I began trading in 2015 and started coaching in 2019. Complete beginners face overwhelming information that creates more confusion than clarity. However, most investment advice skips the fundamental first steps that determine success or failure. Therefore, this guide reveals what no one tells you about starting your investment journey.

👉 In this guide, you will learn:

- 🚨 The critical first steps everyone skips that cost beginners thousands

- 💰 How to start investing with as little as $25 without getting overwhelmed

- 🧠 The psychology behind why 90% of beginners fail within their first year

- 📊 Simple strategies that outperform 80% of professional investors

- ⚠️ Common beginner mistakes that destroy portfolios before they start

- 🎯 The exact order to tackle investing as a complete newcomer

- 💡 What the financial industry doesn’t want you to know about fees

Most investment guides assume you already understand basic concepts. Unfortunately, this assumption leads beginners down expensive paths filled with unnecessary complexity. Additionally, the financial industry profits from confused beginners making costly mistakes repeatedly.

Table of Contents

The Truth About Starting to Invest 💡

Complete beginners face a unique challenge: separating necessary knowledge from marketing noise. Furthermore, the investment industry deliberately complicates simple concepts to justify expensive services. Therefore, understanding the real fundamentals becomes crucial for long-term success.

Why 90% of Beginners Fail in Year One

Most beginners fail because they skip foundational steps everyone considers “boring.” Additionally, they focus on picking winning stocks instead of building systems. Moreover, they treat investing like gambling rather than systematic wealth building.

Common reasons beginners quit investing:

- 📉 Losses from poor timing and emotional decisions

- 💸 High fees that eliminate returns before they compound

- 🎰 Gambling mentality that leads to risky speculation

- 📊 Information overload creating analysis paralysis

- 🔄 Jumping between strategies without giving any time to work

However, successful beginners follow systematic approaches that address psychological challenges first. Therefore, they build sustainable habits rather than chasing immediate returns.

The Investment Industry’s Dirty Secrets

Wall Street makes money from confused beginners making frequent transactions. Furthermore, complex products generate higher fees than simple index funds. Additionally, fear-based marketing creates urgency that leads to poor decisions.

What financial advisors don’t tell beginners:

- 💰 Simple index funds outperform 80% of actively managed funds

- 🧾 High fees compound negatively and destroy long-term returns

- 📈 Time in market beats timing the market consistently

- 🎯 Asset allocation matters more than individual stock selection

- ⚖️ Boring strategies work better than exciting ones

Smart beginners recognize these truths and build strategies accordingly. Therefore, they focus on fundamentals rather than flashy promises.

The Complete Beginner’s Foundation Framework 🏗️

Before investing a single dollar, beginners must establish financial foundations. Furthermore, skipping these steps guarantees future problems regardless of investment performance. Additionally, proper preparation enables aggressive strategies once you start.

Step 1: Emergency Fund Creation (Priority #1)

Emergency funds prevent forced investment liquidations during financial crises. Moreover, having adequate cash reserves enables long-term investment thinking. Therefore, emergency funds represent your investment insurance policy.

Emergency fund guidelines for beginners:

- 💰 Start with $1,000 minimum for basic emergencies

- 🏦 Build to 3-6 months of expenses in high-yield savings

- 📱 Separate account from daily banking to prevent spending

- 🚨 Only for true emergencies, not planned purchases

Step 2: High-Interest Debt Elimination

Credit card debt destroys investment returns through guaranteed high interest charges. Furthermore, paying off 18% credit card debt provides guaranteed 18% returns. Additionally, debt elimination frees up monthly cash flow for investing.

Debt elimination strategy:

- 💳 List all debts with balances and interest rates

- 🎯 Pay minimums on everything, attack highest rate first

- 💰 Use windfalls like tax refunds for accelerated payoff

- 📊 Consider debt consolidation if it lowers overall rates

Step 3: Basic Banking Optimization

Most beginners lose money through poor banking choices. However, optimizing banking provides immediate returns without investment risk. Therefore, smart banking creates more money to invest monthly.

