I remember when I first discovered dividend reinvestment plans in 2016, thinking they seemed too simple to actually work. 💭 I was heavily focused on active trading, constantly buying and selling stocks to chase quick profits.

Then I watched one of my mentors accumulate massive wealth through a boring McDonald’s stock that he’d owned for fifteen years.

🍟 While I stressed about daily price movements, his dividend reinvestment plan quietly turned a $5,000 investment into over $48,000.

That revelation changed everything about my investment approach. Since then, both my coaching clients and I have leveraged DRIP strategies to build substantial long-term wealth.

📈 After six years of coaching investors since 2019, I’ve witnessed this simple strategy consistently outperform complex trading schemes.

Understanding the DRIP effect can transform your investment results without requiring you to become a market timing expert or spend hours managing your portfolio.

Table of Contents

What Exactly Is the DRIP Effect?

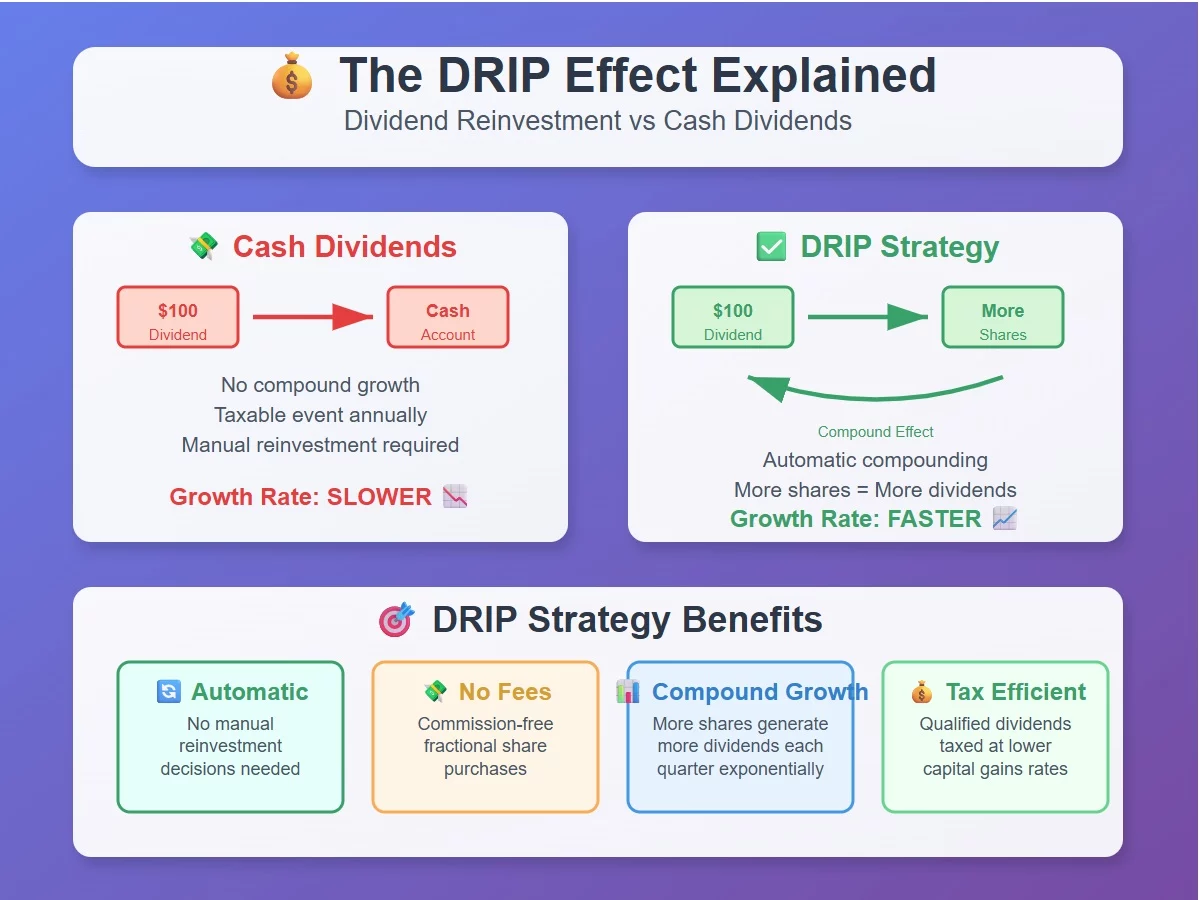

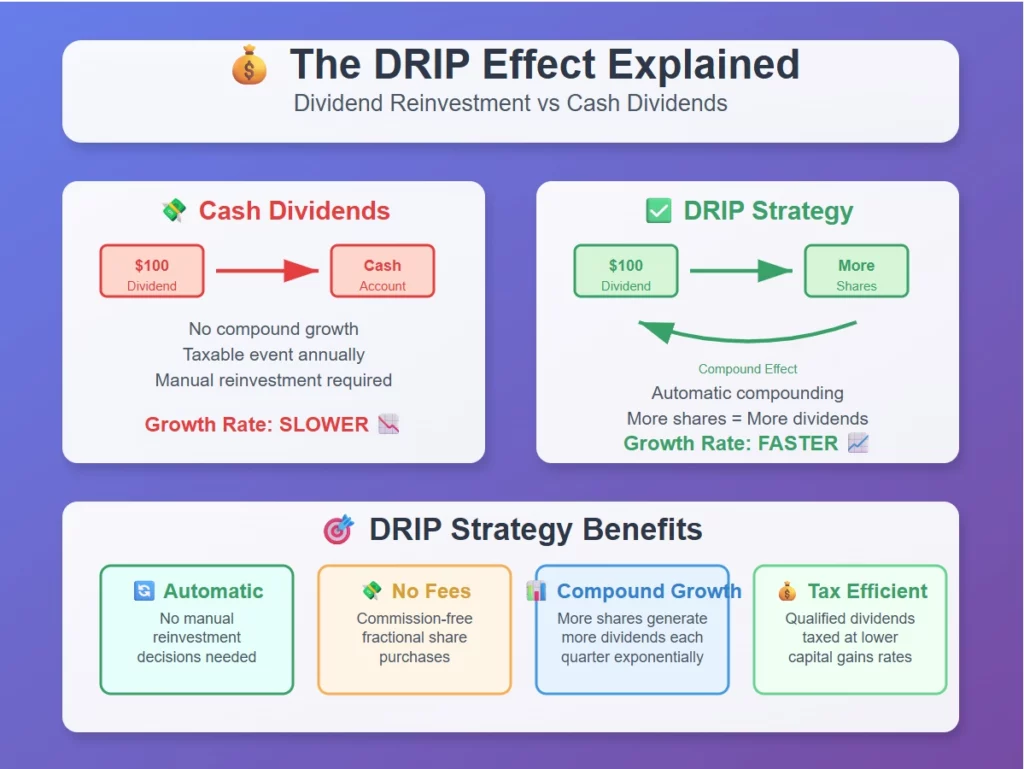

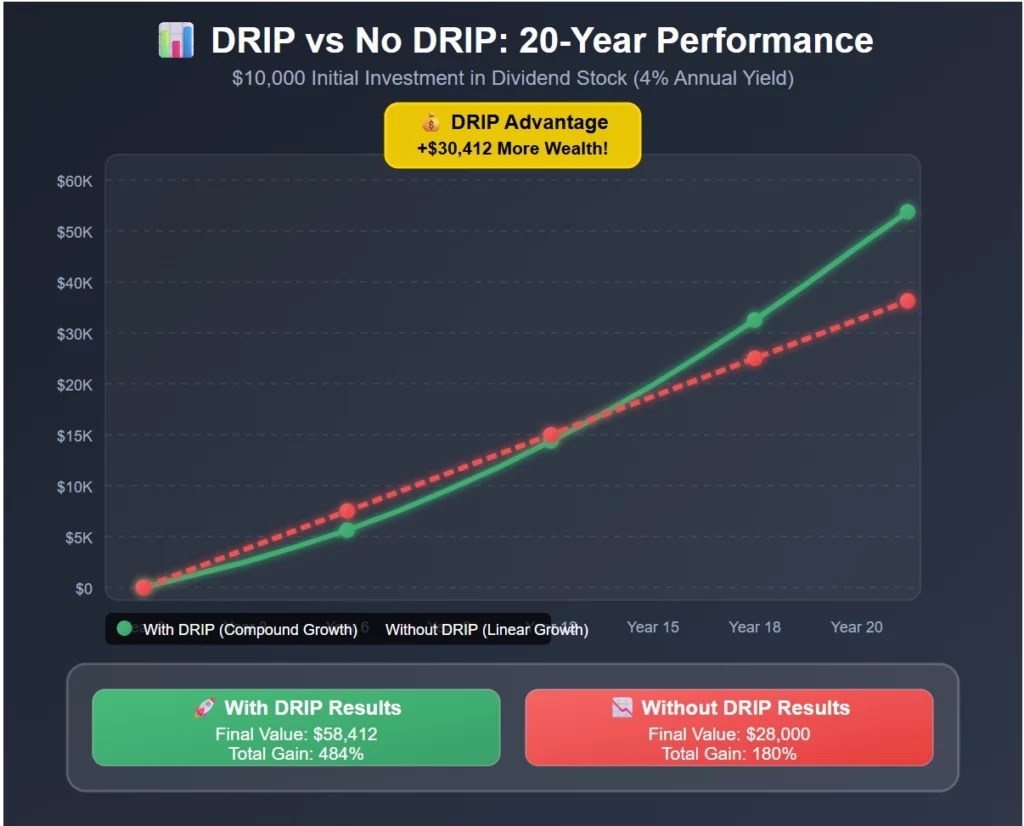

💰 A Dividend Reinvestment Plan (DRIP) automatically uses your dividend payments to purchase additional shares of the same stock instead of sending you cash. Think of it as compound interest on steroids – your dividends buy more shares, which generate more dividends, creating an exponential growth cycle.

