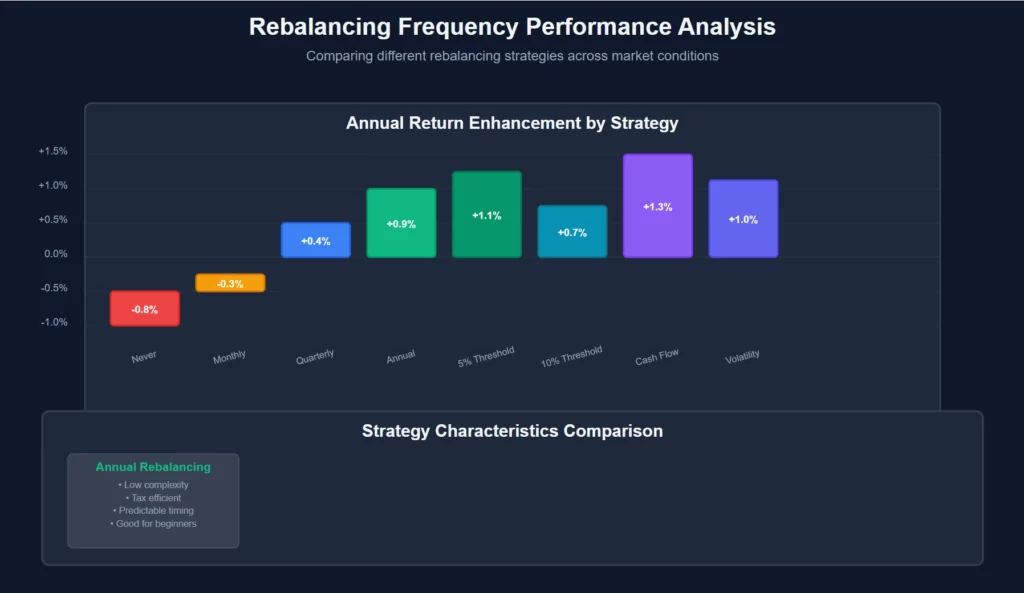

Portfolio rebalancing can add 0.5-1.2% to annual returns through systematic risk management. Unfortunately, emotional decision-making often turns beneficial rebalancing into performance-destroying market timing. Additionally, poor rebalancing strategies create unnecessary tax obligations and trading costs.

Table of Contents

The Science Behind Portfolio Rebalancing 📊

Portfolio rebalancing forces investors to sell high-performing assets and buy underperforming ones systematically. Therefore, it naturally implements “buy low, sell high” strategies without emotional interference. Furthermore, rebalancing maintains target risk levels as market movements shift allocations.

Why Portfolios Drift from Target Allocations

Market Performance Variations Different asset classes rarely move in perfect synchronization. Moreover, strong performance in one area increases its portfolio weight automatically. Additionally, extended bull markets can dramatically skew originally balanced portfolios.

Common portfolio drift scenarios:

- 📈 Stock bull markets increase equity allocation beyond targets

- 🏠 Real estate booms concentrate wealth in property investments

- 💰 Bond bear markets reduce fixed income below minimum thresholds

- 🌍 International outperformance shifts geographic allocation

Time and Compound Growth Effects Compound growth naturally amplifies successful investments over time. Furthermore, exponential growth curves accelerate allocation drift during extended periods. Additionally, dividend reinvestment and new contributions affect balance.

The Rebalancing Return Premium

Academic research demonstrates that systematic rebalancing typically adds 0.5-1.2% annually to portfolio returns. However, this premium varies significantly based on market conditions and rebalancing methodology. Moreover, the benefit comes from both risk reduction and return enhancement.

