I began trading in 2015 and started coaching in 2019. Since then, I have watched investors wrestle with allocation more than timing. However, once they master a simple age based framework, confidence improves quickly. Therefore, this guide delivers a practical, visual walkthrough for building portfolios in 2026. I will use plain language, clear steps, and charts you can copy easily. Moreover, every section favors action over jargon so you move forward today. Finally, I will show guardrails that protect discipline when markets shake violently.

👉 In this guide, you will learn:

- 📊 How asset allocation controls risk, return, and your sleep quality

- 🧭 Why age based portfolios simplify decisions during noisy market cycles

- 🧱 Which building blocks matter most and which you can ignore confidently

- 🔁 How to rebalance automatically without micromanaging daily headlines

- 🧮 A glide path formula you can tweak for personal circumstances

- 🧰 Implementation using low cost index funds across common account types

- 🧠 Rules for behavior so emotions never hijack your long term plan

Table of Contents

What Asset Allocation Actually Means

Asset allocation splits your money between growth assets and stabilizers. Usually that means stocks for growth, bonds for stability, and cash for flexibility. Additionally, some investors add small slices of real estate or commodities thoughtfully. However, most beginners succeed with a simple mix before exploring advanced ingredients. Your chosen percentages set expectations for volatility and long term compounding power. Therefore, allocation becomes the steering wheel while specific funds act like vehicles. Because markets surprise everyone, a balanced wheel helps you stay on course.

👉 Core roles inside a passive portfolio:

- 📈 Stocks: Drive long term growth through ownership of global businesses

- 🪙 Bonds: Provide income and reduce drawdowns during difficult bear markets

- 💧 Cash: Covers emergencies and funds contributions during temporary downturns

- 🧱 Real estate: Adds diversified income when used through broad index funds

- 🧪 Alternatives: Stay optional and small, since complexity rarely improves outcomes

Why Age Based Portfolios Matter in 2026

Age based allocation aligns risk with your time horizon intuitively. Because younger investors have decades, they can handle deeper temporary declines calmly. Meanwhile, investors nearing retirement need steadier income and fewer sharp drawdowns. Therefore, we map a glide path that gradually shifts from stocks toward bonds. Furthermore, modern brokerage automation makes these adjustments painless and predictable. Consequently, you focus on savings rate and career growth rather than predictions.

Key 2026 realities that influence allocation choices:

- 📉 Inflation cooled from peaks, yet periodic spikes still test nerves

- 🧠 Behavioral mistakes remain costly, especially after viral macro headlines

- 🤖 Automation features improved, making rules based rebalancing straightforward

- 🌍 Global diversification matters because leadership rotates across regions

- 💸 Fees continue falling, so broad index funds dominate implementation

The Building Blocks Explained Simply

Let us keep the ingredients simple so your plan stays durable. First, use a total world or total market stock index for breadth. Second, pair that with an aggregate bond index focused on intermediate duration. Third, hold three to six months of expenses in a high yield savings account. Moreover, consider a small real estate index allocation if income stability matters. However, avoid overlapping niche funds until your base habit feels automatic. Because costs compound, pick funds with tiny expense ratios and solid liquidity.

Checklist before you purchase anything:

- 🧾 Expense ratio under 0.10% for core stock and bond funds

- 🏦 Automatic dividend reinvestment available and easy to enable quickly

- 🔁 Rebalancing tools built into the platform or robo advisor interface

- 🌐 Fractional shares supported so contributions stay fully invested

- 🧯 No account maintenance fees or hidden transfer charges lurking

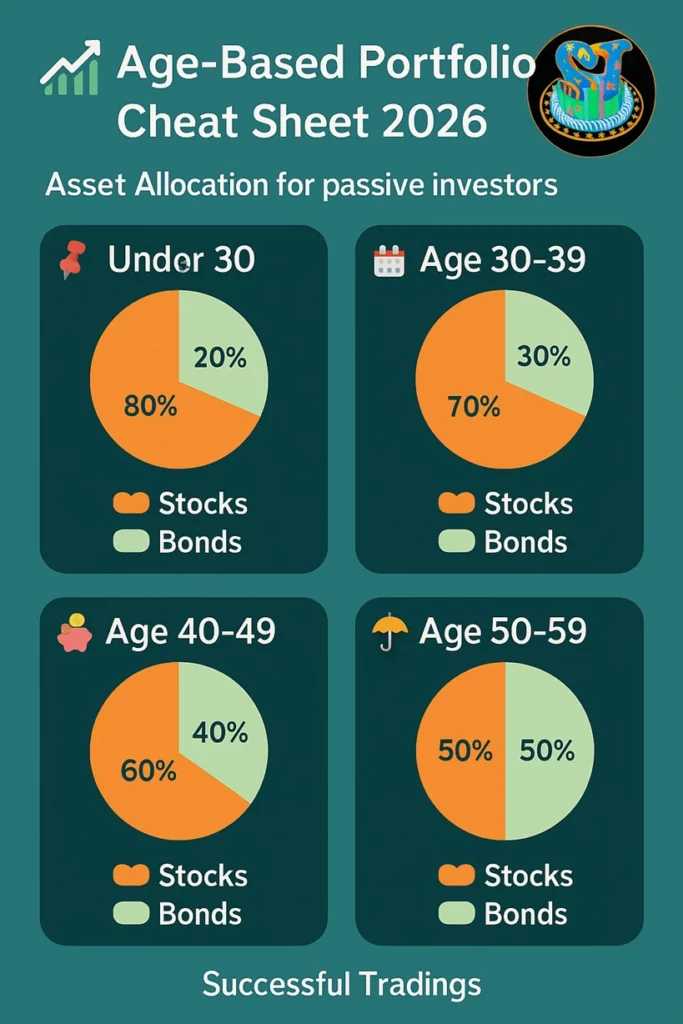

Age Based Model Portfolios by Decade

Use these starting points, then adjust a few points for personal circumstances. Importantly, the ranges reflect comfort zones rather than rigid commandments. Therefore, treat them as rails guiding safer decisions during stressful periods. Additionally, use the glide path chart later to visualize the shift.

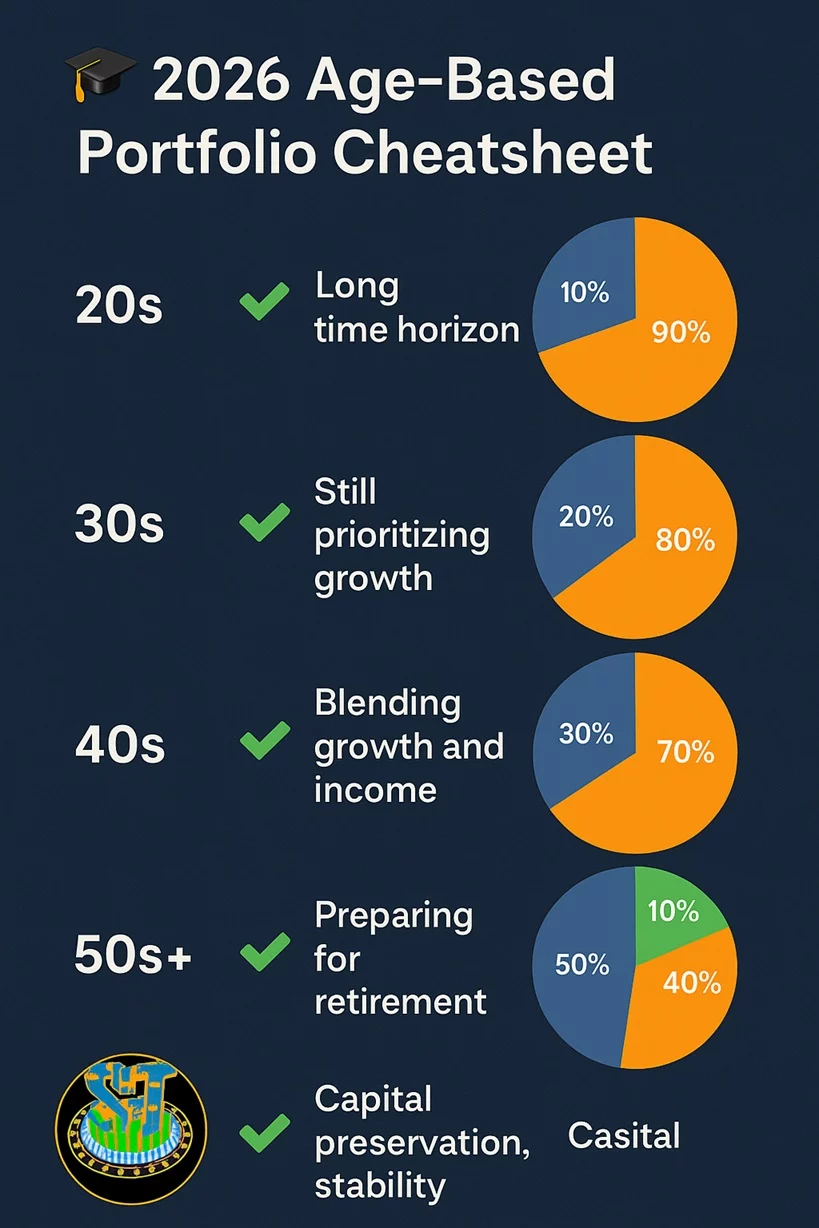

Twenties: 90% stocks, 10% bonds and cash combined. Moreover, international exposure should represent at least thirty percent of stocks. Therefore, you gain balance if domestic leadership rotates unexpectedly next cycle.