🔄 The strategy operates on a brilliant principle: instead of receiving quarterly dividend checks, your money immediately goes back to work buying more ownership in profitable companies. Over time, this creates a snowball effect where your share count grows dramatically.

Core DRIP benefits:

- 🤖 Automatic wealth building (no manual decisions required)

- 💸 Commission-free reinvestment (saves trading fees)

- 📊 Fractional share purchases (every penny gets invested)

- 🎯 Dollar-cost averaging benefits (buy more when prices drop)

- 😌 Emotional discipline (removes temptation to spend dividends)

🎓 I learned this lesson powerfully in 2017 when I compared two identical $10,000 Coca-Cola investments. One client took cash dividends and spent them on lifestyle expenses. Another used DRIP to reinvest everything automatically.

After five years, the cash dividend investor still owned exactly 250 shares worth $15,000. 📉 Meanwhile, the DRIP investor accumulated 340 shares worth over $20,400 – plus they were receiving 36% more dividends quarterly.

The Four Pillars of DRIP Success

🏛️ After coaching hundreds of investors since 2019, I’ve identified four principles that separate successful DRIP investors from those who struggle with consistency.

Compound Growth Acceleration

🚀 Every reinvested dividend buys additional shares that immediately start generating their own dividends. This creates exponential rather than linear growth patterns over extended time periods.

Automatic Dollar-Cost Averaging

📈 DRIP purchases happen quarterly regardless of market conditions, meaning you buy more shares when prices are low and fewer when prices are high. This smooths out volatility while building larger positions during market downturns.

Here’s what shocked one of my clients last year:

Real Client Example:

- 🔥 Market crash quarter: $400 dividend bought 20 additional shares at $20 each

- 📈 Market recovery quarter: $420 dividend bought 12 additional shares at $35 each

- 🎯 Average cost: $25.65 per share across volatile periods

- 💰 Result: 32 additional shares generating $128 more quarterly dividends

Emotional Discipline Builder

🧠 DRIP forces consistent reinvestment behavior during both market euphoria and panic. You never see dividend cash, eliminating the temptation to spend it on non-investment activities.

Fee Elimination Strategy

💵 Most brokerages offer commission-free DRIP services, meaning 100% of your dividends purchase additional shares. This can save thousands in trading fees over decades of investing.

Essential DRIP Investment Vehicles

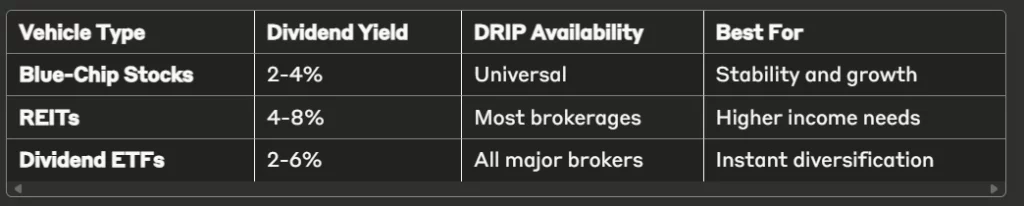

🛠️ Three main categories work exceptionally well with dividend reinvestment strategies. Each serves different investor goals and risk tolerances.

