I began trading in 2015 and started coaching in 2019. Trading stocks at 52-week highs challenges conventional wisdom but offers significant profit opportunities. However, momentum strategies require precise execution and disciplined risk management. Therefore, this guide helps you capitalize on breakout momentum while avoiding costly mistakes.

👉 In this guide, you will learn:

- 🚀 Why 52-week highs often signal continued strength rather than tops

- 📊 Technical analysis indicators that confirm breakout validity

- 💰 Position sizing strategies that maximize gains while limiting losses

- 🎯 Entry and exit timing techniques for momentum trades

- ⚠️ Risk management rules that prevent catastrophic losses

- 📈 How to distinguish between false breakouts and genuine momentum

- 🔍 Market conditions that favor 52-week high trading strategies

Trading stocks at 52-week highs contradicts the natural human instinct to buy low and sell high. Unfortunately, this instinct often leads to buying declining stocks while missing explosive moves. Additionally, momentum trading requires overcoming psychological barriers that stop most traders from succeeding.

Table of Contents

The Psychology Behind 52-Week High Trading 🧠

Human psychology creates natural resistance to buying stocks at new highs. Furthermore, most traders feel more comfortable purchasing “discounted” stocks near lows. However, institutional money and smart investors often drive stocks to new highs for fundamental reasons.

Why 52-week highs attract professional interest:

- 📈 Strong fundamentals justify premium valuations over time

- 🏢 Institutional buying creates sustained upward pressure consistently

- 📊 Technical breakouts attract algorithmic trading systems automatically

- 💰 Momentum strategies have proven track records across market cycles

- 🎯 New highs eliminate overhead resistance from previous holders

Conversely, amateur traders typically exhibit counterproductive behaviors around new highs. Meanwhile, fear of buying “expensive” stocks keeps them out of the strongest performers. Moreover, they often wait for pullbacks that never come in trending markets.

Common psychological mistakes at 52-week highs:

- 😰 Assuming stocks are “too expensive” at new highs

- ⏰ Waiting for pullbacks in strongly trending stocks

- 📉 Shorting stocks simply because they seem “overvalued”

- 🎭 Fighting the trend instead of following institutional money

- 💸 Using oversized positions due to fear of missing out

Successful momentum traders recognize that prices often reach new highs for valid reasons. Therefore, they follow institutional money flows rather than fighting them. Additionally, they understand that trends persist longer than most people expect.

Technical Analysis for 52-Week High Breakouts 📊

Technical analysis provides objective criteria for evaluating 52-week high breakouts. Furthermore, specific indicators help distinguish between false breakouts and genuine momentum moves. Additionally, volume analysis confirms the strength of institutional participation.

Volume Confirmation Signals

Volume serves as the most important confirmation for 52-week high breakouts. Moreover, genuine breakouts typically show volume expansion compared to recent averages. Furthermore, sustained volume above normal levels indicates continued institutional interest.

Volume analysis criteria for valid breakouts:

- 📊 Volume at least 1.5x the 20-day average on breakout day

- 📊 Sustained above-average volume for multiple days following breakout

- 📊 Volume expansion during any pullbacks to breakout level

- 📊 Institutional-sized trades visible on level 2 data

- 📊 Volume leading price on initial breakout attempts

However, false breakouts often occur on light volume or retail-driven moves. Therefore, volume analysis helps filter out low-probability setups. Additionally, watch for volume spikes that accompany fundamental news or earnings releases.

Support and Resistance Analysis

Previous resistance levels become support once successfully broken. Furthermore, the 52-week high level should hold as support on any retest. Additionally, multiple timeframe analysis confirms breakout validity across different perspectives.

Key support/resistance considerations:

- 🎯 Clean breakout above previous 52-week high with volume

- 🎯 Successful retest of breakout level as new support

- 🎯 Weekly and monthly charts confirming upward trend structure

- 🎯 Absence of major overhead resistance from prior distribution

- 🎯 Multiple failed attempts to break resistance before success

Strong stocks often break to new highs without significant retest. Meanwhile, weaker momentum may require retesting the breakout level for support. Moreover, failed retests suggest the breakout lacks conviction.

