I began trading in 2015 and started coaching in 2019. I love passive investing because it simplifies decisions and protects emotions. However, even simple strategies carry risks that deserve real attention and clear rules. Therefore, this guide explains the major risks facing passive investors during 2026. I will show where portfolios bend, how they sometimes break, and why discipline matters. Moreover, I will offer practical controls that reduce regret without complicating your life. Finally, you will leave with a calm checklist and a firmer plan.

👉 In this guide, you will learn:

- 📌 What passive investing truly means in 2026, without confusing buzzwords

- 📉 Where index concentration creates vulnerabilities across common broad-market funds

- 🧩 How tracking error and structure decisions affect long-term predictability

- 💧 Why liquidity shocks and crowding can widen spreads during stressful weeks

- 🧠 Which behavioral traps quietly sabotage otherwise solid passive portfolios

- 🧾 Where taxes, fees, and rebalancing rules either help or quietly hurt

- 🎯 How to write simple safeguards that scale with your contributions

Passive investing still works beautifully when you respect its boundaries. Therefore, I wrote this guide to highlight the edges and offer guardrails. Because risks evolve, your plan should evolve thoughtfully, not reactively, during noisy seasons.

Table of Contents

Passive Investing in 2026: a quick foundation

Passive investing buys diversified indexes through low-cost funds and then holds patiently. Moreover, automation pushes contributions and reinvests dividends according to simple rules. Consequently, the strategy reduces timing errors and shrinks decision fatigue during volatile months. You still face drawdowns, sequence risk, and scary headlines like everyone else. However, your behavior changes because rules replace most improvisation and short-term opinions.

Key principles that still matter most:

- 🧭 Keep allocation aligned with time horizon and sleep quality always.

- 💵 Minimize expenses and frictions that compound negatively over decades.

- 🌍 Diversify across geographies, sectors, durations, and credit exposures thoughtfully.

- 🔁 Rebalance on a calendar or band rule rather than chasing heat.

- 🧠 Write rules for stress days so feelings never hijack smart habits.

Therefore, passive investing remains powerful when you implement it with consistency. Problems arise when concentration grows, liquidity thins, or behavior slips during storms.

Risk #1: Index concentration and crowding

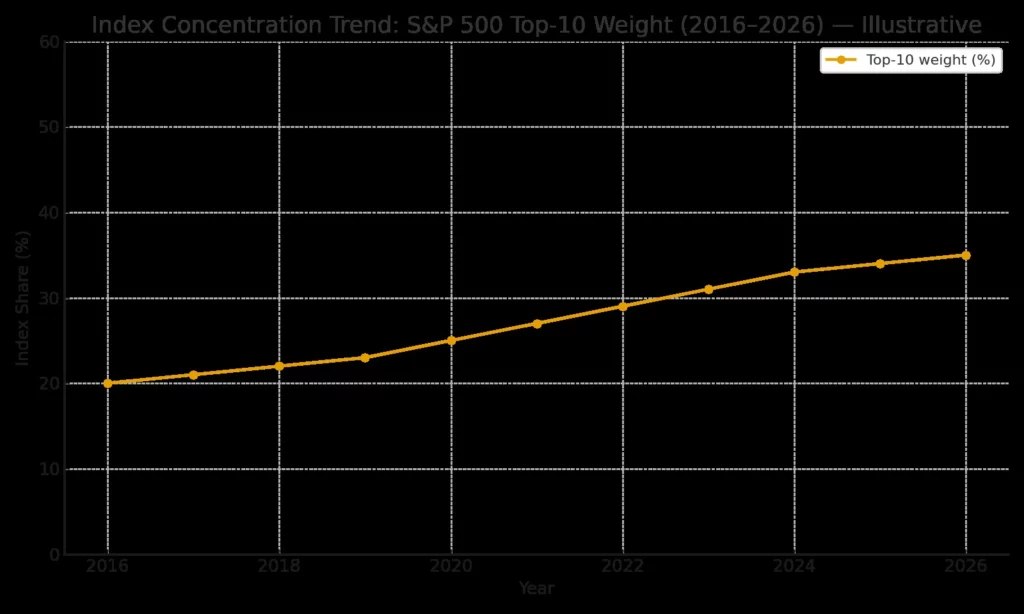

📈 Market-cap indexes can crowd heavily into dominant companies during momentum phases. Therefore, top holdings sometimes represent outsized portions of fund weight and risk. When leadership narrows, your “diversified” index can act surprisingly concentrated. Moreover, common benchmarks may overlap, compounding exposure when you own multiple funds.