Blue-Chip Dividend Stocks: The DRIP Foundation

📊 Large, established companies like Johnson & Johnson, Coca-Cola, and Microsoft provide reliable dividend payments with consistent reinvestment opportunities. These companies have decades-long track records of paying and increasing dividends annually.

👨💼 One of my coaching clients, David, has used Johnson & Johnson’s DRIP for twelve years. He started with 100 shares and now owns 187 shares through pure dividend reinvestment, generating 87% more quarterly income without adding any additional capital.

REITs: Maximum Dividend Power

🏢 Real Estate Investment Trusts typically offer higher dividend yields than traditional stocks, making them powerful DRIP vehicles for income-focused investors seeking accelerated wealth building.

Dividend ETFs: Instant Diversification

🌍 Exchange-traded funds like VYM, SCHD, and DGRO provide immediate exposure to hundreds of dividend-paying companies while offering automatic reinvestment capabilities through any major brokerage platform.

💡 I typically recommend dividend ETFs for beginners overwhelmed by individual stock selection. They provide instant diversification while you learn about specific company analysis and sector allocation strategies. <div style=”text-align: center; margin: 30px 0;”> <img src=”drip_performance_chart” alt=”DRIP Performance Comparison Chart – 20-Year Wealth Building Example” style=”max-width: 100%; height: auto; border-radius: 10px; box-shadow: 0 4px 8px rgba(0,0,0,0.1);”> </div>

How DRIP Strategies Work in Practice

⚙️ Building a successful DRIP portfolio involves four strategic steps that anyone can implement, regardless of investment experience or initial capital amount.

Step 1: Choose Quality Dividend Companies

🎯 Focus on companies with sustainable business models, consistent earnings growth, and long histories of dividend payments. Look for dividend aristocrats that have increased payments for at least 25 consecutive years.

Selection criteria checklist:

- 📈 Revenue growth averaging 5%+ annually over five years

- 💰 Payout ratios below 60% of earnings (ensures sustainability)

- 🏆 Dividend growth streak of at least ten years

- 💪 Strong competitive advantages (moats) in their industries

Step 2: Set Up Automatic Reinvestment

🤖 Enable DRIP services through your brokerage account for each qualifying dividend stock. Most major platforms including Fidelity, Schwab, and Vanguard offer commission-free dividend reinvestment services.

Automation setup process:

- 🔄 Log into your brokerage account dashboard

- 💻 Navigate to dividend reinvestment settings

- ✅ Enable DRIP for individual stocks or entire account

- 📧 Confirm automatic reinvestment preferences

Step 3: Monitor Performance Quarterly

📊 Review your DRIP progress every three months rather than daily, focusing on share accumulation and dividend growth rather than short-term price fluctuations.

Key metrics to track:

- 📈 Total share count increases from reinvestment

- 💰 Quarterly dividend income growth percentages

- 🎯 Average cost basis improvements over time

- 📊 Total return including reinvested dividends

Step 4: Scale Your Strategy

💪 Gradually add new positions to your DRIP portfolio as your knowledge and confidence grow. Diversify across different sectors and dividend strategies while maintaining quality standards.

The biggest mistake I see new DRIP investors make is checking their accounts too frequently. 📱 Daily market movements create noise that can undermine the long-term discipline required for DRIP success.

Real-World DRIP Performance Example

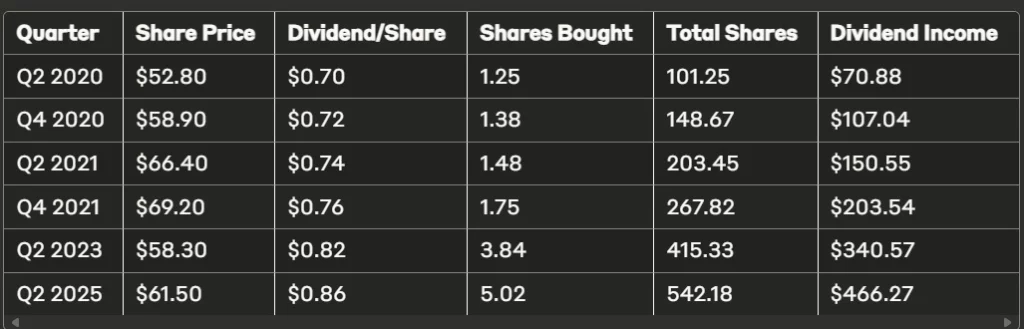

📊 Let me share the exact DRIP results from one of my coaching clients who started with Realty Income Corporation during the 2020 market volatility.

