Table of Contents

👉 You’ll learn the essentials, see practical examples, and get visuals to reinforce the concepts. I’ll keep sentences tight, transitions natural, and the voice direct and encouraging.

What Are Index Funds?

Index funds are mutual funds built to mirror a benchmark like the S&P 500. Instead of picking winners, you own the whole basket. Consequently, you get broad diversification, very low costs, and easy compounding.

- 📊 Diversification: One purchase spreads risk across many companies and sectors.

- 💸 Low cost: Expense ratios often sit under 0.10%, saving you money annually.

- ⏳ Long horizon: The design favors buy-and-hold investors who trust compounding.

- 🏦 Mutual fund structure: Priced once daily after the market closes.

Because index funds do not trade intraday, beginners dodge impulsive decisions. Additionally, retirement plans automate contributions and reinvest dividends by default. That convenience reduces friction and improves discipline consistently.

- ❌ No intraday trading flexibility

- ❌ Minimum investments may apply

- ❌ Less tax-efficient than ETFs in taxable accounts

Quick history: John “Jack” Bogle launched the first index fund in 1976. Critics mocked it. Eventually, the results silenced doubters because low costs and broad diversification drive performance over decades.

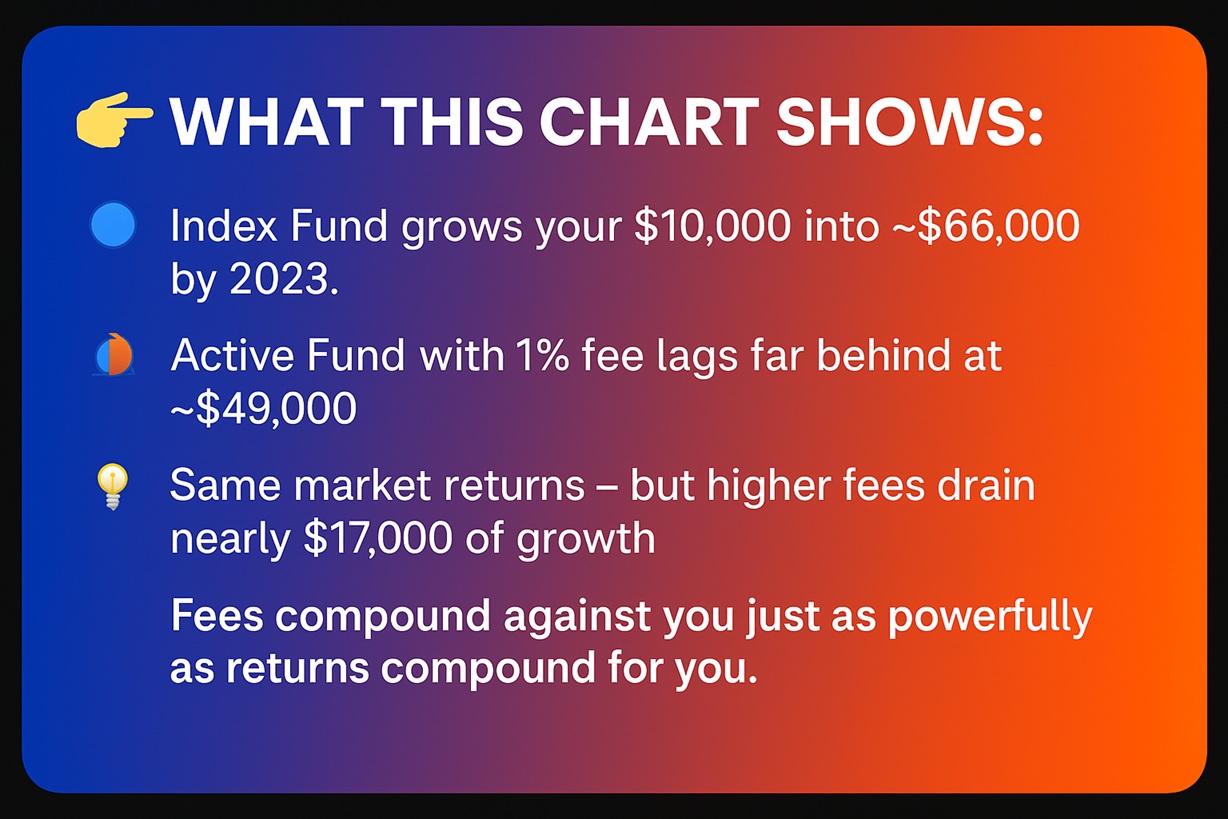

Case study: Imagine investing $10,000 in an S&P 500 index fund in 2003. By 2023, reinvesting dividends, your balance would approach $66,000. Meanwhile, higher-fee options typically lag because expenses compound against you.

What Are ETFs?

Exchange-Traded Funds track indexes or themes and trade like stocks. Therefore, you get diversification plus intraday liquidity. Moreover, ETF structures usually deliver excellent tax efficiency in taxable accounts.

- 📈 Intraday trading: Buy or sell during market hours as needs arise.

- 💵 Low minimums: Purchase single shares or fractional shares easily.

- 📊 Variety: Gain exposure to equities, bonds, commodities, and sectors quickly.

