I began trading in 2015 and started coaching in 2019. Side hustles changed my investment game completely. Moreover, extra income creates unique opportunities that regular paychecks cannot match. Therefore, this guide shows you how to turn side hustle earnings into serious wealth.

👉 In this guide, you will learn:

- 💡 Why side hustle money beats regular income for investing

- 📊 How to automate your extra earnings into growth investments

- 🎯 Which investment strategies work best for irregular income

- 🔄 How to scale your side hustle profits into passive income

- 🚀 Smart tax moves that maximize your side income investing

- 📈 Portfolio allocation strategies specifically for extra earnings

- 💎 Advanced techniques to compound your side hustle wealth

Side hustle income offers investment advantages that most people miss. Consequently, I created this strategy to help you maximize every extra dollar. Additionally, the right approach can accelerate your wealth building by years.

Table of Contents

Why Side Hustle Money Is Investment Gold 🥇

Side income creates unique investment opportunities that regular salaries cannot provide. First, extra earnings feel less essential than your main paycheck. Furthermore, this psychological difference enables higher-risk, higher-reward strategies. Meanwhile, side hustle money often comes in irregular chunks perfect for specific investments.

Key advantages that boost wealth building:

- 💰 Extra income feels more disposable than salary money

- 🎲 Enables aggressive growth strategies without lifestyle risk

- 📅 Irregular timing perfect for dollar-cost averaging into markets

- 🧠 Creates investment experimentation without fear

- 🔄 Compounds faster due to immediate reinvestment potential

Successful side hustlers understand this money differently than their main income. Therefore, they invest it more aggressively and strategically. Consequently, their wealth grows faster than traditional savers.

The Side Hustle Investment Hierarchy 📈

Not all side hustle income should follow the same investment path. Instead, create a hierarchy based on your specific situation. Moreover, this approach maximizes both safety and growth potential systematically.

Level 1: Foundation Building (First $5,000)

Emergency fund completion takes priority over everything else. However, side hustle money can accelerate this process dramatically. Meanwhile, you avoid the temptation to spend extra earnings frivolously.

Foundation Strategy:

- 🏦 Complete 3-6 month emergency fund first

- 🏦 High-yield savings account for immediate access

- 🏦 Money market funds for slightly higher returns

- 🏦 Short-term CDs for guaranteed growth

Level 2: Tax-Advantaged Acceleration ($5,000-$15,000)

Side income can supercharge retirement contributions beyond your regular limits. Furthermore, irregular earnings often allow larger contributions during good months. Additionally, tax benefits multiply your investment power immediately.

Acceleration Strategy:

- 🎯 Max out Roth IRA contributions ($7,000 annually)

- 🎯 Increase 401k contributions if you have regular employment

- 🎯 Solo 401k setup if side hustle becomes significant business

- 🎯 HSA maxing for triple tax advantage when available

Level 3: Growth Acceleration ($15,000+)

Extra income beyond retirement maximums creates serious wealth building opportunities. Moreover, this money can pursue aggressive growth strategies safely. Consequently, your side hustle becomes a wealth multiplication engine.

Growth Strategy:

- 📊 Aggressive growth stock funds and ETFs

- 📊 Individual growth stocks for higher potential returns

- 📊 International and emerging market exposure

- 📊 Alternative investments and REITs for diversification

Automating Your Side Hustle Investments 🤖

Manual investing often fails with irregular income streams. Instead, automation ensures consistent investment regardless of earnings fluctuations. In addition, systematic approaches remove emotional decision-making from the process.

The 50/30/20 Side Hustle Rule

Rather than complex calculations, use this simple allocation system:

50% Immediate Investment Direct half of every side hustle payment into investments immediately. What’s more, this prevents lifestyle inflation from absorbing your extra earnings. Plus, immediate investment captures market timing benefits automatically.

30% Business Growth Reinvest nearly one-third back into expanding your side hustle. Similarly, growing your income source multiplies future investment contributions exponentially. Meanwhile, business reinvestment often provides tax deductions.