Thirties: 80% stocks, 20% bonds and cash combined. Additionally, increase emergency savings as family commitments expand across years. Consequently, you reduce forced selling risk when surprises hit your budget.

Forties: 70% stocks, 30% bonds and cash combined. However, adjust upward if your job feels exceptionally stable and growing. Meanwhile, increase bonds if sleep quality suffers during normal market swings.

Fifties: 60% stocks, 40% bonds and cash combined. Furthermore, consider a short term bond sleeve to stabilize upcoming withdrawals. Therefore, sequence of returns risk becomes manageable ahead of retirement.

Sixties and beyond: 40% to 50% stocks, remainder across bonds and cash. Additionally, create a two year cash buffer for spending stability during downturns. Consequently, you protect lifestyle while your equities recover in future rallies.

A Simple Glide Path Formula You Can Customize

A popular rule suggests stocks equal one hundred ten minus your age. Therefore, a thirty year old might hold eighty percent stocks and twenty bonds. However, risk capacity matters as much as tolerance during financial planning. If your income feels unstable, subtract an extra five to ten points. Additionally, add five points if you expect a pension or rental income. Moreover, revisit annually and adjust slowly rather than pivoting abruptly overnight. Because habits drive outcomes, small scheduled nudges outperform large emotional swings.

Here is a visual of a classic glide path using that formula:

Risk Capacity Versus Risk Tolerance

Risk tolerance describes your feelings during volatility across market cycles. Risk capacity describes your financial ability to endure losses without harm. Therefore, a secure dual income household can often handle higher equity exposure. However, a single contractor with variable income should choose calmer allocations. Additionally, health, dependents, and location influence capacity toward different directions. Consequently, the right allocation fits your life instead of headlines or peers.

Signal questions that help you dial the mix responsibly:

- 🧑⚕️ Could you handle twelve months of expenses without selling investments suddenly?

- 🧾 Do you expect a pension or guaranteed income during retirement years?

- 🧰 How quickly can you replace employment if an industry slowdown arrives?

- 🍼 Will childcare, education, or caregiving obligations expand soon meaningfully?

- 🧘 How well do you sleep when markets drop fifteen percent unexpectedly?

Implementation Using Low Cost Index Funds and ETFs

You can build age based allocations with three funds very efficiently. First, choose a broad global stock fund with deep liquidity and tiny fees. Second, add an aggregate bond fund with mostly intermediate duration exposure. Third, hold high yield savings or treasury bills for your emergency reserve. Additionally, many families prefer a single target date index fund solution. However, verify the stock to bond ratio actually matches your preferred glide path. Furthermore, check underlying fees and trading spreads before locking the selection.

Account specific placement matters for taxes and behavior over long horizons:

- 🏦 Retirement accounts: Place bonds here to shelter interest income effectively

- 💼 Taxable accounts: Favor stock index funds with low turnover and great tax efficiency

- 🧾 HSAs: Invest the long term portion aggressively, then reimburse expenses strategically later

- 🧸 Custodial accounts: Keep allocations simple and teach contribution rituals early

- 🧑💻 Robo advisors: Accept small fees only if rebalancing and automation save your time

Rebalancing Rules and Automation for 2026

Rebalancing returns your allocation to target when markets push weights around. Therefore, you sell a bit of winners and add to laggards on schedule. However, you avoid constant tinkering by choosing rules and sticking carefully. Additionally, modern brokers let you automate thresholds and reinvest dividends automatically. Consequently, maintenance stays light while your plan remains aligned through volatility.