- ⚖️ Tax efficiency: In-kind creation and redemption reduce capital gains distributions.

SPY launched in 1993 and proved the concept at scale. Subsequently, ETFs exploded in popularity worldwide. Today, competition drove costs downward while access improved through fractional investing apps.

⚠️ Flexibility is a double-edged sword. Because ETFs trade easily, some beginners overtrade. Consequently, they undermine the passive plan. Set rules and automate contributions to protect yourself.

Similarities Between Index Funds and ETFs

- 📊 Diversification: Both spread risk across many holdings instantly.

- 💸 Low fees: Both cost far less than actively managed alternatives.

- ⏳ Long-term fit: Both reward patience and consistency over decades.

- 🔄 Reinvestment: Dividends can reinvest and boost compounding automatically.

- 🌍 Availability: Most brokerages and retirement plans support both vehicles.

In practice, performance looks extremely similar when they track the same index. The main differences relate to trading mechanics, automation options, and tax treatment in taxable accounts.

Key Differences Between Index Funds and ETFs

- 📈 Trading: ETFs trade intraday; index funds price once daily after close.

- 💵 Minimums: ETFs allow tiny entries; index funds sometimes require higher minimums.

- ⚖️ Taxes: ETFs usually avoid capital gains distributions until you sell.

- 💸 Fees: Both are cheap; ETFs often edge lower across categories.

- 🔄 Automation: Index funds integrate perfectly with payroll deductions and rebalancing.

Which Is Better for Beginners?

🎯 For retirement plans, index funds feel smoother thanks to automation.

However, for taxable accounts and small starts, ETFs often win because they’re flexible and tax-efficient.

- 📖 Pick index funds if you invest mainly through a 401(k) or IRA.

- 💸 Pick index funds if you want automatic contributions and reinvestment.

- 📈 Pick ETFs if you want intraday liquidity and fractional entries.

- ⚖️ Pick ETFs if you prioritize tax efficiency in a taxable brokerage.

- 🌍 Pick ETFs if you want thematic or international exposure quickly.

Practical Strategies Using Both

- 🧩 Core + satellite: Use index funds for your core; add ETF satellites for themes.

- 💸 Dollar-cost averaging: Automate index fund buys; top up ETFs opportunistically.

- 🌍 Global blend: Pair U.S. index funds with international or sector ETFs.

- ⚖️ Tax placement: Keep index funds inside IRAs; hold ETFs in taxable accounts.

For example, Sarah automates 401(k) contributions into an S&P 500 index fund.

Then, she buys international and technology ETFs in a taxable account.

Consequently, her retirement grows reliably, while her taxable account remains flexible and tax-aware.

FAQs

❓ Which grows faster: index funds or ETFs?

Growth is nearly identical if both track the same index. Differences usually stem from fees and taxes, not strategy names.

❓ Are ETFs riskier than index funds?

Not inherently. Both reflect market volatility. However, intraday trading can tempt overtrading, which raises behavioral risk.

❓ Can I lose money with either?

Yes. Markets fluctuate. Diversification helps, but downturns still impact both vehicles similarly over short periods.

❓ Which is cheaper: index funds or ETFs?

ETFs often edge slightly cheaper. Nevertheless, both are dramatically less expensive than actively managed alternatives.

❓ Can I hold both?

Absolutely. Many investors use index funds for retirement automation and ETFs for taxable, flexible exposure.

❓ Which fits retirement accounts better?

Index funds usually fit better because payroll deductions and reinvestments happen seamlessly without intraday decisions.

❓ Which fits taxable accounts better?

ETFs typically excel thanks to in-kind creation/redemption, which reduces capital gains distributions until you sell.

❓ Do both pay dividends?

Yes. Both pass through dividends, and most platforms allow automatic reinvestment to support compounding.

Recommended Video 🎥

For a visual walkthrough that reinforces this comparison, watch my explainer on the Successful Tradings channel.

You’ll see charts, tax notes, and practical steps that map directly to this article’s framework.

Conclusion

Index funds and ETFs solved the same problem from different angles: affordable diversification with minimal friction. Since 2015, I’ve traded through rallies and selloffs; since 2019, I’ve coached beginners through the noise. Ultimately, the winners kept costs low, automated contributions, and let compounding work patiently.

- 📊 Both diversify widely and reduce single-stock risk immediately.

- 💸 Both keep fees tiny so more of your money compounds.

- ⚖️ Index funds shine in retirement plans; ETFs excel in taxable accounts.

- 🔄 Automation plus discipline beats prediction and perfection every time.

Start with a clear allocation across stocks and bonds. Then, pick the vehicle that fits each account’s purpose.

Finally, automate and review annually.

With that simple system, you’ll avoid most pitfalls and stay focused on what matters: time in the market, not timing the market.

👉 Next Step 1: Begin investing with $100 today

👉 Next Step 2: Implement Dollar Cost Averaging

Hold a Master Degree in Electrical engineering from Texas A&M University.

African born – French Raised and US matured who speak 5 languages.

Active Stock Options Trader and Coach since 2014.

Most Swing Trade weekly Options and Specialize in 10-Baggers !

YouTube Channel: https://www.youtube.com/c/SuccessfulTradings

Other Website: https://237answersblog.com/