Sources of Rebalancing Benefits:

- 🎯 Forced contrarian investing captures mean reversion profits

- ⚖️ Risk level maintenance prevents excessive concentration

- 📊 Discipline prevents emotional market timing mistakes

- 💰 Tax-loss harvesting opportunities in taxable accounts

When Rebalancing Reduces Returns:

- 📈 During strong trending markets without significant reversals

- 💸 When transaction costs exceed rebalancing benefits

- 🧾 In taxable accounts with high capital gains tax obligations

- ⏰ With excessively frequent rebalancing that whipsaws positions

Determining Your Optimal Rebalancing Frequency ⏰

Rebalancing frequency represents a crucial optimization decision affecting both returns and costs. Therefore, the optimal approach depends on portfolio size, account types, and market conditions. Furthermore, different strategies work better for different investor profiles.

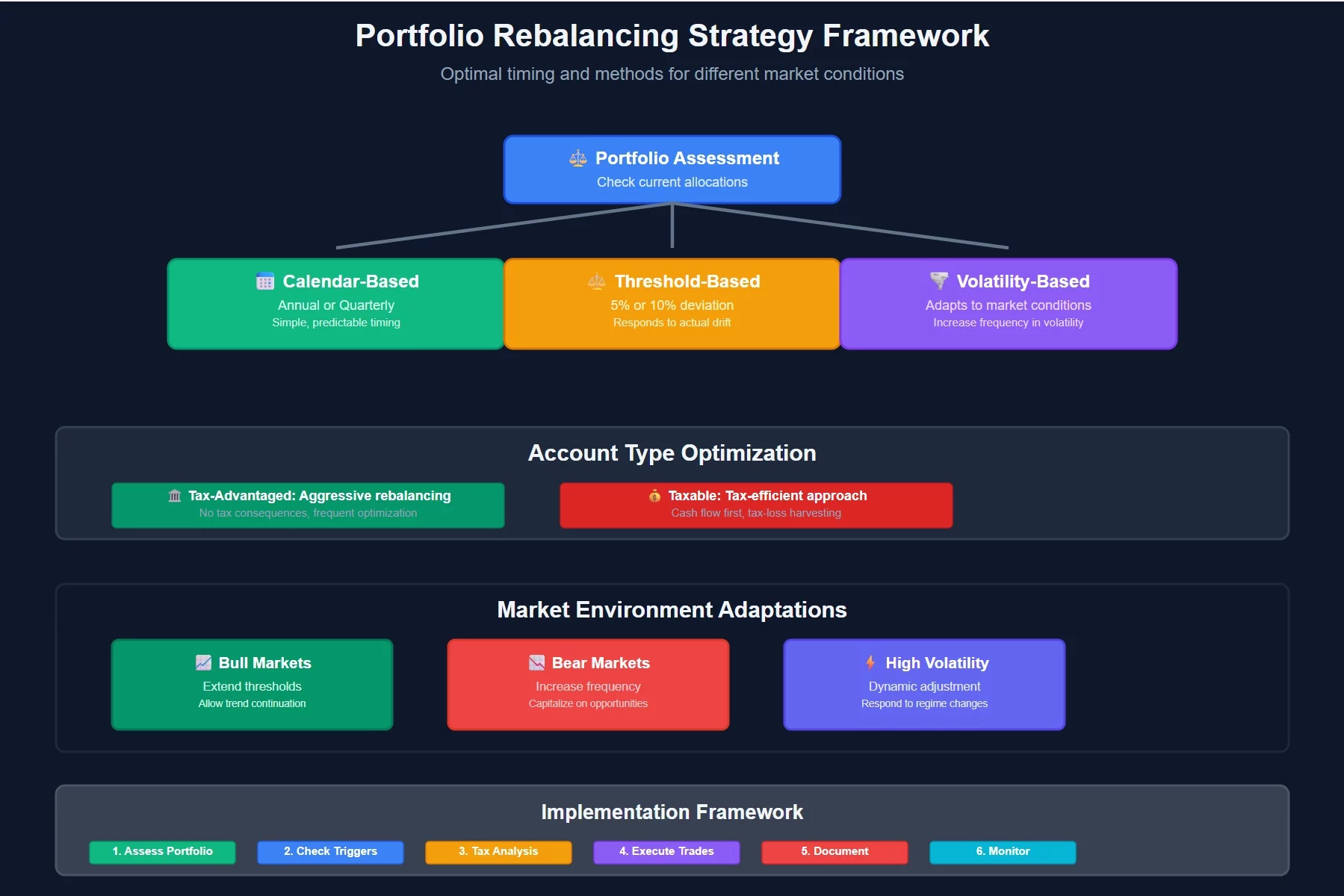

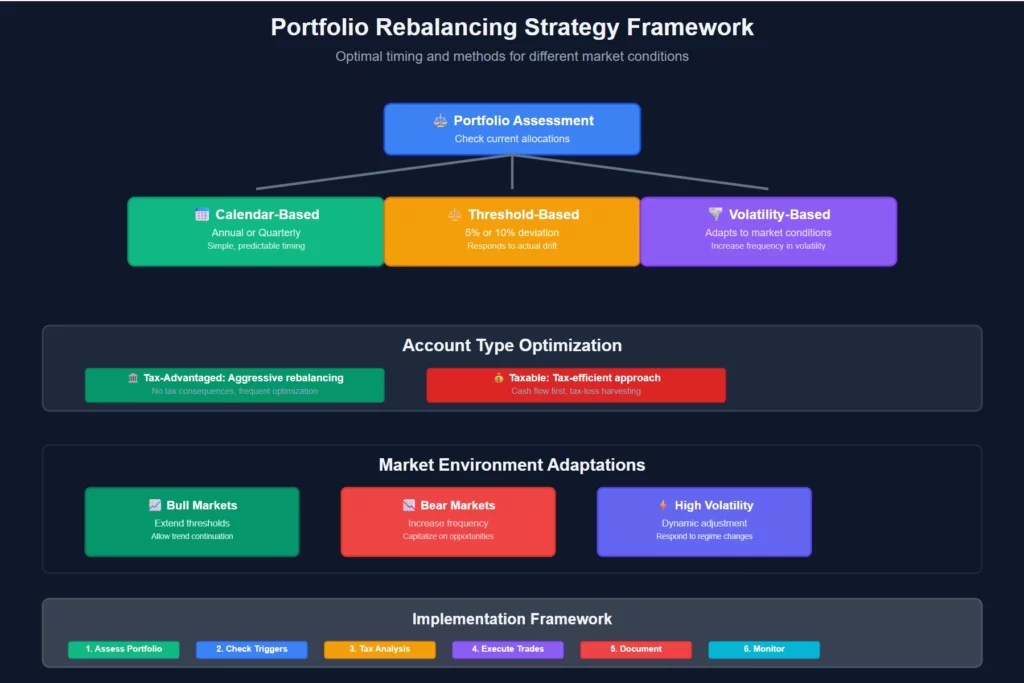

Calendar-Based Rebalancing Strategies

Annual Rebalancing Annual rebalancing provides sufficient frequency for most investors while minimizing transaction costs. Moreover, it aligns with tax planning and performance review cycles. Additionally, annual rebalancing reduces the temptation for frequent tinkering.

Annual rebalancing advantages:

- 📅 Simple implementation with predictable timing

- 💰 Lower transaction costs and tax implications

- 🧠 Reduced behavioral mistakes from overtrading

- 📊 Sufficient frequency for meaningful risk control

Quarterly Rebalancing Quarterly rebalancing captures more frequent opportunities while maintaining reasonable costs. Furthermore, it provides better risk control during volatile periods. However, increased frequency may generate higher taxes in taxable accounts.

Monthly Rebalancing Monthly rebalancing typically provides diminishing returns while increasing costs significantly. Moreover, frequent rebalancing can interfere with natural market trends. Additionally, behavioral research shows monthly rebalancing often leads to overtrading.

Threshold-Based Rebalancing Systems

5% Threshold Rule Rebalance when any asset class deviates 5% or more from target allocation. Furthermore, this approach responds to actual portfolio drift rather than arbitrary timing. Additionally, threshold rebalancing adapts to market volatility automatically.