Potential symptoms you might notice:

- 🚨 More portfolio movement explained by fewer companies than before.

- 📉 Larger drawdowns when a narrow leadership group finally loses steam.

- 🔁 High overlap across “different” funds that follow correlated parent indexes.

Practical mitigations you can apply today:

- 🧰 Add a total international index to reduce domestic leadership dependency.

- 🔢 Cap any single position at five percent of total portfolio value.

- 🧮 Consider equal-weight or multi-factor slices for modest concentration relief.

- 🔄 Rebalance bands pull excess weight back toward your target systematically.

Risk #2: Tracking error and structure

🎯 Tracking error measures how closely a fund follows its stated index. Therefore, replication method, fees, securities lending, and cash drag all influence tracking. Moreover, emerging markets and small caps sometimes track less cleanly during stressed periods. Synthetic replication or derivatives usage can also introduce counterparty and structure considerations.

Watch these drivers carefully:

- 🧾 Expense ratios and internal friction that erode close tracking over time.

- 🧪 Optimization versus full replication inside complex or illiquid index segments.

- 🧷 Securities lending practices and how revenue offsets tracking shortfalls.

- 🧰 Derivative overlays used for exposure and their collateral management processes.

Practical mitigations worth adopting:

- 🔎 Compare multi-year tracking differences across candidate funds before purchasing.

- 🧾 Favor long-lived funds with clear methodology and transparent disclosures.

- 🌐 Use broader universes where practical, since breadth eases replication challenges.

- 🔁 Revisit tracking error during annual reviews, not during scary headlines.

Risk #3: Liquidity squeezes and wide spreads

💧 Most broad ETFs trade tightly under normal conditions with small spreads. However, stress weeks can widen spreads and reduce depth for certain exposures. Consequently, market orders during volatility can execute at unexpectedly poor prices. Moreover, bond funds sometimes price underlying securities slower than exchange quotes.

Tactical habits that reduce frustration:

- 🕒 Use limit orders during turbulent sessions rather than blind market orders.

- ⏱️ Avoid trading near the open or close when spreads usually widen.

- 📊 Prefer deep, liquid funds with thick order books and active authorized participants.

- 🔁 Stage rebalancing across multiple days when conditions feel disorderly or thin.

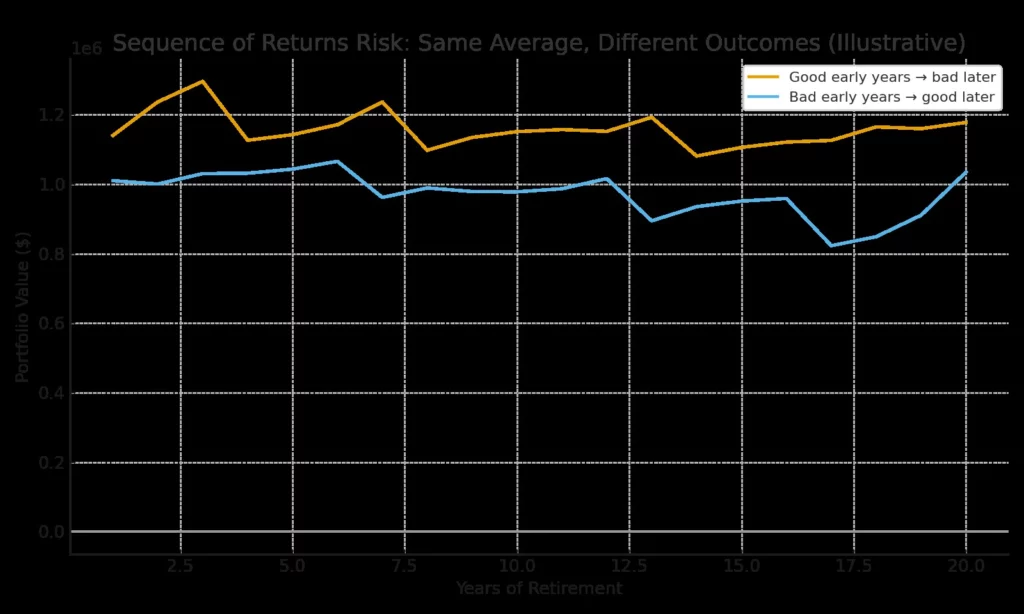

Risk #4: Sequence of returns risk

🧮 Average returns can hide dangerous early-period losses during withdrawal phases. Therefore, retirees face sequence risk when negative years arrive at the beginning. The same average return with a different order can mean very different outcomes. Moreover, spending from a shrinking base accelerates depletion and stresses behavior.