20% Flexibility Fund Keep one-fifth for irregular expenses and opportunities. However, invest this portion if unused after 90 days. As a result, you maintain liquidity while maximizing growth potential.

Automation Tools That Actually Work 📱

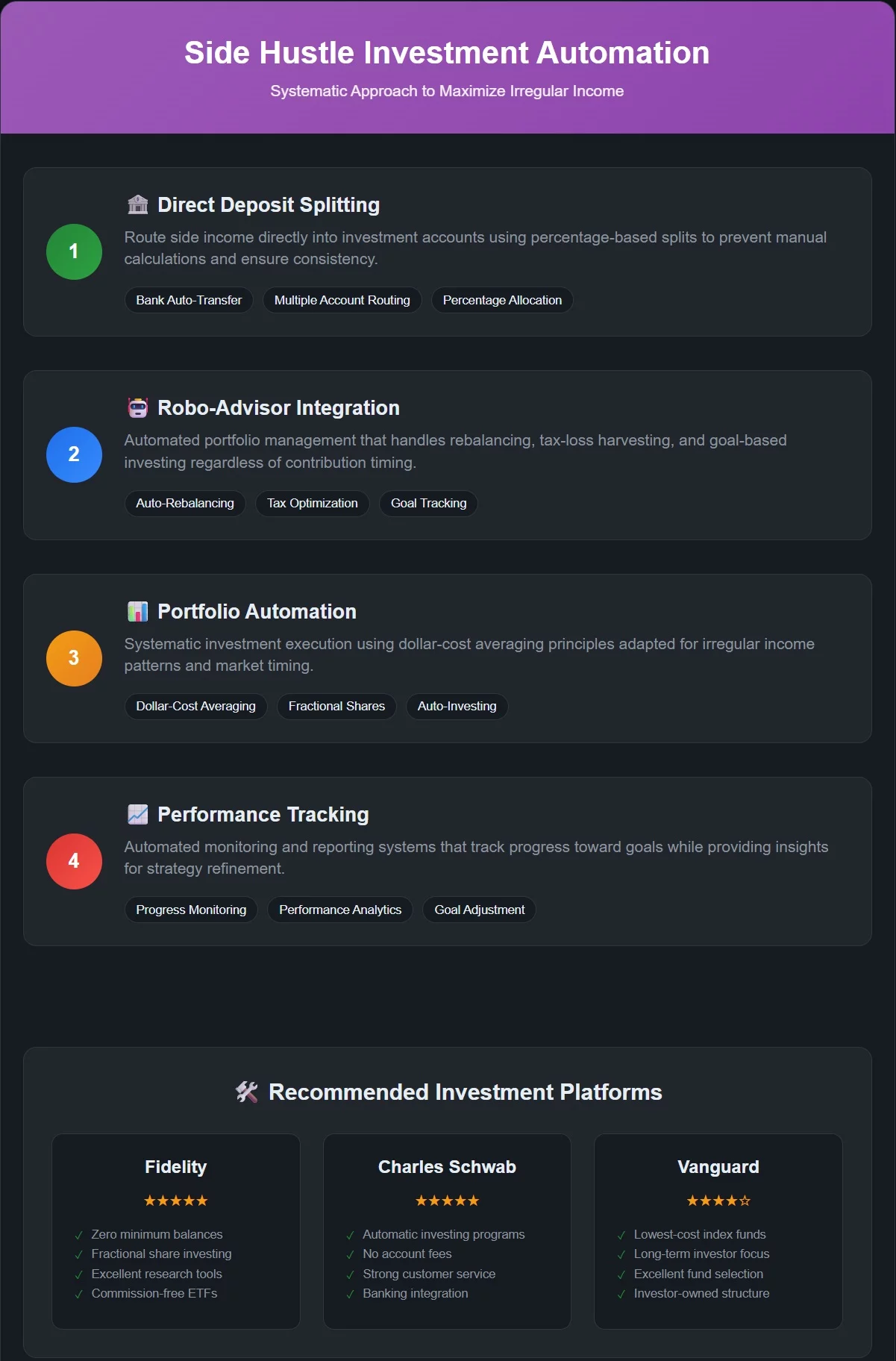

Technology makes side hustle investing effortless when configured correctly. Moreover, the right tools eliminate manual tracking and decision fatigue. Therefore, your investment strategy runs itself successfully.