Banking optimization checklist:

- 🏦 High-yield savings account for emergency fund (4-5% APY)

- 💳 No-fee checking account with fee reimbursements

- 🚫 Eliminate unnecessary bank fees and monthly charges

- 📱 Mobile banking for easy account monitoring

The $25 Start Strategy: Your First Investment 💵

Many beginners believe they need thousands to start investing. However, you can begin with $25 through fractional shares and commission-free brokerages. Moreover, starting small builds confidence and experience without major risk.

Choosing Your First Investment Platform

Beginners need platforms that combine simplicity with education. Furthermore, commission-free trading prevents fees from eliminating small investment returns. Additionally, fractional shares enable diversification with limited funds.

Best platforms for complete beginners:

- 📱 Fidelity: No minimums, excellent education resources

- 📱 Schwab: Strong customer service, comprehensive tools

- 📱 Vanguard: Lowest-cost index funds, long-term focus

- 📱 Robo-advisors: Automated management for hands-off approach

Your First $25 Investment Strategy

Start with the simplest possible approach to build confidence. Therefore, begin with a total stock market index fund that provides instant diversification. Additionally, this approach eliminates the need to pick individual stocks.

The beginner’s first investment:

- 🎯 Investment: Total Stock Market Index Fund (VTI or equivalent)

- 💰 Amount: $25-100 to start

- 📅 Frequency: Monthly automatic investment

- 📊 Strategy: Buy and hold for long-term growth

This simple approach provides exposure to the entire U.S. stock market instantly. Moreover, it requires no research or ongoing decisions. Furthermore, it establishes the investing habit without complexity.

Investment Account Types: Getting Started Right 🏦

Beginners often choose wrong account types that create tax problems later. However, understanding basic account differences prevents costly mistakes. Therefore, selecting appropriate accounts becomes crucial for optimization.