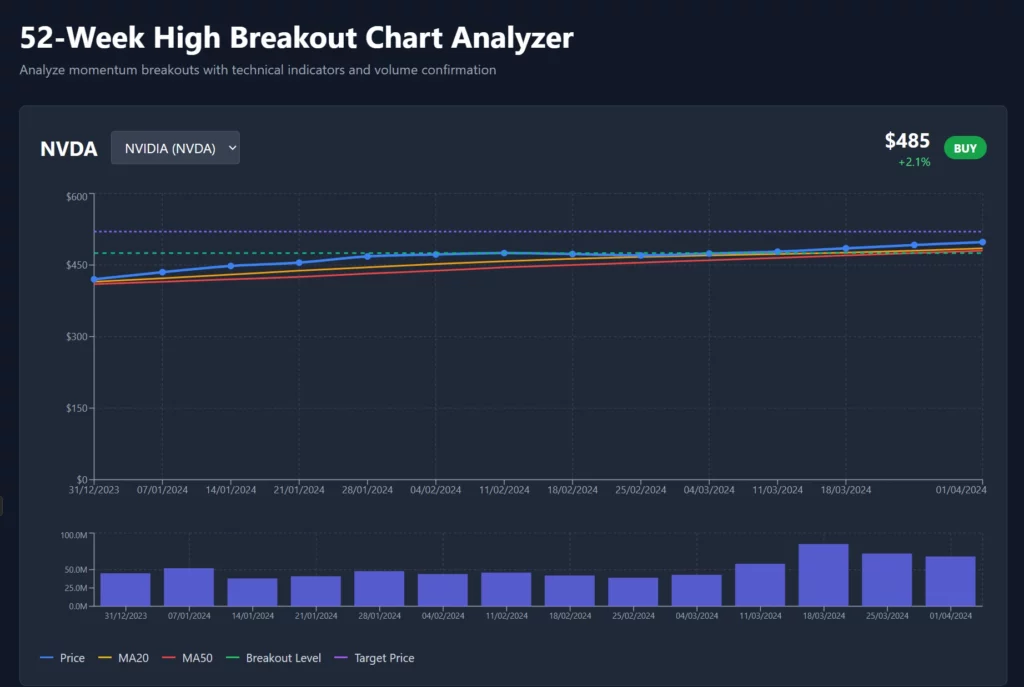

Moving Average Alignment

Moving average structure provides context for 52-week high breakouts. Therefore, all major moving averages should trend upward with proper alignment. Furthermore, price should remain above key moving averages throughout the momentum move.

Optimal moving average setup:

- 📈 20-day > 50-day > 100-day > 200-day moving averages

- 📈 Price trading above all major moving averages consistently

- 📈 Moving averages trending upward with expanding gaps

- 📈 Pullbacks finding support at key moving average levels

- 📈 Volume increasing on bounces from moving average support

Conflicting moving average signals suggest caution around breakouts. Additionally, stocks below major moving averages face headwinds from overhead resistance.

Market Conditions That Favor Momentum Trading 🌟

Market environment significantly impacts 52-week high breakout success rates. Therefore, understanding favorable conditions improves strategy effectiveness. Furthermore, adapting position sizes based on market conditions optimizes risk-adjusted returns.

Bull Market Characteristics

Strong bull markets provide the best environment for momentum trading strategies. Moreover, rising tide lifts most stocks while sector rotation creates continuous opportunities. Additionally, institutional money flows favor growth and momentum during bull markets.

Optimal bull market conditions:

- 📈 Major indices making consistent new highs with volume

- 📈 Sector rotation keeping momentum alive across different areas

- 📈 Low volatility (VIX below 20) encouraging risk-taking

- 📈 Strong economic data supporting growth narratives

- 📈 Federal Reserve policy supporting market liquidity

Bear markets and high volatility periods reduce momentum strategy effectiveness. Therefore, defensive positioning becomes more appropriate during uncertain conditions. Additionally, shorter holding periods may prove necessary in volatile environments.

