Table of Contents

Introduction: Why I Love Paper Trading

I’m excited to share my journey with paper trading platforms. Looking back, I wish I had started with them from day one. Paper trading lets me practice without risking real money. And honestly, that removed so much stress. So today, I’ll walk you through the best platforms I’ve used.

Along the way, I’ll compare features and give you my opinions. Transitioning from platform to platform, I’ll explain what works best for each type of beginner. Plus, I’ve included a video recommendation from Successful Trading that explains a top simulator in action!

What Is Paper Trading — And Why It Matters

First, let’s define paper trading. It’s simulated trading using real-time data and fake money. It’s like training wheels for the market. Importantly, it gives you practice without letting emotions wreck your trades. Many online brokers offer it, like Interactive Brokers and TradeStation (Investopedia).

Next, it’s not a perfect mirror of real trading. Simulators often don’t show slippage or fees. And you don’t feel emotional pressure when trades don’t cost real money (Investopedia). Still, I believe it’s essential for learning the mechanics and building confidence.

How I Chose Platforms to Review

To make this guide helpful, I compared platforms that:

- Offer live market data in simulations.

- Are easy to sign up for.

- Let you adjust order types and track performance.

- Are beginner-friendly.

As a new trader, I wanted something intuitive. At the same time, I wanted realistic tools.

So I tested platforms like Thinkorswim, TradingView, Webull, Moomoo, Interactive Brokers, and TradeStation.

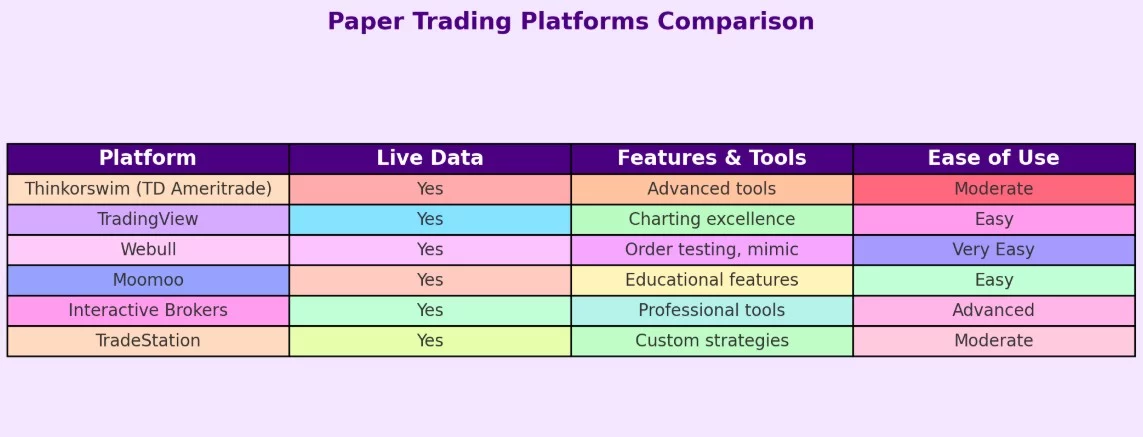

Platform Comparison Table

Here’s a quick view of the platforms I’ll discuss (details come next):

1. Thinkorswim (TD Ameritrade)

I first used Thinkorswim. It offers a fully-featured simulator. You get real-time data, technical tools, and paper account setup.

The interface is rich, but it felt overwhelming at first.

However, once I got used to it, the charting and tools became powerful training aids.

Transitioning from basic to pro, this platform helped me grow.

2. TradingView

Then I switched to TradingView. It’s browser-based, sleek, and intuitive. Its charts are gorgeous, and paper trading is embedded. I could test orders right on the chart.

As I jumped from indicators to drawing tools, everything felt smooth. I loved the social aspect too—so many ideas shared.

3. Webull

Next up was Webull. It’s simple and mobile-friendly. I downloaded the app and started paper trading within minutes. It lets you test multiple order types and mimic real conditions.

The clean interface helped me focus. Plus, it’s ideal for trading on the go.