Two reliable approaches work for most passive investors:

- 🔁 Calendar method: Rebalance annually or semiannually on the same date

- 🎯 Band method: Rebalance when any sleeve drifts five percentage points from target

- 💵 Cash flows: Direct new contributions toward underweight assets before selling anything

- 🧮 Tax aware: Harvest losses in taxable accounts while keeping risk level constant

- 📬 Notifications: Set platform alerts so you execute when rules actually trigger

Tax Placement and Withdrawal Planning

Taxes influence net returns, especially across long multi decade compounding journeys. Therefore, place bond funds inside tax deferred or tax free accounts when possible. Additionally, prioritize low turnover stock index funds in taxable accounts for efficiency. Moreover, consider municipal bonds if your marginal tax rate sits meaningfully high. However, never let taxes dominate allocation because goals come first always. Finally, map withdrawals from least efficient accounts before touching your compounding engines.

Practical tax moves many passive investors adopt confidently:

- 🧾 Use tax loss harvesting rules during drawdowns without altering total risk

- 🧮 Max employer retirement matches before funding lower priority vehicles

- 🧰 Convert small traditional IRA balances to Roth during income valleys

- 🧯 Keep at least one year of spending in cash plus near cash

- 🧭 Create a written withdrawal policy that covers bear market scenarios

Risk and Return: What Different Mixes Tend to Deliver

Expectations help you stay calm when markets move faster than feelings prefer. Therefore, here is an illustrative comparison across three common allocations. Returns reflect long term averages while drawdowns mirror painful historical episodes. However, remember that future markets can differ, so treat ranges as guides.

Infographic: 2026 Age Based Portfolio Cheatsheet

Use this quick visual when you need a fast refresher during reviews.

Furthermore, share it with family members so everyone understands the plan clearly.

Because alignment reduces stress, simple visuals prevent arguments around market noise.

Infographic: Rebalancing Rules Checklist

Here we summarize the automation rules that keep your allocation disciplined. Additionally, the graphic pairs each rule with a quick why for clarity. However, if your platform lacks one feature, simply use the closest alternative.

Use these checkpoints during each review to avoid drifting allocations. First, compare current weights against targets and bands. Second, redirect new contributions toward underweight assets automatically. Third, harvest losses tactically in taxable accounts when rules permit. Finally, document actions briefly, because written notes reduce future second guessing and emotional adjustments. During pressure days.

Frequently Asked Questions

How often should I rebalance a passive age based portfolio? Rebalance annually or when bands breach five percentage points, whichever arrives first. Therefore, you reduce trading while keeping risk aligned with your written policy.

Should I include international stocks in an age based plan? Yes, because regional leadership rotates unpredictably across decades and market cycles. Additionally, global diversification reduces home bias and improves resilience across regimes.

What if markets drop right after I adjust my allocation? Stay with your rules and redirect contributions toward underweight assets automatically. Consequently, you buy at better prices while emotions cool and conditions stabilize.

Can I use a single target date index fund instead? Yes, provided the fund’s glide path matches your preferred stock to bond mix.

However, confirm fees remain low and underlying indexes stay broad and diversified.

How much cash should retirees hold for near term spending needs? Many retirees hold two years of withdrawals across cash and short treasuries. Additionally, they refill the bucket during recoveries rather than during drawdowns.

Should I add real estate or commodities for extra diversification today? Small slices can help, yet they should not crowd out core holdings. Therefore, keep alternatives modest unless your plan and behavior remain exceptionally strong.

Video Recommendation 🎥

For a friendly walkthrough, watch my Successful Tradings video on passive allocation. It explains stock and bond mixes, rebalancing bands, and behavioral guardrails clearly.

Moreover, the examples match this 2026 framework so you can follow easily. Here is the link to the channel: https://www.youtube.com/@SuccessfulTradings . Search for my comparison explaining index funds versus ETFs for beginners precisely.

Therefore, you will see implementation steps that translate directly into brokerage actions.

Conclusion

I have seen investors overcomplicate allocation and then freeze during volatility.

However, a simple age based glide path keeps risk and behavior aligned. Therefore, choose a mix, automate contributions, and rebalance with written rules.

Additionally, keep fees tiny and diversify globally so leadership rotation never surprises.

Finally, review annually, adjust slowly, and protect your lifestyle with a cash buffer. With patience and process, your portfolio can support goals through changing conditions.

👉 Next Step 1: How to Mitigate Passive Investing Risks

👉 Next Step 2: Passive Investing for Retirement

Hold a Master Degree in Electrical engineering from Texas A&M University.

African born – French Raised and US matured who speak 5 languages.

Active Stock Options Trader and Coach since 2014.

Most Swing Trade weekly Options and Specialize in 10-Baggers !

YouTube Channel: https://www.youtube.com/c/SuccessfulTradings

Other Website: https://237answersblog.com/