Sector Leadership Analysis

Individual sectors exhibit varying momentum characteristics throughout market cycles. Furthermore, identifying leading sectors improves stock selection within those areas. Additionally, sector rotation patterns create predictable momentum opportunities.

Strong sector characteristics for momentum trading:

- 🎯 Sector ETF making new highs with increasing volume

- 🎯 Multiple stocks within sector breaking to new highs

- 🎯 Fundamental catalysts supporting sector growth themes

- 🎯 Institutional money flows favoring specific sectors

- 🎯 Technical breakouts across multiple timeframes

Avoid momentum trades in lagging sectors without catalysts. Moreover, sectors facing regulatory headwinds rarely sustain momentum moves. Additionally, crowded sectors may face sudden reversals from profit-taking.

Position Sizing and Risk Management 💼

Proper position sizing separates successful momentum traders from those who blow up accounts. Furthermore, 52-week high trading requires smaller initial positions due to increased volatility. Additionally, scaling techniques allow participation while limiting downside risk.

The 1% Risk Rule

Never risk more than 1% of account equity on any single momentum trade. Moreover, position size should be calculated based on stop-loss distance rather than dollar amount. Furthermore, this rule prevents any single trade from causing significant account damage.

Position sizing calculation example:

- 💰 $100,000 account = $1,000 maximum risk per trade

- 💰 Stock at $100 with $95 stop = $5 risk per share

- 💰 Maximum position size = $1,000 ÷ $5 = 200 shares

- 💰 Total position value = 200 × $100 = $20,000 (20% of account)

However, most traders use excessive position sizes when buying momentum stocks. Therefore, discipline around position sizing becomes crucial for long-term success. Additionally, smaller positions allow for averaging up into strength.

Stop-Loss Placement Strategies

Stop-loss orders protect capital when momentum fails to materialize. Furthermore, initial stops should be placed below key technical levels. Additionally, trailing stops allow profits to run while protecting gains.

Effective stop-loss techniques:

- 🛡️ Initial stop below breakout level or recent swing low

- 🛡️ Trailing stop below most recent swing low as stock advances

- 🛡️ Volume-based stops when selling pressure overwhelms buying

- 🛡️ Time-based stops if momentum fails to develop quickly

- 🛡️ Fundamental stops if business conditions deteriorate

Never move stops against your position to avoid losses. Moreover, honor your stops even when convinced the stock will recover. Additionally, consistent stop discipline builds long-term trading success.

Scaling and Pyramiding Techniques

Adding to winning positions amplifies gains from successful momentum trades. However, scaling requires careful position management and risk control. Furthermore, each additional purchase should have its own stop-loss level.

Smart scaling approaches:

- 📈 Add 25-50% to position after stock advances 5-10%

- 📈 Each addition gets progressively smaller position size

- 📈 Trail stops higher with each successful addition

- 📈 Stop adding if stock shows signs of momentum exhaustion

- 📈 Take partial profits to reduce overall position risk

Avoid averaging down into failing momentum trades. Moreover, never add to positions that have triggered stop-losses. Additionally, limit total position size across all additions to reasonable percentage.

Entry Timing and Execution Strategies ⏰

Precise entry timing significantly impacts momentum trade profitability. Therefore, waiting for optimal entry points improves risk-reward ratios. Furthermore, understanding different entry techniques provides flexibility for various market conditions.

Breakout Entry Methods

Direct breakout entries offer the best risk-reward when executed properly. Moreover, early entry captures maximum momentum while limiting downside risk. Additionally, volume confirmation validates breakout authenticity.

Primary breakout entry techniques:

- 🚀 Buy immediately on breakout above 52-week high with volume

- 🚀 Use limit orders slightly above resistance to ensure fills

- 🚀 Enter partial position on breakout, add on confirmation

- 🚀 Wait for first pullback to breakout level for better entry

- 🚀 Use options strategies to limit capital requirements

Market orders ensure execution but may result in poor fills during volatile breakouts. Therefore, limit orders slightly above resistance provide better price control. Additionally, partial entries allow testing momentum before committing full position.