Client Profile: Margaret, 45-year-old teacher

Strategy: $500 monthly purchases plus full DRIP reinvestment

Timeline: March 2020 – August 2025 (65 months)

Quarterly DRIP Results:

Final Results:

- 💰 Original shares: 100 (purchased for $5,280)

- 📈 DRIP shares added: 442.18 shares (zero additional cost)

- 📊 Total position value: $33,344 (August 2025)

- 🎯 Quarterly dividend income: $466.27 (342% increase)

🎉 Margaret’s discipline with DRIP reinvestment transformed her modest initial investment into a substantial income-generating asset. The key was never stopping reinvestment, even during market uncertainty periods.

Why Investment Costs Matter for DRIP Success

💸 Traditional dividend investing often involves significant transaction costs that can dramatically reduce long-term returns. DRIP strategies eliminate most of these fees while maximizing reinvestment efficiency.

The Real Cost of Manual Reinvestment

💡 Let me share a calculation that convinced one client to switch from manual dividend reinvestment to automatic DRIP services.

10-year comparison assuming $200 quarterly dividends:

🔴 Manual reinvestment costs:

- Commission per trade: $6.95

- Quarterly trading cost: $27.80 (4 stocks)

- Annual fees: $111.20

- 10-year total fees: $1,112

🟢 DRIP automatic reinvestment:

- Commission per reinvestment: $0.00

- Quarterly cost: $0.00

- Annual fees: $0.00

- 10-year total fees: $0.00

🎉 Bottom Line: DRIP saved over $1,100 in fees that compound into additional wealth over time!

Furthermore, DRIP services allow fractional share purchases, meaning every penny of dividends gets invested immediately. 🪙 Manual reinvestment often leaves cash sitting idle until you accumulate enough for full share purchases.

Additional DRIP Cost Benefits:

- 🎯 No minimum investment requirements for reinvestment

- 💰 Fractional shares purchased to four decimal places

- 🔄 Immediate reinvestment (no cash drag periods)

- 📊 Automatic record-keeping for tax purposes

Setting Realistic DRIP Performance Expectations

📊 DRIP investing focuses on long-term wealth building rather than generating quick profits. Understanding historical patterns helps maintain realistic expectations and prevents costly emotional decisions.

Historical Dividend Growth Patterns

📈 Quality dividend stocks have averaged approximately 6-8% annual dividend growth over extended periods, though individual years vary significantly. This growth compounds powerfully when combined with reinvestment strategies.

Key performance statistics:

- Average dividend yield: 2-4% for quality companies

- Annual dividend growth: 6-8% for dividend aristocrats

- Share accumulation rate: 8-12% annually through reinvestment

- Total return expectations: 10-12% including price appreciation

Understanding Normal Market Cycles

🌊 Dividend-paying stocks experience regular price fluctuations that actually benefit DRIP investors. Lower prices mean dividend dollars purchase more shares, accelerating wealth accumulation during market downturns.

What to expect during different market conditions:

- 📉 Bear markets: Higher dividend yields, more shares purchased

- 📈 Bull markets: Lower yields but higher share values

- 🌊 Volatile periods: Enhanced dollar-cost averaging benefits

- 📊 Recovery phases: Accelerated portfolio value growth

🧘 I learned about volatility benefits firsthand during March 2020. The COVID crash was frightening – dividend stocks dropped 30% in weeks. My DRIP clients who maintained discipline bought shares at incredible discounts and saw exceptional wealth growth during the recovery.

Key mindset: Market volatility becomes your friend when using DRIP strategies consistently over time.

Asset Allocation Strategies for DRIP Investors

🎯 Successful dividend reinvestment requires appropriate allocation across different dividend-paying sectors and asset classes based on individual goals and risk tolerance.

Sector-Based DRIP Allocation

🏭 Diversifying DRIP investments across multiple sectors reduces concentration risk while capturing different dividend growth patterns and economic cycle benefits.

Recommended sector allocation:

- 🏦 Financial Services: 20-25% (Banks, insurance, REITs)

- 🏭 Industrials: 15-20% (Manufacturing, transportation)

- 💊 Healthcare: 15-20% (Pharmaceuticals, medical devices)

- 🛒 Consumer Staples: 15-20% (Food, beverages, household goods)

- ⚡ Utilities: 10-15% (Electric, gas, water companies)

- 💻 Technology: 10-15% (Dividend-paying tech giants)

Risk-Based Allocation Guidelines

⚖️ Balance higher-yielding investments with lower-risk options based on your investment timeline and income requirements.