Actionable safeguards that lessen damage:

- 🧯 Hold a one to two year cash buffer for spending stability.

- 🧰 Pair equities with high-quality bonds to moderate deep drawdowns meaningfully.

- 🔁 Use flexible withdrawal rules that trim distributions after very poor years.

- 🔄 Refill the cash bucket during recoveries rather than selling into weakness.

Risk #5: Fees, frictions, and stealthy complexity

💸 Passive investors sometimes relax after choosing a low expense ratio. However, small costs still compound negatively against growing balances over decades. Therefore, watch custodial fees, advisor fees, cash drags, and unnecessary fund layers. Moreover, complex wrapper products can hide higher total costs behind friendly marketing.

Practical frictions to examine annually:

- 🧾 Advisory fees that compound faster than outperformance realistically appears.

- 💧 Cash sweep programs paying little while reducing effective market exposure.

- 🧰 Secondary wrappers that stack expenses without meaningful diversification additions.

- 🧷 Trading commissions or currency conversions that reappear during international investing.

Cleaner habits that protect compounding:

- 🔎 Compare “net of all fees” returns rather than headline expense ratios alone.

- 💵 Keep idle cash minimal while respecting your emergency reserve playbook.

- 🧭 Prefer straightforward vehicles over niche wrappers that add little net benefit.

Risk #6: Tax surprises and distribution timing

🧾 Index funds usually remain tax efficient, yet distributions still surprise investors.

Therefore, capital gains from rebalances or corporate actions can land unexpectedly.

Moreover, dividends vary by index composition and the calendar inside your jurisdiction.

In taxable accounts, these realities influence your actual spendable, after-tax results.

Helpful moves that keep taxes under control:

- 🧮 Place bonds in tax-advantaged accounts whenever available and sensible.

- 🧾 Favor broad, low-turnover equity funds for taxable account placements.

- 🧰 Harvest losses during deep drawdowns without altering your risk profile.

- 📅 Mind distribution calendars so purchases avoid immediate taxable payouts.

Risk #7: Behavior during volatility

🧠 The largest passive risk comes from abandoning your rules during storms.

Therefore, write your policy when calm, and trust it when stressed.

Moreover, automate contributions so emotions never override scheduled decisions.

Finally, keep your review cadence predictable, brief, and boring by design.

Rules that keep you steady during rough periods:

- 📅 Perform a scheduled review monthly, regardless of headlines or social noise.

- 💬 Track deviations and write a short reason before committing any manual change.

- 🤖 Use automation for contributions, reinvestment, and rebalancing thresholds.

- 🧘 Reduce app notifications and portfolio checking frequency during volatile weeks.

Infographic: The 2026 Passive Risk Map

- 🗺️ How to read it: Start top-left and scan clockwise for quick coverage.

- 🧩 What to do next: Circle your top two weaknesses and deploy one mitigation today.

- 🚀 Outcome you want: Fewer surprises and fewer reactive changes during market stress.

Infographic: Mitigation Checklist You Can Print

- ✅ Use it monthly: Confirm each control shows “on” or “not applicable” for you.

- 🔁 Keep it boring: Routine beats heroics when the calendar measures wealth building.

- 📈 Measure progress: Track contributions, not predictions, because inputs drive outcomes.

Case Study: a concentrated index meets a sector shock

🔬 Imagine an index where the top ten companies grow to thirty-five percent.

The index looks diversified yet rides mostly on a narrow leadership group.

However, a sector-specific shock hits three leaders simultaneously and sentiment swings.

Therefore, the “diversified” portfolio behaves like a sector bet temporarily.

Investors feel confused because they expected smoother behavior from a broad index.

Mitigations like equal-weight slices and international exposure soften those weeks materially.

Moreover, rebalancing bands move excess weight back toward equilibrium without emotion.

Case Study: two retirees, same average return, opposite outcomes

👵 Two retirees hold identical allocations and the same average annual return.

However, one faces negative years early while the other gets them late.

Therefore, early drawdowns force larger percentage withdrawals from a smaller base.

Over time, balances diverge materially despite identical long-term averages across the horizon.

A two-year cash buffer and flexible withdrawals cushion that unlucky sequence.

Moreover, rebalancing into equities during recoveries accelerates healing without guesswork.