Pullback Entry Strategies

Waiting for pullbacks provides better entry prices but risks missing explosive moves. However, many strong stocks offer pullback opportunities after initial breakouts. Furthermore, pullbacks test breakout levels and provide lower-risk entries.

Pullback entry criteria:

- 📉 Stock pulls back to breakout level on declining volume

- 📉 Pullback holds above previous resistance (now support)

- 📉 Volume expands as stock bounces from support test

- 📉 Moving averages provide additional support confluence

- 📉 Pullback occurs within 1-2 weeks of initial breakout

Failed pullbacks that break below support invalidate the setup. Therefore, stops should be placed below the pullback low. Additionally, extended pullbacks suggest weakening momentum.

Exit Strategies and Profit-Taking 🎯

Determining exit points separates good momentum trades from great ones. Furthermore, most traders hold too long and give back substantial profits. Additionally, systematic profit-taking removes emotion from exit decisions.

Target-Based Exits

Price targets provide objective exit criteria based on technical analysis. Moreover, measured moves from breakout patterns offer realistic profit expectations. Furthermore, resistance levels from higher timeframes suggest natural exit points.

Target calculation methods:

- 🎯 Measure previous trading range and project from breakout

- 🎯 Use Fibonacci extensions from swing low to breakout high

- 🎯 Identify next major resistance level from weekly/monthly charts

- 🎯 Calculate average true range multiplied by expected move

- 🎯 Use sector comparisons to estimate relative strength potential

However, strong momentum may exceed conservative targets significantly. Therefore, trailing stops allow participation in extended moves. Additionally, taking partial profits at targets while holding core position optimizes returns.

Momentum Exhaustion Signals

Technical indicators help identify when momentum begins weakening. Furthermore, volume characteristics change as smart money begins distributing. Additionally, price action provides early warning signs of trend reversal.

Momentum exhaustion warning signs:

- ⚠️ Volume declining while price continues higher (divergence)

- ⚠️ Gaps becoming smaller or failing to hold gains

- ⚠️ Increased volatility with larger intraday ranges

- ⚠️ Failed attempts to make new highs on multiple tries

- ⚠️ Distribution patterns forming on higher timeframes

Early recognition of exhaustion signals protects profits from major reversals. Moreover, partial profit-taking during distribution phases preserves gains. Additionally, tightening stops becomes appropriate as momentum weakens.

Common Mistakes in 52-Week High Trading 🚨

Understanding typical mistakes helps traders avoid costly errors. Furthermore, these mistakes often result from emotional decision-making rather than systematic approaches. Therefore, recognizing these patterns improves overall trading performance.

Chasing Extended Moves

FOMO drives traders to chase stocks already extended from breakout levels. However, late entries significantly worsen risk-reward ratios. Moreover, extended moves often coincide with momentum exhaustion phases.

Signs of extended moves to avoid:

- 📈 Stock up 20%+ from breakout level without pullback

- 📈 Multiple gaps higher in succession without consolidation

- 📈 Heavy media coverage and retail investor enthusiasm

- 📈 Options premiums extremely elevated from volatility

- 📈 Social media buzz and widespread recommendation

Wait for pullbacks or find earlier-stage opportunities instead. Additionally, patience prevents overcommitting to poor risk-reward setups. Moreover, better opportunities constantly emerge in dynamic markets.

Ignoring Market Context

Individual stock momentum requires supportive market conditions for sustainability. However, many traders ignore broader market context when evaluating setups. Furthermore, fighting overall market direction reduces success rates significantly.

Market context considerations:

- 📊 Overall market trend and momentum

- 📊 Sector rotation and leadership patterns

- 📊 Volatility levels and institutional behavior

- 📊 Economic data and Federal Reserve policy

- 📊 Geopolitical events affecting risk sentiment

Strong stocks may buck weak market trends temporarily. Nevertheless, sustained momentum typically requires supportive market environment. Additionally, defensive positioning becomes appropriate during market weakness.