Conservative DRIP allocation (age 50+):

- 40% Blue-chip dividend stocks

- 30% Utility stocks and bonds

- 20% REITs and dividend ETFs

- 10% International dividend funds

Aggressive DRIP allocation (age 20-40):

- 60% Growth-oriented dividend stocks

- 20% REITs and high-yield investments

- 15% International dividend opportunities

- 5% Dividend-focused small-cap stocks

💡 I learned allocation importance with a client who concentrated 80% of DRIP investments in energy stocks during 2014-2016. When oil prices collapsed, his dividend income dropped 60% while diversified clients maintained steady growth.

Advanced DRIP Optimization Strategies

🚀 After years of refinement, I’ve developed advanced techniques that enhance DRIP returns while maintaining the strategy’s core simplicity benefits.

Tax-Loss Harvesting with DRIP

📋 Coordinate DRIP reinvestment with tax-loss harvesting in taxable accounts to minimize tax liability while maximizing after-tax returns.

Implementation approach:

- 🗓️ Review positions annually in December

- 📊 Identify underperforming DRIP holdings with losses

- 💰 Harvest losses to offset dividend income taxes

- 🔄 Reinvest proceeds in similar but not identical assets

DRIP Laddering Strategy

⏰ Stagger DRIP initiations across different quarters to smooth out reinvestment timing and capture various market conditions throughout each year.

Quarterly initiation schedule:

- Q1: Consumer staples and healthcare DRIPs

- Q2: Technology and financial services DRIPs

- Q3: Industrial and utility DRIPs

- Q4: REIT and international DRIPs

This technique generated exceptional results during volatile markets when different sectors performed well at different times throughout annual cycles.

Dividend Growth Acceleration

📈 Focus DRIP investments on companies with accelerating dividend growth rates rather than just high current yields, maximizing long-term income potential.

Target criteria:

- 🎯 Dividend growth acceleration over past three years

- 💪 Earnings growth supporting higher future payouts

- 🏆 Management commitment to shareholder returns

- 📊 Industry tailwinds supporting sustained growth

Recommended Platforms for DRIP Investing

🏦 Platform selection significantly impacts DRIP success through fee structures, available options, and automation capabilities.

Best Overall: Fidelity

🏆 Zero-fee dividend reinvestment across all eligible securities, excellent research tools, and comprehensive DRIP automation features make Fidelity ideal for serious dividend investors.

Key benefits:

- 💰 No fees for DRIP services

- 📊 Fractional share reinvestment

- 🔍 Outstanding dividend research tools

- 📱 Mobile DRIP management

Best for Beginners: Charles Schwab

👥 User-friendly interface combined with extensive educational resources and low-cost dividend ETF options make Schwab perfect for DRIP newcomers.

Advantages:

- 📚 Comprehensive dividend education center

- 💡 DRIP setup guidance and support

- 🎯 Excellent dividend stock screeners

- 🤝 Outstanding customer service

Best for Advanced Investors: Vanguard

📈 Industry-leading low-cost dividend funds, strong automation capabilities, and investor-owned structure make Vanguard excellent for sophisticated DRIP strategies.

Premium features:

- 💎 Ultra-low-cost dividend ETFs and funds

- 🤖 Advanced automation options

- 📊 Comprehensive performance tracking

- 🎓 Investment-grade research capabilities

Platform selection criteria: Prioritize zero DRIP fees, fractional share capabilities, and broad investment selection. Ensure the platform offers specific dividend investments you want to purchase regularly.

Video Recommendation

📺 For a deeper dive into implementing dividend reinvestment strategies, I highly recommend my YouTube video: “DRIP Investing Strategy: How I Build Passive Income That Grows Every Quarter” on the Successful Tradings YouTube Channel.

🎬 This video covers real portfolio examples and demonstrates exactly how I set up automated DRIP systems for maximum long-term wealth building with minimal effort.

DRIP Success Stories from My Coaching Experience

🌟 Real success stories from my coaching clients demonstrate how ordinary people build extraordinary wealth through consistent DRIP execution and long-term discipline.