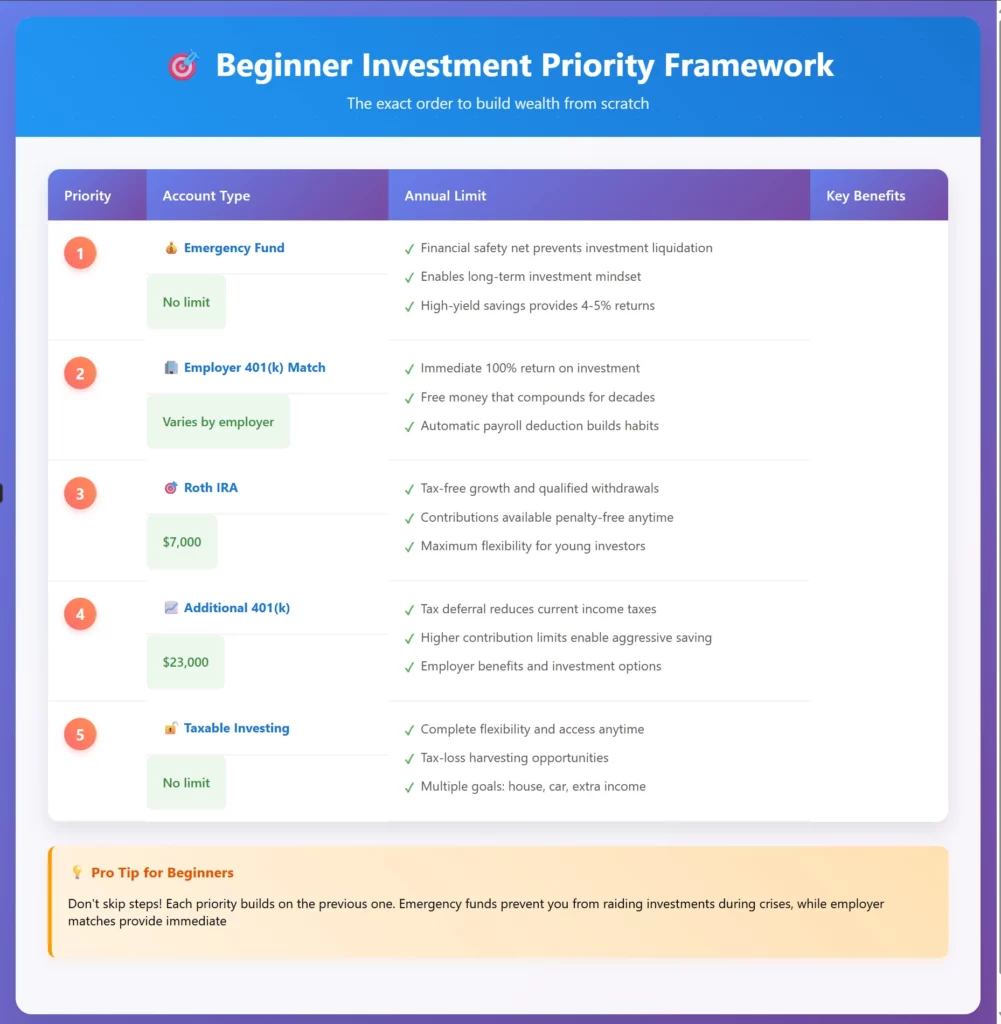

The Beginner’s Account Priority System

Different account types serve different purposes in wealth building. Furthermore, tax advantages make some accounts more valuable than others. Additionally, contribution limits require strategic planning for maximum benefit.

Priority Order for Beginners:

- Emergency Fund (High-yield savings)

- Purpose: Financial safety net

- Amount: 3-6 months expenses

- Access: Immediate when needed

- Employer 401(k) Match (If available)

- Purpose: Free money from employer

- Amount: Minimum for full match

- Benefit: Immediate 100% return

- Roth IRA ($7,000 annual limit)

- Purpose: Tax-free growth and flexibility

- Amount: $583 monthly maximum

- Benefit: Tax-free withdrawals in retirement

- Additional 401(k) (Beyond match)

- Purpose: Tax deferral and higher limits

- Amount: Up to $23,000 annually

- Benefit: Reduces current tax burden

- Taxable Investment Account

- Purpose: Flexibility and additional growth

- Amount: No limits

- Benefit: Access anytime without penalties

This priority order maximizes tax advantages while maintaining flexibility. Moreover, it ensures you capture all available benefits systematically.

The Psychology of Beginner Investing 🧠

Investment success depends more on psychology than strategy. Furthermore, beginners must understand their emotional responses to market volatility. Additionally, building proper mindset prevents costly behavioral mistakes.

Overcoming Beginner Fear and Greed

Fear and greed destroy more investment portfolios than market crashes. However, beginners can develop emotional discipline through proper preparation and education. Therefore, psychological preparation becomes as important as financial preparation.

Common Beginner Emotional Challenges:

- 😰 Market Fear: Selling during downturns at worst times

- 💰 FOMO Greed: Chasing hot stocks and trending investments

- 📊 Analysis Paralysis: Researching forever without taking action

- 🎢 Volatility Panic: Emotional reactions to normal market movements

- 🎯 Perfectionism: Waiting for perfect timing that never comes

Building Investment Discipline

Successful investing requires systematic approaches that override emotional impulses. Furthermore, automation eliminates most psychological challenges. Therefore, beginners should focus on building systems rather than making decisions.

Discipline-Building Strategies:

- 🤖 Automatic Investing: Monthly transfers eliminate timing decisions

- 📚 Continued Education: Knowledge reduces fear and improves decisions

- 📊 Simple Strategies: Complexity creates emotional stress and mistakes

- ⏰ Long-term Focus: Short-term volatility becomes irrelevant

- 🎯 Written Plan: Clear goals prevent emotional strategy changes

The Biggest Beginner Mistakes (And How to Avoid Them) ⚠️

Understanding common mistakes helps beginners avoid expensive learning experiences. Furthermore, these mistakes compound over time and can derail long-term wealth building. Therefore, prevention proves much cheaper than correction.

Mistake #1: Trying to Pick Individual Stocks

Most beginners start by trying to find the next Apple or Amazon. However, professional fund managers with teams of analysts rarely beat simple index funds. Moreover, individual stock picking requires research skills most beginners lack.

Why Stock Picking Fails for Beginners:

- 📊 Lack of research tools and analytical skills

- 🧠 Emotional attachment to specific companies

- 📈 Insufficient diversification increases risk dramatically

- ⏰ Time requirements most beginners cannot meet

- 💰 Transaction costs from frequent trading

Better Alternative: Start with broad market index funds that provide instant diversification across hundreds or thousands of companies.