Inadequate Risk Management

Excitement around momentum trades often leads to oversized positions. However, 52-week high trading carries inherent volatility risks. Therefore, strict risk management becomes even more critical.

Risk management failures:

- 💸 Position sizes exceeding account risk tolerance

- 💸 Failure to use stop-losses or moving them against position

- 💸 Adding to losing positions hoping for recovery

- 💸 Concentrating too much capital in momentum trades

- 💸 Ignoring correlation risks across similar positions

Consistent application of risk rules prevents account destruction. Moreover, smaller profits with preserved capital beat large losses. Additionally, disciplined risk management enables long-term trading success.

Advanced 52-Week High Trading Strategies 🔬

Experienced traders can employ sophisticated techniques to enhance momentum trading results.

Furthermore, these strategies require deeper market understanding and execution skills.

Additionally, advanced approaches often involve derivatives and complex position structures.

Options Strategies for Momentum Trading

Options provide leveraged exposure to momentum moves while limiting capital requirements. However, time decay and volatility changes affect options differently than stock positions. Therefore, understanding options Greeks becomes essential for success.

Effective options strategies for momentum:

- 📈 Long calls for leveraged upside exposure with limited risk

- 📈 Call spreads to reduce premium costs while maintaining upside

- 📈 Protective puts on stock positions for downside protection

- 📈 Covered calls on stock positions for additional income

- 📈 Straddles/strangles for volatility expansion plays

Options require more sophisticated risk management than stock trades. Moreover, implied volatility levels significantly impact strategy profitability. Additionally, options provide flexibility for various market scenarios.

Swing Trading vs. Day Trading Approaches

Timeframe selection affects strategy implementation and profit potential. Furthermore, different approaches suit different trader personalities and lifestyles. Additionally, market conditions may favor certain timeframes over others.

Swing trading advantages:

- ⏰ Captures larger moves over days to weeks

- ⏰ Less intensive monitoring requirements

- ⏰ Better for those with full-time jobs

- ⏰ Allows overnight gap potential

- ⏰ Reduces transaction costs from frequent trading

Day trading momentum advantages:

- ⚡ Eliminates overnight risk from news events

- ⚡ Captures intraday momentum bursts

- ⚡ Allows multiple opportunities per day

- ⚡ Provides faster feedback on strategy effectiveness

- ⚡ Enables quick adaptation to changing conditions

Choose timeframes matching your available time and risk tolerance. Moreover, consistency within chosen timeframes improves strategy effectiveness. Additionally, some traders successfully combine both approaches.

Market Scanning and Stock Selection 🔍

Identifying quality 52-week high candidates requires systematic screening processes. Furthermore, automation helps scan thousands of stocks efficiently. Additionally, fundamental filters improve technical setups’ probability of success.

Technical Screening Criteria

Automated scans can identify potential momentum candidates based on technical criteria. However, manual review remains necessary to evaluate setup quality. Furthermore, combining multiple filters improves signal reliability.

Essential technical scan criteria:

- 📊 Stock making new 52-week high within last 5 days

- 📊 Volume above 20-day average on breakout day

- 📊 Stock above all major moving averages

- 📊 Relative strength index between 50-80 (not overbought)

- 📊 Average daily volume above $10 million for liquidity

Additional qualitative factors require manual review. Watch me demonstrate this search criteria on Finviz in the video below.

Therefore, automated scans provide starting points rather than final decisions. Moreover, market context influences scan interpretation.

Fundamental Considerations

Strong fundamental catalysts support sustained momentum moves. Furthermore, earnings growth and revenue expansion justify premium valuations. Additionally, fundamental analysis helps distinguish between speculation and legitimate opportunities.

Fundamental factors favoring momentum:

- 💰 Accelerating earnings and revenue growth trends

- 💰 Strong balance sheet supporting growth investments

- 💰 Market share gains in expanding industries

- 💰 New products or services driving growth

- 💰 Positive analyst revisions and guidance raises

However, fundamental analysis should supplement rather than replace technical signals. Moreover, markets often anticipate fundamental changes before they become obvious. Additionally, technical momentum may persist despite fundamental concerns.