Jennifer’s Retirement Acceleration

Background: 38-year-old nurse seeking early retirement through passive income

Strategy: $800 monthly across five dividend aristocrats with full DRIP reinvestment

Timeline: January 2020 – August 2025 (5.5 years)

Results:

- Total contributions: $52,800

- Portfolio value: $73,450

- Annual dividend income: $2,940 (growing 8% annually)

- Share accumulation: 47% increase through reinvestment

🎯 Jennifer initially worried about starting during 2020 market uncertainty. However, her disciplined DRIP approach turned volatility into opportunity. Even through market crashes and recovery periods, she never stopped reinvesting dividends.

Key lesson: Consistency and automation beat market timing every single time.

Robert’s Wealth Multiplication

Background: 28-year-old engineer seeking aggressive wealth building

Strategy: $1,500 monthly split between individual dividend stocks (60%) and REITs (40%)

Timeline: March 2019 – August 2025 (6.5 years)

Results:

- Total contributions: $117,000

- Portfolio value: $162,300

- Annual dividend income: $6,480 (12% yield on original investment)

- Compound annual growth rate: 14.2%

💪 Robert’s success demonstrates how scaling contribution amounts dramatically accelerates DRIP benefits. He started with $800 monthly but increased to $1,500 after promotions and raises.

Key lesson: Higher contributions amplify compound growth while maintaining disciplined reinvestment habits.

Common DRIP Mistakes to Avoid

⚠️ Even simple DRIP strategies can be derailed by behavioral mistakes that reduce long-term returns. Avoiding these pitfalls dramatically improves success probability.

Mistake #1: Chasing High Dividend Yields

❌ The error: Focusing on current yield rather than dividend sustainability and growth potential.

🎯 Why it happens: High yields appear attractive but often signal financial distress or unsustainable payout ratios.

✅ The solution: Prioritize dividend growth and company quality over current yield percentages. Sustainable 3% yields that grow 8% annually outperform unsustainable 8% yields that get cut.

Mistake #2: Stopping DRIP During Market Downturns

❌ The error: Pausing dividend reinvestment during market declines when shares are cheapest.

🎯 Why it happens: Fear overwhelms logic during market crashes and volatility periods.

✅ The solution: Automate everything and avoid checking account balances during volatile periods. Market downturns provide the best DRIP opportunities when dividend dollars buy more shares.

Mistake #3: Over-Concentrating in High-Yield Sectors

❌ The error: Allocating too much capital to REITs, utilities, or energy stocks seeking maximum current income.

🎯 Why it happens: Yield-chasing behavior and insufficient diversification across growth-oriented dividend sectors.

✅ The solution: Maintain balanced allocation across multiple sectors and dividend strategies. Include dividend growth stocks alongside higher-yielding investments.

Mistake #4: Ignoring Tax Implications

❌ The error: Failing to consider tax consequences of dividend reinvestment in taxable accounts.

🎯 Why it happens: Focus on gross returns rather than after-tax wealth building efficiency.

✅ The solution: Prioritize DRIP strategies in tax-advantaged accounts like IRAs and 401(k)s. Use qualified dividend stocks in taxable accounts for favorable tax treatment.

DRIP Strategies in Different Market Conditions

📈📉 My decade of experience includes multiple market cycles that reinforced DRIP effectiveness across different economic environments and volatility periods.

Bull Markets (Rising Prices)

📈 During sustained uptrends, DRIP strategies benefit from appreciating share values while continuing to accumulate additional ownership through reinvestment.

Performance characteristics:

- Lower dividend yields due to higher stock prices

- Accelerated portfolio value growth

- Continued share accumulation at higher prices

Strategy adjustments:

- Continue consistent reinvestment regardless of valuation concerns

- Focus on dividend growth rather than current yield

- Maintain long-term perspective during euphoric market periods

Bear Markets (Falling Prices)

📉 Bear markets showcase where DRIP truly excels. Lower stock prices mean dividend dollars purchase significantly more shares, accelerating wealth accumulation for disciplined long-term investors.

Performance characteristics:

- Higher dividend yields due to lower stock prices

- Enhanced share accumulation from reinvestment

- Temporary portfolio value declines with long-term benefits

Strategy advantages:

- Dollar-cost averaging at progressively lower prices

- Higher future dividend income from additional shares

- Opportunity to accelerate wealth building during pessimism

Sideways Markets (Range-Bound)

🌊 Volatile, range-bound markets provide excellent DRIP conditions by offering multiple opportunities to reinvest at various price points throughout market cycles.