Implementation example:

- 🎯 Target allocation: 60% stocks, 40% bonds

- ⚖️ Rebalance triggers: Stocks reach 65%+ or 55%-, Bonds reach 45%+ or 35%-

- 📊 Check allocations monthly but only trade when thresholds breach

10% Threshold Rule Conservative threshold allowing more drift before rebalancing. Moreover, this reduces transaction frequency while maintaining risk control. Additionally, 10% thresholds work better for tax-efficient strategies.

Hybrid Threshold-Calendar Approach Combine threshold monitoring with maximum calendar intervals. Therefore, rebalance when thresholds breach OR annually, whichever comes first. Furthermore, this prevents excessive drift during trending markets.

Account-Type Specific Strategies

Tax-Advantaged Accounts (401k, IRA) Aggressive rebalancing strategies work best in tax-sheltered accounts. Moreover, transaction costs are typically minimal or zero. Additionally, no tax consequences enable frequent optimization.

Tax-advantaged rebalancing approach:

- ⚡ Quarterly or threshold-based rebalancing

- 📊 Precise target allocation maintenance

- 🔄 Immediate rebalancing when opportunities arise

- 💰 Focus purely on risk-return optimization

Taxable Investment Accounts Tax considerations dominate rebalancing decisions in taxable accounts. Furthermore, realizing capital gains creates immediate tax obligations. Additionally, tax-loss harvesting opportunities can enhance after-tax returns.

Taxable account rebalancing strategy:

- 🧾 Annual rebalancing with tax-loss harvesting

- 📈 Use new contributions for rebalancing when possible

- ⚖️ Accept wider allocation bands to minimize taxes

- 🎯 Coordinate with other accounts for overall balance

Tax-Efficient Rebalancing Techniques 🧾

Tax efficiency transforms rebalancing from a cost center into a profit opportunity. Therefore, sophisticated techniques minimize tax obligations while maintaining portfolio balance. Furthermore, proper tax management can add significant after-tax returns.

Cash Flow Rebalancing

New Contribution Allocation Direct new investments toward underweighted asset classes before selling appreciated holdings. Moreover, this approach avoids triggering taxable events entirely. Additionally, consistent contributions enable gradual rebalancing over time.

Cash flow rebalancing process:

- 📊 Calculate current allocation versus targets

- 💰 Direct new contributions to underweighted assets

- ⚖️ Continue until allocations return to acceptable ranges

- 🔄 Only trade existing holdings if drift becomes excessive

Dividend and Distribution Reinvestment Use dividend payments and capital gain distributions strategically for rebalancing. Furthermore, reinvestment decisions can gradually correct allocation drift. Additionally, this technique requires no additional capital or trading.

Tax-Loss Harvesting Integration

Coordinated Loss Harvesting Combine rebalancing with systematic tax-loss harvesting in taxable accounts. Moreover, selling losing positions for tax benefits while rebalancing winners creates dual value. Additionally, wash sale rules require careful coordination.

Tax-loss harvesting rebalancing:

- 📉 Identify losing positions exceeding allocation targets

- 💰 Harvest losses while reducing overweight allocations

- 🔄 Purchase similar but not identical securities

- 📊 Use proceeds to buy underweight asset classes

Multi-Account Coordination Coordinate rebalancing across taxable and tax-advantaged accounts for optimal efficiency. Furthermore, make taxable changes in retirement accounts when possible. Additionally, overall portfolio balance matters more than individual account balance.

Market Condition Adaptations 📈

Different market environments require adapted rebalancing approaches. Therefore, flexible strategies outperform rigid rules during varying conditions. Furthermore, understanding market cycles helps optimize rebalancing timing and frequency.

Bull Market Rebalancing

Trend Momentum Considerations Strong trending markets can continue longer than expected, making aggressive rebalancing counterproductive. However, risk management remains important during extended rallies. Therefore, modified approaches balance trend-following with risk control.

Bull market adaptations:

- 📈 Extend rebalancing thresholds during strong trends

- ⚖️ Use wider allocation bands for trending assets

- 💰 Focus new contributions on underweight assets

- 🎯 Gradually reduce overweight positions rather than immediate rebalancing

Valuation-Based Adjustments Expensive markets may justify more aggressive rebalancing despite strong trends. Furthermore, valuation metrics help distinguish sustainable trends from unsustainable bubbles. Additionally, risk management becomes increasingly important at market peaks.