Building a 52-Week High Trading System 🔧

Systematic approaches remove emotion and improve consistency in momentum trading. Furthermore, documented rules provide objective criteria for all trading decisions. Additionally, backtesting validates strategy effectiveness across different market conditions.

Entry Rules and Criteria

Clear entry rules eliminate discretionary decision-making during market hours. Moreover, systematic approaches enable consistent execution regardless of emotional state. Furthermore, documented criteria allow strategy refinement over time.

Sample entry rule framework:

- 🎯 Stock breaks above 52-week high on volume 1.5x average

- 🎯 All moving averages trending upward with proper alignment

- 🎯 Market in uptrend with low volatility (VIX < 25)

- 🎯 Sector showing relative strength vs. market

- 🎯 Position size calculated for 1% account risk

Additional filters may improve setup quality but reduce opportunity frequency. Therefore, balance between signal quality and quantity based on strategy goals. Moreover, paper trading validates rule effectiveness before risking capital.

Exit Rules and Management

Systematic exit rules protect profits and limit losses consistently. Furthermore, predetermined criteria remove emotion from profit-taking decisions. Additionally, multiple exit strategies handle different market scenarios.

Comprehensive exit rule structure:

- 🛡️ Initial stop-loss 2-3% below breakout level

- 🛡️ Trail stop to breakout level after 10% gain

- 🛡️ Take 25% profit at 15% gain from entry

- 🛡️ Trail remaining position with 8% stop from highs

- 🛡️ Exit all on momentum exhaustion signals

Consistent rule application prevents emotional override during stressful market periods. Moreover, documented rules enable strategy evaluation and improvement. Additionally, systematic approaches build trading confidence over time.

FAQs 🤔

Q: Isn’t buying at 52-week highs just buying overpriced stocks? A: Stocks often reach new highs because they deserve higher valuations. Strong fundamentals, institutional buying, and momentum can drive continued appreciation. Price alone doesn’t determine value.

Q: How do I know if a breakout is real or false? A: Volume confirmation, proper retest of breakout level, and sustained price action above resistance suggest genuine breakouts. False breakouts typically show weak volume and quick reversals.

Q: What’s the biggest risk in momentum trading? A: Sudden momentum reversals can cause rapid losses. Proper position sizing, stop-losses, and profit-taking rules manage this risk effectively.

Q: Should I use market or limit orders for breakout entries? A: Limit orders slightly above resistance provide better price control while ensuring execution. Market orders during volatile breakouts may result in poor fills.

Q: How long should I hold momentum positions? A: Hold until momentum shows signs of exhaustion or technical support breaks. This could be days to weeks depending on the stock and market conditions.

Q: Can I trade momentum in bear markets? A: Momentum strategies work best in bull markets. Bear markets require more selective approaches, shorter holding periods, and defensive position sizing.

Q: What indicators work best for momentum trading? A: Volume, moving averages, and relative strength indicators provide the most reliable signals. Avoid overcomplicating with too many indicators.

Q: How many momentum positions should I hold simultaneously? A: Limit to 3-5 positions to ensure proper monitoring and risk management. Diversify across different sectors when possible.

Conclusion

Trading stocks at 52-week highs requires overcoming natural psychological biases against buying strength. However, momentum strategies capitalize on institutional money flows and fundamental improvements that drive continued appreciation.

Success demands systematic approaches with strict risk management and profit-taking rules. Furthermore, understanding stock market context and technical confirmation signals improves setup selection significantly.

Patience and discipline separate successful momentum traders from those who chase extended moves or ignore risk management. Finally, continuous learning and strategy refinement enable adaptation to changing market conditions.

Hold a Master Degree in Electrical engineering from Texas A&M University.

African born – French Raised and US matured who speak 5 languages.

Active Stock Options Trader and Coach since 2014.

Most Swing Trade weekly Options and Specialize in 10-Baggers !

YouTube Channel: https://www.youtube.com/c/SuccessfulTradings

Other Website: https://237answersblog.com/