Direct Deposit Splitting:

- 💳 Route side income directly into investment accounts

- 💳 Percentage-based splits prevent manual calculations

- 💳 Multiple account routing for diversified investing

- 💳 Automatic emergency fund contributions first

Robo-Advisor Integration:

- 🤖 Automated portfolio rebalancing regardless of contribution timing

- 🤖 Tax-loss harvesting for irregular income patterns

- 🤖 Goal-based investing aligned with side hustle objectives

- 🤖 Low-cost management for smaller account balances

Side Hustle Investment Strategies by Income Level 💡

Different side income levels require different investment approaches. Moreover, your strategy should evolve as earnings grow. Therefore, understanding these levels helps optimize your wealth building.

Starter Level: $500-$2,000 Monthly 🌱

New side hustlers need simple, flexible strategies that accommodate learning curves. Furthermore, basic approaches build confidence while generating meaningful returns. Meanwhile, complexity can overwhelm beginners and reduce consistency.

Simple Growth Strategy:

- 📈 Total stock market index funds for broad exposure

- 📈 Target-date funds for automatic adjustment

- 📈 S&P 500 ETFs for reliable growth

- 📈 International index funds for diversification

Implementation Tips:

- Start with one low-cost index fund

- Add international exposure after $5,000 invested

- Use fractional shares for immediate investing

- Increase complexity gradually as knowledge grows

Intermediate Level: $2,000-$5,000 Monthly 🚀

Substantial side income enables more sophisticated strategies and tax optimization. Moreover, larger amounts justify additional complexity and research time. Consequently, returns can accelerate significantly with proper management.

Enhanced Growth Strategy:

- 📊 Growth-focused ETF portfolio across sectors

- 📊 Individual stock positions in companies you understand

- 📊 REIT investments for income diversification

- 📊 Emerging markets for higher growth potential

Tax Optimization Focus:

- 🧾 Maximize tax-advantaged account contributions

- 🧾 Tax-loss harvesting in taxable accounts

- 🧾 Strategic Roth conversions during low-income years

- 🧾 Business expense deductions to reduce taxable income

Advanced Level: $5,000+ Monthly 💎

High side income creates opportunities for sophisticated wealth building strategies. Furthermore, substantial amounts justify professional guidance and complex structures. Additionally, tax planning becomes critically important at this level.

Advanced Growth Strategy:

- 🎯 Concentrated positions in high-conviction stocks

- 🎯 Options strategies for income enhancement

- 🎯 Alternative investments including private REITs

- 🎯 Cryptocurrency allocation for growth potential

Wealth Preservation Elements:

- 🛡️ Diversification across asset classes and geographies

- 🛡️ Estate planning considerations for growing wealth

- 🛡️ Asset protection strategies for high earners

- 🛡️ Professional tax and investment management

Tax-Smart Side Hustle Investing 🧾

Side income creates unique tax situations that require specific strategies. Moreover, irregular earnings often provide tax optimization opportunities. Therefore, understanding these nuances can save thousands annually.

Business Structure Benefits

Treating your side hustle as a business unlocks significant tax advantages. Furthermore, business expenses reduce your taxable income substantially. Meanwhile, business structures enable retirement account contributions beyond employee limits.