Webull’s ease really helped me stay consistent with practice.

4. Moomoo

I also tried Moomoo from when it was known as Futu. It offers paper trading and in-app tutorials.

The educational tips make it ideal for absolute beginners.

I followed along with lessons while practicing trades.

The design felt modern, and I appreciated the support within the app. It built my confidence steadily.

5. Interactive Brokers (IBKR)

Then I got brave and tried Interactive Brokers. The paper account gives real-world order types, margin rules, and complex tools. It’s more suited to people aiming for more advanced trading systems. At first, I struggled. But slowly, I learned to use the features. It prepared me well for pro setups.

6. TradeStation

Lastly, TradeStation offered a simulator and automated strategy testing. I could backtest strategies then paper-trade them in real time. It felt like coding practice and trading combined. That technical edge made it a game-changer when transitioning toward algorithmic trading.

Summary of My Experience

In short, here’s how I felt:

- Most intuitive: Webull and Moomoo helped me start fast.

- Best charts: TradingView wins for visuals and ease.

- Most powerful tools: Thinkorswim, IBKR, and TradeStation gave deep customization.

- Best for learning: Moomoo’s tutorials were great for step-by-step learning.

You might choose depending on your comfort level and learning style. Honestly, I rotated through several as I leveled up.

Smooth Transition Strategies

Also, starting simple then progressing works best. Begin with Webull or Moomoo to get familiar.

Then add layers by testing on TradingView. When ready, graduate to Thinkorswim for deeper tools.

Finally, move to Interactive Brokers or TradeStation to explore scripting or strategy testing.

That gradual climb helped me avoid overwhelm. Every step built confidence and knowledge.

Video Recommendation: See It in Action

Here’s an informative video I created on my YouTube channel that demonstrates how to paper trade using a simulator:

Trading for Beginners Part 1 – FULL TRADING COURSE TUTORIAL

This beginner-focused tutorial walks through paper trading basics clearly.

You’ll see how to set up trades, manage orders, and build foundational skills.

It’s paced perfectly for those new to platforms.

FAQs

Q1: What makes a good paper trading platform for beginners?

You want live market data, ease of use, educational help, and a realistic order experience. That combo builds skills faster.

Q2: Can paper trading results predict real-money trading success?

Not entirely. Paper trading lacks emotional stakes and doesn’t factor in slippage, fees, or anxiety.

But it’s vital for practice and confidence.

Q3: How long should I paper trade before going live?

There’s no universal answer. I recommend at least a few weeks or until your strategy shows consistent simulated success.

Track trades and treat it like real learning.

Q4: Should I use multiple platforms or stick to one?

Start with one to build consistency. Later, test others to expand your skills.

Cross-platform exposure helps you adapt to varying tools and conditions.

Q5: Do I need to keep a trading journal even with paper trades?

Absolutely. Journaling helps you analyze patterns, track wins and mistakes, and refine your plan.

Even the pros use journals after paper sessions .

Q6: Are there fees to paper trade?

Usually no. But simulated accounts may restrict features until you open a funded account. Still, paper trading is free and essential for beginners.

Final Thoughts

In closing, paper trading saved me from costly mistakes. It built my muscle memory, strategy, and confidence before risking real money.

So whether you start with Webull, climb through TradingView, or eventually explore IBKR—you’re growing step by step.

Remember, consistent practice beats occasional big attempts.

Track your results, learn every day, and review your trades honestly.

With time, you’ll feel ready for real trading especially if you are a college student trader.

And don’t forget to check out the Successful Tradings video above to see paper trading in action.

Happy practicing, and I look forward to hearing about your trading progress!

Hold a Master Degree in Electrical engineering from Texas A&M University.

African born – French Raised and US matured who speak 5 languages.

Active Stock Options Trader and Coach since 2014.

Most Swing Trade weekly Options and Specialize in 10-Baggers !

YouTube Channel: https://www.youtube.com/c/SuccessfulTradings

Other Website: https://237answersblog.com/