Mistake #2: Chasing Performance and Hot Trends

Beginners often invest in last year’s best performers expecting continued success. However, performance typically reverses when everyone notices. Furthermore, trend-chasing creates a pattern of buying high and selling low.

Performance Chasing Warning Signs:

- 📈 Investing based on recent news headlines

- 💰 Following “hot” sectors like AI or crypto exclusively

- 📊 Switching strategies every few months

- 🎯 Focusing on short-term returns over long-term growth

Better Alternative: Stick with diversified, low-cost index funds regardless of market trends or media coverage.

Mistake #3: Paying Excessive Fees

High fees destroy investment returns through compounding negative effects. However, beginners often don’t understand fee structures or their long-term impact. Moreover, the financial industry downplays fee importance while maximizing profits.

How High Fees Destroy Wealth:

- 💸 1% annual fee reduces 30-year returns by approximately 25%

- 📉 Active fund fees often exceed 1% annually

- 💰 Trading fees accumulate quickly with frequent transactions

- 🧾 Hidden fees in complex products can exceed 2-3% annually

Better Alternative: Focus on index funds with expense ratios below 0.20% annually.

Mistake #4: Market Timing Attempts

Beginners often try to time the market by waiting for “perfect” entry points. However, market timing consistently fails even for professional investors. Furthermore, waiting for crashes often means missing years of growth.

Why Market Timing Fails:

- ⏰ Must be right twice: when to sell AND when to buy back

- 📊 Missing best market days dramatically reduces returns

- 🧠 Emotional decision-making during stressful periods

- 📈 Markets trend upward over time despite short-term volatility

Better Alternative: Use dollar-cost averaging through regular monthly investments regardless of market conditions.

Building Your Investment Portfolio Step-by-Step 📊

Portfolio construction seems complex but follows simple principles. Furthermore, beginners can build effective portfolios with just 2-3 funds. Additionally, simplicity often outperforms complexity over long periods.

The Three-Fund Portfolio for Beginners

The three-fund portfolio provides global diversification with minimal complexity. Moreover, it covers all major asset classes through low-cost index funds. Therefore, it offers professional-quality diversification at minimal cost.

Simple Three-Fund Portfolio:

- 📊 70% Total Stock Market Index (U.S. stocks for growth)

- 🌍 20% International Stock Index (Global diversification)

- 🏛️ 10% Bond Market Index (Stability and income)

This allocation provides exposure to thousands of stocks and bonds globally. Furthermore, it requires minimal maintenance through annual rebalancing. Additionally, all major fund companies offer these exact funds.

Age-Based Allocation Guidelines

Risk tolerance should generally decrease with age as retirement approaches. However, beginners in their 20s-30s can maintain aggressive allocations. Moreover, longer time horizons allow recovery from market downturns.

Allocation by Age (Stock/Bond Split):

- 📊 Ages 20-30: 90% stocks, 10% bonds

- 📊 Ages 30-40: 80% stocks, 20% bonds

- 📊 Ages 40-50: 70% stocks, 30% bonds

- 📊 Ages 50+: 60% stocks, 40% bonds

Adjust these guidelines based on personal risk tolerance and job security. Furthermore, those with secure pensions can maintain higher stock allocations.

Dollar-Cost Averaging Strategy

Dollar-cost averaging involves investing fixed amounts regularly regardless of market conditions. Therefore, you buy more shares when prices are low and fewer when prices are high. Additionally, this approach eliminates timing decisions completely.

Dollar-Cost Averaging Benefits:

- 📈 Reduces average purchase price over time

- 🧠 Eliminates emotional timing decisions

- 💰 Makes investing affordable through small amounts

- ⏰ Takes advantage of market volatility automatically

- 🎯 Builds consistent investing habits

Start with whatever amount fits your budget, even $25 monthly. Moreover, increase contributions when your income grows through raises or bonuses.

Advanced Strategies for Growing Beginners 🚀

Once beginners master basics, they can explore slightly more sophisticated strategies. However, complexity should only be added after fundamentals are solid. Furthermore, advanced strategies should enhance rather than replace core holdings.