Performance characteristics:

- Consistent dividend yields across price ranges

- Regular reinvestment opportunities at different valuations

- Steady wealth building through share accumulation

Strategy benefits:

- Multiple buying opportunities across the trading range

- Reduced timing risk through systematic reinvestment

- Consistent progress toward long-term wealth goals

Frequently Asked Questions About DRIP Investing

How much should I invest using DRIP strategies?

Start with dividend stocks representing 20-30% of your total portfolio allocation. Most successful DRIP investors begin with $500-1000 monthly across 3-5 quality dividend companies, then scale up as experience and confidence grow.

What’s the difference between DRIP and regular dividend investing?

DRIP automatically reinvests dividends to purchase additional shares, while regular dividend investing sends cash payments to your account. DRIP eliminates transaction fees, enables fractional share purchases, and creates compound growth through automatic reinvestment.

Should I use DRIP in taxable or tax-advantaged accounts?

DRIP works excellently in both account types. Tax-advantaged accounts (401k, IRA) provide maximum benefit since reinvested dividends aren’t immediately taxable. In taxable accounts, focus on qualified dividend stocks for favorable tax treatment.

Can I use DRIP with dividend ETFs and mutual funds?

Absolutely! Most brokerages offer automatic dividend reinvestment for ETFs and mutual funds commission-free. This provides instant diversification across hundreds of dividend-paying companies with single-click DRIP activation.

How do I track cost basis with DRIP reinvestment?

Most brokerages automatically track cost basis for DRIP purchases, including fractional shares. Review quarterly statements and maintain digital records for tax purposes. Many platforms provide downloadable cost basis reports for tax preparation.

What happens to DRIP shares if I want to sell?

DRIP shares are identical to regular shares and can be sold anytime during market hours. Fractional shares are automatically sold proportionally. Consider tax implications and maintain some shares for continued dividend income.

Should I stop DRIP when dividend yields seem low?

Never stop DRIP based on current yield levels alone. Focus on dividend growth potential and company quality rather than momentary yield fluctuations. Low yields often accompany strong price appreciation and future dividend growth.

How do company-sponsored DRIPs compare to brokerage DRIPs?

Brokerage DRIPs offer more flexibility, better automation, and easier management across multiple holdings. Company-sponsored DRIPs occasionally offer discounted shares but require more administrative effort and record-keeping complexity.

Can I modify DRIP settings for partial reinvestment?

Many brokerages allow partial dividend reinvestment, sending some dividends as cash while reinvesting the remainder. This provides flexibility for investors needing some current income alongside wealth building through reinvestment.

What are the best dividend sectors for DRIP strategies?

Focus on sectors with sustainable dividend growth: healthcare, consumer staples, technology dividend aristocrats, and utilities. Avoid cyclical sectors like energy or materials unless they represent small portfolio allocations for diversification.

Conclusion: Your Path to Automatic Wealth Building

🎯 After nearly a decade of implementing DRIP strategies personally and coaching hundreds of investors, I’m convinced dividend reinvestment represents the most reliable path to passive wealth building.

DRIP’s true power lies in automation and compound growth acceleration.

🤖 When you enable automatic dividend reinvestment, you eliminate emotional decision-making while ensuring every dividend dollar immediately generates future income.

The strategy succeeds because it transforms market volatility into opportunity.

📈 Instead of fearing price fluctuations, DRIP investors benefit from lower prices through enhanced share accumulation and higher future dividend payments.

Key principles for DRIP success:

- 🌱 Focus on quality companies with sustainable dividend growth

- 🔄 Automate everything to remove emotional interference

- 💰 Prioritize dividend growth over current yield

- 🧘 Maintain discipline during market volatility

Remember, successful DRIP investing requires patience and consistency rather than perfect timing or market predictions.

🎯 The compound growth effects become most powerful after five to ten years of disciplined reinvestment.

Start today with quality dividend stocks and enable automatic reinvestment.

Your future self will thank you for beginning this wealth-building journey rather than waiting for perfect market conditions.

👉 Next Step : Age-Based Asset Allocation

Hold a Master Degree in Electrical engineering from Texas A&M University.

African born – French Raised and US matured who speak 5 languages.

Active Stock Options Trader and Coach since 2014.

Most Swing Trade weekly Options and Specialize in 10-Baggers !

YouTube Channel: https://www.youtube.com/c/SuccessfulTradings

Other Website: https://237answersblog.com/