Bear Market and Volatility Management

Crisis Rebalancing Opportunities Market crashes create exceptional rebalancing opportunities for disciplined investors. Moreover, fear-driven selling often creates attractive valuations. Additionally, systematic rebalancing prevents panic-driven allocation decisions.

Bear market rebalancing strategy:

- 📉 Increase rebalancing frequency during volatility

- 💰 Use emergency cash reserves for opportunistic rebalancing

- 🎯 Maintain discipline despite emotional pressure to deviate

- ⚖️ Focus on risk assets becoming significantly underweight

Volatility Timing Strategies High volatility periods often provide better rebalancing opportunities than low volatility periods. Furthermore, volatility clustering means opportunities often come in waves. Additionally, volatility-based triggers can enhance returns.

Portfolio Assessment Checklist 🎯

Before implementing any rebalancing strategy, evaluate your current portfolio systematically. Furthermore, understanding your starting point enables optimal decision-making. Additionally, regular assessment prevents drift from becoming excessive.

Current Allocation Analysis:

- 📊 Calculate actual percentages for each asset class

- 🎯 Compare current allocation to target allocation

- 📈 Identify which assets have drifted most significantly

- ⏰ Review time since last rebalancing action

Performance Attribution Review:

- 💰 Determine which assets drove portfolio performance

- 📉 Identify underperforming positions requiring analysis

- 🌍 Assess geographic and sector concentration levels

- 🔍 Evaluate whether drift resulted from market movement or poor selection

Behavioral Psychology of Rebalancing 🧠

Human psychology creates significant barriers to effective rebalancing. Therefore, understanding these biases enables better system design. Furthermore, automated approaches often overcome behavioral limitations more effectively than manual processes.

Common Behavioral Biases

Loss Aversion in Rebalancing Investors hesitate to sell winning positions while reluctant to buy losing ones. However, this natural tendency directly opposes optimal rebalancing behavior. Moreover, loss aversion often prevents beneficial rebalancing during market stress.

Overcoming loss aversion:

- 🎯 Focus on portfolio-level goals rather than individual positions

- 📊 Use systematic rules that remove emotional decisions

- 💰 Frame rebalancing as risk management rather than performance optimization

- 🔄 Implement gradual rebalancing to reduce psychological impact

Recency Bias and Market Timing Recent performance heavily influences rebalancing decisions despite being poor predictors. Furthermore, investors often abandon rebalancing during extended trends. Additionally, recency bias causes overreaction to short-term market movements.

Herding and Social Proof Investors often deviate from rebalancing strategies when others appear to be outperforming. However, chasing performance typically results in poor timing decisions. Moreover, media coverage amplifies herding tendencies during market extremes.

Building Disciplined Systems

Automated Rebalancing Solutions Robo-advisors and target-date funds provide automated rebalancing without emotional interference. Moreover, automation ensures consistent implementation regardless of market conditions. Additionally, technology removes the burden of rebalancing decisions from individual investors.

Automated system benefits:

- 🤖 Eliminates emotional decision-making entirely

- ⏰ Ensures consistent implementation timing

- 📊 Optimizes for tax efficiency automatically

- 💰 Reduces transaction costs through efficient execution

Written Investment Policy Statements Document rebalancing rules during calm periods to guide decisions during stress. Furthermore, written policies prevent emotional deviation from sound strategies. Additionally, policy statements enable evaluation of strategy effectiveness over time.

Practical Implementation Guide ⚡

Successful rebalancing requires systematic implementation and ongoing monitoring. Therefore, clear processes ensure consistent execution. Furthermore, practical considerations often determine strategy success more than theoretical optimization.

Step-by-Step Rebalancing Process

Step 1: Portfolio Assessment Calculate current allocations across all accounts and asset classes. However, use market values rather than contribution amounts. Moreover, include all investment accounts for comprehensive analysis.