Solo 401k Advantages:

- 🏢 Contribute up to $70,000 annually in 2025

- 🏢 Employee and employer contribution limits

- 🏢 Higher limits than traditional IRAs

- 🏢 Loan options for liquidity needs

Business Expense Deductions:

- 💰 Home office expenses reduce taxable income

- 💰 Equipment purchases for side hustle activities

- 💰 Marketing and advertising costs

- 💰 Professional development and education expenses

Timing Income and Deductions

Irregular side income allows strategic timing of taxes. Moreover, you can shift income between years to optimize brackets. Additionally, expense timing can maximize deduction benefits.

Income Timing Strategies:

- 📅 Delay December payments to following year

- 📅 Accelerate January income to current year

- 📅 Batch large projects in low-income years

- 📅 Spread bonuses across tax years

Deduction Timing Strategies:

- 📅 Purchase equipment before year-end

- 📅 Prepay business expenses in high-income years

- 📅 Time professional development strategically

- 📅 Maximize retirement contributions by deadline

Portfolio Allocation for Side Hustlers 📊

Side hustle investors need different allocation strategies than traditional savers. Moreover, irregular income requires flexibility in investment approaches. Therefore, your portfolio should adapt to earning fluctuations.

The Dynamic Allocation Model

Rather than fixed percentages, use ranges that adjust with income levels. Furthermore, this approach accommodates the natural volatility of side earnings. Meanwhile, you maintain long-term strategic direction.

High Income Months (Above Average):

- 🎯 80% stocks for maximum growth capture

- 🎯 15% bonds for stability and rebalancing

- 🎯 5% alternatives for diversification

Average Income Months (Normal Range):

- 🎯 70% stocks for continued growth

- 🎯 20% bonds for increased stability

- 🎯 10% alternatives including REITs

Low Income Months (Below Average):

- 🎯 60% stocks to reduce volatility

- 🎯 30% bonds for defensive positioning

- 🎯 10% cash for flexibility and opportunities

Rebalancing with Irregular Contributions

Traditional rebalancing assumes regular contributions, but side hustles provide irregular cash flows. Instead, use contribution-based rebalancing that works with your earning patterns. Moreover, this approach can enhance returns while maintaining target allocation.

Contribution Rebalancing Rules:

- 📈 Direct new money to underweight positions

- 📈 Sell only when positions exceed targets by 10%+

- 📈 Use large windfalls for major rebalancing

- 📈 Monthly reviews but quarterly action maximum

Advanced Side Hustle Investment Techniques 🚀

Experienced side hustlers can employ sophisticated strategies that amplify returns. Moreover, these techniques require higher income levels to justify complexity. Therefore, implement gradually as your earnings and knowledge grow.

Options Strategies for Income Enhancement

Side hustle investors can use options to generate additional income from stock holdings. Furthermore, covered calls and cash-secured puts provide monthly income streams. However, these strategies require understanding and appropriate risk management.

Conservative Options Approaches:

- 📈 Covered calls on existing stock positions

- 📈 Cash-secured puts on stocks you want to own

- 📈 Protective puts for downside protection

- 📈 Collar strategies for risk management

Real Estate Investment Scaling

Side income can fund real estate investments that create additional passive income. Moreover, real estate provides inflation protection and tax advantages. Additionally, REITs offer real estate exposure without direct ownership complexities.

Real Estate Investment Ladder:

- 🏠 REIT ETFs for broad real estate exposure

- 🏠 Real estate crowdfunding platforms

- 🏠 Down payment saving for rental property

- 🏠 Direct real estate investment and management

Alternative Investment Access

Higher side income levels enable access to alternative investments typically reserved for wealthy investors. Furthermore, these alternatives can provide diversification and enhanced returns. Meanwhile, minimums become achievable with substantial side earnings.

Alternative Investment Options:

- 💎 Private equity through platforms like EquityZen

- 💎 Hedge fund access via interval funds

- 💎 Commodities through ETFs and futures

- 💎 Cryptocurrency beyond basic Bitcoin and Ethereum

Common Side Hustle Investment Mistakes 🚨

Most side hustlers make predictable mistakes that limit their wealth building potential. Moreover, understanding these pitfalls helps you avoid costly errors. Therefore, learning from others’ mistakes accelerates your success.