Visuals to embed

- 📊 Chart 1: Index concentration trend 2016–2026 with a clear rising line.

- 📉 Chart 2: Sequence risk comparison showing diverging balances over twenty years.

- 🧭 Infographic 1: Nine-box “Risk Map” with concise titles and fixes.

- ✅ Infographic 2: Printable “Mitigation Checklist” usable during monthly reviews.

Practical controls you can implement this week

- 🧱 Set a position cap so no single holding exceeds five percent.

- 🌍 Add an international index and a core bond index for breadth.

- 💸 Verify expense ratios and hidden frictions across every account and wrapper.

- 🔁 Choose rebalancing bands of plus or minus five percentage points.

- 🧯 Maintain a cash buffer sized to real spending, not guesswork or hope.

- 🧾 Place bonds in tax-advantaged accounts and equities in taxable accounts.

- 🧮 Harvest losses during drawdowns while preserving your overall risk profile.

- 📅 Schedule a calm, ten-minute monthly review and log any changes honestly.

- ✍️ Keep a written policy statement you can share with a trusted partner.

What 2026 changes about risk

- 📡 Macro shocks travel faster, so headlines spike volatility during quiet periods.

- 🤖 Automation reduces errors, yet it can magnify crowding if rules match everywhere.

- 🌐 Leadership rotation quickens, which punishes home bias and single region bets.

- 🧾 Tax rules evolve, so distribution calendars deserve another yearly glance.

- 🧠 Information overload increases, therefore filtering sources becomes a discipline.

Therefore, stay simple while staying current.

Moreover, review your policy annually and verify that controls still fit. Finally, keep your portfolio aligned with your time horizon and life stage.

Video recommendation 🎥

🎬 For a friendly walkthrough, watch my Successful Tradings video that contrasts index funds and ETFs for beginners.

It explains costs, tracking, and behavior with simple visuals and examples.

Moreover, it reinforces how rules tame volatility without complicated market timing guesses. Watch it here: https://www.youtube.com/@SuccessfulTradings and search “Index Funds vs ETFs Explained for Beginners”.

You will see how structure, fees, and rules affect risk across actual portfolios.

FAQs

Is passive investing still safe in 2026?

Yes, when you manage concentration, liquidity, taxes, and behavior with clear rules. Moreover, low costs and diversification still drive most outcomes over decades.

How do I know if my index fund is too concentrated?

Check top holdings weight and overlap across your funds monthly. Therefore, reduce single-company exposure and diversify internationally when weights feel uncomfortable.

What is tracking error, and should I worry about it?

Tracking error measures the gap between your fund and its index. You should compare multi-year differences and favor managers who consistently minimize friction.

Are bond funds still helpful if yields seem low?

Bonds reduce drawdowns and support rebalancing, which protects behavior during stress. Moreover, they supply dry powder when equities sell off sharply and recover later.

Should I change funds when spreads widen during volatility?

Use limit orders and avoid emotional switching during stressed trading sessions. Therefore, prioritize execution discipline and schedule rebalancing rather than reacting impulsively.

How much cash should retirees hold?

Many retirees keep one to two years of spending in cash. Moreover, they refill the bucket during recoveries rather than selling into weakness.

Can I still be passive if I use factor or equal-weight slices?

Yes, if you keep costs low and rules simple across rebalancing. Additionally, you remain passive when decisions follow policy rather than short-term predictions.

How often should I rebalance in 2026?

Rebalance annually or when any sleeve drifts five percentage points beyond target. Moreover, direct new contributions to underweights before selling anything in taxable accounts.

What single change reduces risk most for typical beginners?

Add global diversification and adopt written rebalancing bands immediately.

Therefore, your portfolio avoids concentration and your behavior avoids panicked improvisations.

Conclusion

Passive investing thrives when you know its edges and respect them.

Therefore, cap positions, diversify globally, and automate rebalancing with calm rules.

Moreover, hold a cash buffer, control taxes, and protect behavior during storms.

Finally, review annually and adjust slowly so discipline compounds like your money.

👉 Next Step: Retirement Investing Strategies

Hold a Master Degree in Electrical engineering from Texas A&M University.

African born – French Raised and US matured who speak 5 languages.

Active Stock Options Trader and Coach since 2014.

Most Swing Trade weekly Options and Specialize in 10-Baggers !

YouTube Channel: https://www.youtube.com/c/SuccessfulTradings

Other Website: https://237answersblog.com/