Step 2: Deviation Measurement Determine how far each asset class deviates from target allocation. Furthermore, prioritize the largest deviations for rebalancing action. Additionally, consider both absolute and relative deviation measurements.

Step 3: Tax Optimization Analysis Evaluate tax implications before executing trades in taxable accounts. Moreover, coordinate rebalancing across account types for optimal efficiency. Additionally, consider using new contributions before selling appreciated assets.

Step 4: Execution Strategy Implement rebalancing trades systematically starting with largest deviations. Furthermore, use limit orders to control execution costs. Additionally, spread large rebalancing across multiple days if necessary.

Step 5: Documentation and Review Record rebalancing actions and rationale for future reference. Moreover, evaluate effectiveness of rebalancing strategy periodically. Additionally, adjust approaches based on changing circumstances.

Technology Tools and Platforms

Portfolio Management Software Dedicated portfolio management tools provide sophisticated rebalancing analysis. Furthermore, they can model different rebalancing scenarios before execution. Additionally, many integrate with brokerage accounts for automated implementation.

Popular portfolio management features:

- 📊 Real-time allocation monitoring and deviation alerts

- 🧾 Tax-loss harvesting optimization

- 🔄 Multi-account rebalancing coordination

- 📈 Performance attribution analysis

Brokerage Platform Tools Most major brokerages offer basic rebalancing tools for account holders. Moreover, these tools often integrate with target-date funds and model portfolios. Additionally, some provide automated rebalancing services.

Robo-Advisor Integration Robo-advisors excel at automated rebalancing with tax optimization. Furthermore, they typically rebalance more frequently than individual investors. Additionally, they coordinate rebalancing with tax-loss harvesting systematically.

Table: Rebalancing Strategy Comparison

Advanced Rebalancing Strategies 🚀

Sophisticated investors can implement advanced techniques that enhance traditional rebalancing approaches. However, these strategies require greater complexity and ongoing monitoring. Furthermore, advanced strategies work best for larger portfolios with multiple account types.

Dynamic Asset Allocation

Volatility-Adjusted Rebalancing Adjust target allocations based on market volatility levels. Moreover, reduce risk asset allocation during high volatility periods. Additionally, increase risk allocation when volatility returns to normal levels.

Dynamic allocation approach:

- 📊 Monitor market volatility using VIX or similar metrics

- ⚖️ Reduce equity allocation by 5-10% during extreme volatility

- 🔄 Return to normal allocation when volatility normalizes

- 📈 Document rules to prevent emotional decision-making

Valuation-Based Adjustments Modify rebalancing thresholds based on asset class valuations. Furthermore, allow greater allocation to undervalued assets. Additionally, reduce allocation to overvalued assets before normal rebalancing triggers.

Multi-Asset Rebalancing

Currency Hedging Decisions International investments introduce currency risk requiring rebalancing consideration. Moreover, currency movements can create significant allocation drift. Additionally, hedging decisions affect optimal rebalancing frequency.

Alternative Investment Integration REITs, commodities, and other alternatives require specialized rebalancing approaches. Furthermore, alternative investments often have different liquidity characteristics. Additionally, their correlation patterns may change during market stress.

Factor-Based Rebalancing Value, growth, small-cap, and other factor exposures may require independent rebalancing. Moreover, factor performance can diverge significantly over time. Additionally, factor rebalancing can enhance returns beyond traditional asset class rebalancing.

Common Rebalancing Mistakes 🚨

Understanding typical rebalancing errors helps investors avoid costly mistakes. Furthermore, these mistakes can turn beneficial strategies into performance drags. Therefore, awareness and prevention prove crucial for rebalancing success.

Mistake #1: Excessive Rebalancing Frequency

Many investors rebalance too frequently, generating unnecessary costs and taxes. However, daily or weekly rebalancing rarely improves returns meaningfully. Moreover, frequent rebalancing can interfere with natural market trends.

Mistake #2: Ignoring Tax Consequences

Rebalancing in taxable accounts without considering taxes can eliminate benefits entirely. Furthermore, realizing large capital gains for minor allocation adjustments proves counterproductive. Additionally, coordinating rebalancing across account types improves efficiency.