Lifestyle Inflation Trap

Extra income often leads to increased spending rather than investment. Furthermore, lifestyle inflation consumes wealth building opportunities permanently. Instead, maintain your baseline lifestyle while investing all additional earnings.

Avoiding Lifestyle Inflation:

- 🛡️ Automate investments before money hits checking accounts

- 🛡️ Set specific savings goals for side income

- 🛡️ Track spending to identify inflation creep

- 🛡️ Celebrate milestones with experiences, not purchases

Timing the Market Fantasy

Irregular income tempts investors to time market entries and exits. However, market timing consistently fails even for professionals. Instead, dollar-cost averaging with irregular contributions provides better long-term results.

Systematic Investing Benefits:

- 📊 Reduces average cost through market fluctuations

- 📊 Eliminates emotional decision-making

- 📊 Provides consistent market participation

- 📊 Simplifies investment process and reduces stress

Over-Diversification Paralysis

Beginning investors often create overly complex portfolios with dozens of holdings. Moreover, excessive diversification reduces returns without significantly lowering risk. Therefore, simple approaches often outperform complex strategies.

Optimal Diversification Guidelines:

- 🎯 3-5 index funds provide adequate diversification

- 🎯 Total market funds eliminate individual stock risk

- 🎯 International exposure reduces geographic concentration

- 🎯 Bond allocation provides stability and rebalancing opportunities

Video Recommendation 🎥

🎬 For practical implementation guidance, watch my Successful Tradings video about systematic wealth building with irregular income streams. The video demonstrates how dollar-cost averaging works with variable contributions. Moreover, it shows real examples of portfolio construction for side hustlers.

Watch it here: https://www.youtube.com/@SuccessfulTradings and search for “Dollar Cost Averaging with Irregular Income.”

You will learn specific techniques that transform side hustle earnings into substantial long-term wealth.

FAQs 🤔

How much of my side hustle income should I invest? Invest at least 50% of side income after emergency fund completion. Treat side money differently than salary income for better growth.

Should I pay off debt or invest side hustle money? Pay off high-interest debt (above 6%) before investing. Continue minimum payments while investing if rates are lower.

What’s the minimum amount needed to start investing? Start investing immediately with any amount above $100. Fractional shares eliminate minimum requirements at most brokerages.

How do I handle taxes on side hustle investments? Track all income and investment transactions carefully. Consider quarterly estimated tax payments for substantial earnings.

Should I use robo-advisors or manage investments myself? Robo-advisors work well for beginners wanting automation. Self-directed investing offers more control and potentially lower fees.

How often should I rebalance my portfolio? Rebalance quarterly or when allocations drift more than 5% from targets. Use new contributions for rebalancing before selling positions.

What mistakes do most side hustlers make? Lifestyle inflation and inconsistent investing are the biggest mistakes. Trying to time markets with irregular income often backfires.

Can I use retirement accounts for side hustle income? Yes, side hustle income qualifies for IRA and solo 401k contributions. Business income enables higher contribution limits.

Conclusion

Side hustle income creates unique investment opportunities that traditional salaries cannot match. Therefore, systematic approaches that automate investing maximize wealth building potential. Moreover, treating extra earnings differently enables aggressive growth strategies safely.

Furthermore, successful side hustlers understand that investment hierarchy matters more than perfect timing. Additionally, consistent systems outperform complex strategies that require constant attention.

Finally, your side hustle investments should scale with your income growth automatically. Start simple with index funds and add complexity as earnings increase. This approach transforms extra income into substantial long-term wealth systematically.

Hold a Master Degree in Electrical engineering from Texas A&M University.

African born – French Raised and US matured who speak 5 languages.

Active Stock Options Trader and Coach since 2014.

Most Swing Trade weekly Options and Specialize in 10-Baggers !

YouTube Channel: https://www.youtube.com/c/SuccessfulTradings

Other Website: https://237answersblog.com/