Tax-Loss Harvesting for Beginners

Tax-loss harvesting involves selling losing investments to offset gains for tax purposes. However, beginners should understand basic rules before attempting this strategy. Moreover, tax benefits may not justify complexity for small portfolios.

Tax-Loss Harvesting Basics:

- 🧾 Sell losing investments to realize losses for tax purposes

- 💰 Use losses to offset capital gains from other investments

- 📊 Wash sale rules prevent immediate repurchase of same securities

- 🎯 Focus on tax-advantaged accounts first before worrying about taxes

Adding International and Sector Exposure

Diversification beyond U.S. stocks can reduce portfolio risk. Therefore, international exposure provides protection against U.S.-specific problems. Additionally, sector funds can provide targeted exposure to growth areas.

International Diversification:

- 🌍 Developed international markets (Europe, Japan, Australia)

- 🌎 Emerging markets (China, India, Brazil) for higher growth potential

- 💱 Currency exposure adds another diversification layer

- 📊 International funds available through major providers

Real Estate Investment Trusts (REITs)

REITs provide real estate exposure without direct property ownership. Furthermore, they offer income and inflation protection benefits. However, they add complexity and may not be necessary for beginners.

REIT Considerations for Beginners:

- 🏠 Provides real estate diversification

- 💰 Higher dividend yields than typical stocks

- 📈 Different performance patterns than stocks and bonds

- 🧾 Tax implications differ from regular stock dividends

Creating Your Investment Action Plan 📋

Success requires systematic implementation rather than perfect planning. Therefore, beginners should focus on taking action with simple strategies. Moreover, plans can be adjusted as knowledge and experience grow.

30-Day Quick Start Plan

Month one should focus on foundation building rather than investment complexity. Furthermore, establishing systems prevents future decision fatigue. Additionally, starting simple builds confidence for future growth.

Week 1: Foundation Setup

- 🏦 Open high-yield savings account for emergency fund

- 💳 List all debts and create payoff strategy

- 📱 Research and choose investment platform

- 📚 Read one basic investing book or resource

Week 2: Account Opening

- 🎯 Open investment account with chosen platform

- 🏦 Set up automatic transfers from checking to savings

- 💰 Determine monthly investment amount based on budget

- 📊 Research total market index fund options

Week 3: First Investment

- 💵 Make first investment in total market index fund

- 🤖 Set up automatic monthly investment transfers

- 📈 Create simple tracking spreadsheet (optional)

- 🎯 Write down investment goals and timeline

Week 4: System Optimization

- 🔄 Review and adjust automatic transfers if needed

- 📚 Continue education through books or resources

- 📊 Plan for increasing contributions with income growth

- 🎯 Set calendar reminder for annual portfolio review

Common Beginner Questions Answered

Q: How much money do I need to start investing? A: You can start with as little as $25 through fractional shares at most brokerages. However, $100-500 provides more meaningful diversification options.

Q: Should I pay off debt before investing? A: Pay off high-interest debt (above 6%) first, but always capture employer 401(k) matches regardless of debt levels.

Q: What if the market crashes right after I start? A: Market crashes provide buying opportunities for long-term passive investors.

Continue regular investments and view lower prices as sales on future returns.

Q: How often should I check my investment account? A: Monthly at most. Daily checking leads to emotional decisions and unnecessary stress about normal market volatility.

Q: Should I hire a financial advisor as a beginner? A: Most beginners can successfully invest using simple strategies without paying advisory fees. Consider advisors only for complex situations.

Conclusion

Investing for complete beginners doesn’t require complex strategies or large amounts of money.

Furthermore, the most important step is simply getting started with systematic, simple approaches.

Success comes from building proper foundations, avoiding common mistakes, and maintaining long-term perspectives regardless of short-term market volatility.

Remember: time in the market beats timing the market, and consistency beats perfection in wealth building.

Most importantly, every expert was once a beginner who took that crucial first step toward financial independence.

Hold a Master Degree in Electrical engineering from Texas A&M University.

African born – French Raised and US matured who speak 5 languages.

Active Stock Options Trader and Coach since 2014.

Most Swing Trade weekly Options and Specialize in 10-Baggers !

YouTube Channel: https://www.youtube.com/c/SuccessfulTradings

Other Website: https://237answersblog.com/