Mistake #3: Abandoning Strategy During Extremes

Investors often abandon rebalancing strategies during market extremes when they provide the most benefit. However, crisis periods offer the best rebalancing opportunities. Moreover, maintaining discipline during stress separates successful from unsuccessful investors.

Mistake #4: Perfectionism Over Progress

Attempting to achieve exact target allocations wastes time and money unnecessarily. Furthermore, close approximations often provide similar benefits with lower costs. Additionally, perfectionism can prevent investors from rebalancing at all.

Mistake #5: Neglecting Transaction Costs

High transaction costs can eliminate rebalancing benefits, especially in smaller portfolios.

Moreover, frequent trading in high-cost investments proves counterproductive. Additionally, using low-cost index funds enhances rebalancing effectiveness.

Video Recommendation 🎥

🎬 For comprehensive guidance on portfolio rebalancing strategies, watch my Successful Tradings video about systematic rebalancing approaches. The video demonstrates practical techniques for different market conditions and account types. Moreover, it shows real examples of tax-efficient rebalancing execution.

Watch it here: https://www.youtube.com/@SuccessfulTradings and search for “Portfolio Rebalancing Strategy 2025.”

You will learn specific techniques that can add 0.5-1.2% annually to your portfolio returns through disciplined rebalancing.

FAQs 🤔

Q: How often should I rebalance my portfolio? A: Most investors benefit from annual rebalancing or 5% threshold-based approaches. More frequent rebalancing rarely improves returns while increasing costs and complexity.

Q: Should I rebalance if it triggers large capital gains? A: In taxable accounts, use new contributions for rebalancing first. Only realize gains if allocation drift becomes extreme (>10-15%) or you can harvest offsetting losses.

Q: Is it better to rebalance with new money or by selling? A: Always use new contributions for rebalancing when possible. This approach avoids transaction costs and tax consequences while gradually correcting allocation drift.

Q: What’s the difference between calendar and threshold-based rebalancing? A: Calendar rebalancing occurs at fixed intervals (annual, quarterly) while threshold rebalancing triggers when allocations deviate by specific percentages (5%, 10%) from targets.

Q: Should I rebalance during market crashes? A: Yes, market crashes often provide the best rebalancing opportunities. Maintain discipline and follow your systematic approach despite emotional pressure to deviate.

Q: How do I rebalance across multiple accounts efficiently? A: Consider your entire portfolio across all accounts. Make tax-efficient changes in retirement accounts first, then use new contributions in taxable accounts before selling appreciated assets.

Q: What tools can help automate my rebalancing? A: Robo-advisors, target-date funds, and brokerage rebalancing tools provide automated solutions. Many integrate tax-loss harvesting with systematic rebalancing.

Q: Is rebalancing worth it for small portfolios? A: Yes, but use low-cost methods like directing new contributions to underweight assets. Avoid frequent trading that generates costs exceeding rebalancing benefits.

Conclusion

Portfolio rebalancing represents one of the most powerful yet underutilized investment strategies available.

Therefore, systematic implementation can add 0.5-1.2% annually to portfolio returns while controlling risk effectively.

Furthermore, the key lies in finding the optimal balance between frequency and efficiency.

Success requires understanding that rebalancing works through disciplined contrarian investing rather than market timing.

Additionally, tax efficiency often determines whether rebalancing adds or subtracts value in taxable accounts.

Finally, automated approaches typically outperform manual rebalancing by removing emotional decision-making and ensuring consistent implementation.

Remember that systematic discipline during market extremes separates successful rebalancing from ineffective tinkering.

Hold a Master Degree in Electrical engineering from Texas A&M University.

African born – French Raised and US matured who speak 5 languages.

Active Stock Options Trader and Coach since 2014.

Most Swing Trade weekly Options and Specialize in 10-Baggers !

YouTube Channel: https://www.youtube.com/c/SuccessfulTradings

Other Website: https://237answersblog.com/