Starting your options trading journey with a small account can feel overwhelming, especially when you see complex strategies everywhere. However, I’ve discovered that debit spreads offer an excellent entry point for new traders working with limited capital. Throughout this comprehensive guide, I’ll walk you through everything you need to know about debit spreads, specifically tailored for beginners managing smaller trading accounts.

Moreover, I’ll share practical insights that I’ve learned from years of trading experience. Consequently, you’ll understand not just the theory, but also the real-world application of these powerful strategies.

Table of Contents

Understanding Debit Spreads: The Foundation for Small Account Success

A debit spread represents one of the most beginner-friendly options strategies available today. Essentially, this strategy involves buying one option while simultaneously selling another option of the same type. Furthermore, both options share the same expiration date but have different strike prices.

The term “debit” comes from the fact that you pay money upfront to establish this position. Additionally, this upfront cost represents your maximum possible loss, which makes risk management much easier for beginners. Therefore, you know exactly how much you’re risking from the moment you enter the trade.

What makes debit spreads particularly attractive for small accounts is their defined risk profile. Subsequently, you can allocate a specific percentage of your account to each trade without worrying about unlimited losses. Meanwhile, the profit potential remains substantial enough to grow your account steadily over time.

Call Debit Spreads vs Put Debit Spreads

Call debit spreads work best when you expect the underlying stock to move higher. Specifically, you buy a lower strike call option while selling a higher strike call option. Conversely, put debit spreads profit when you anticipate downward price movement in the underlying security.

For put debit spreads, you purchase a higher strike put option and sell a lower strike put option. Importantly, both strategies limit your maximum loss to the net premium paid. Nevertheless, they also cap your maximum profit potential, which creates a favorable risk-to-reward ratio.

Step-by-Step Debit Spread Construction

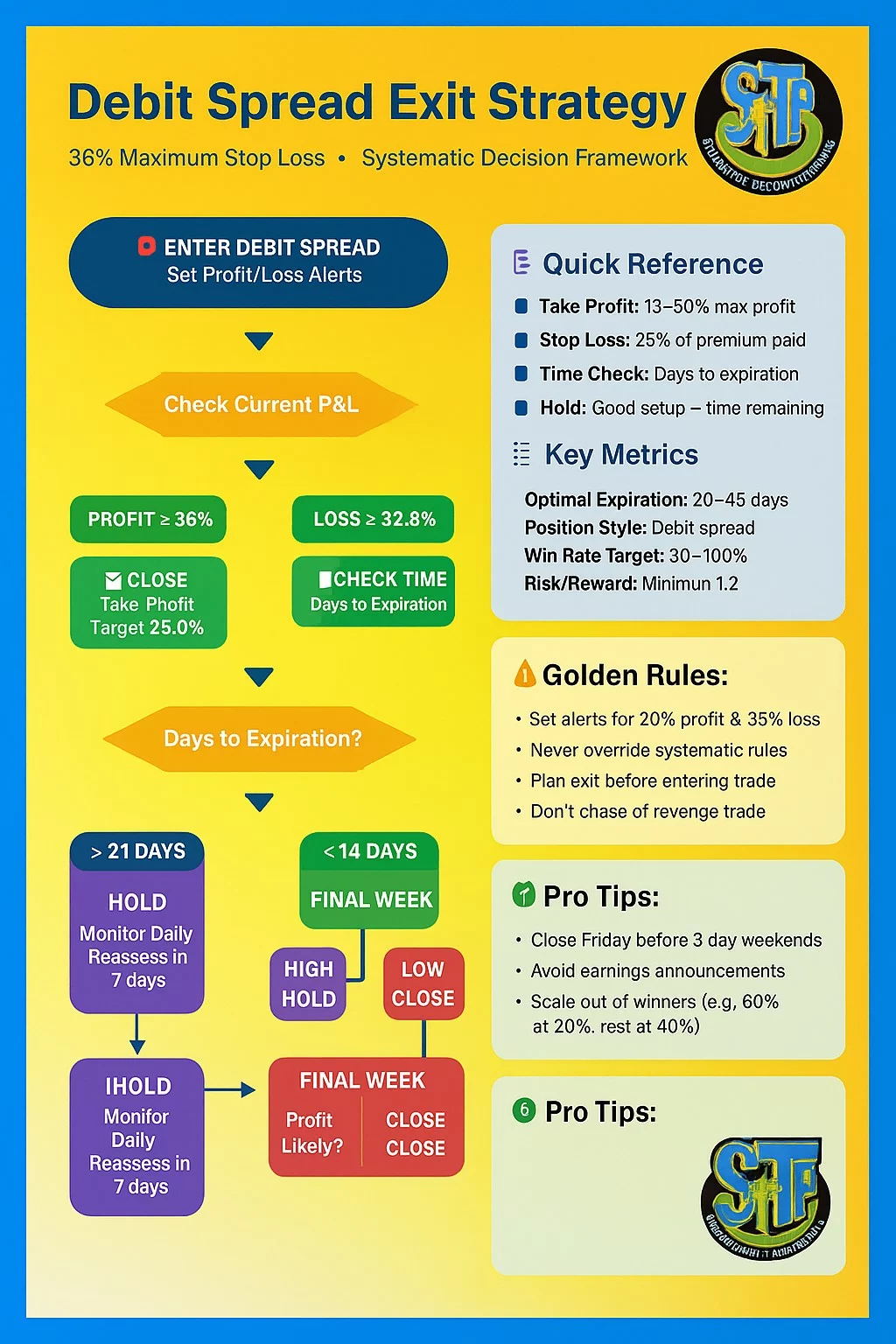

Here is a step by step diagram flow to create a debit spread position I use.

I purposely made it very conservative for profit target just so that you can play with it in paper trading.

After you play with this strategy for a while, you can adjsut your profit target.

My recomemndation is to use scaled exit when your position is winning.

That consists of selling portion of your position at different profit levels.

Here is a step by step Debit Spread Exit strategy i created for you with clear stop loss target.

Why Debit Spreads Excel for Small Trading Accounts

Small trading accounts face unique challenges that debit spreads address effectively.

First, most brokers require significant capital for naked option selling or complex multi-leg strategies.

However, debit spreads typically require much less buying power, making them accessible to smaller accounts.

Additionally, the defined risk nature of debit spreads prevents account-destroying losses that can occur with other strategies. Therefore, you can focus on learning and improving your trading skills without fear of catastrophic losses.

Furthermore, the limited capital requirements allow for proper position sizing even with accounts under $10,000.

Another significant advantage involves the reduced complexity compared to other spread strategies.

Consequently, beginners can master the mechanics quickly and focus on market analysis and timing.

Meanwhile, the profit potential remains attractive enough to generate meaningful returns on small account balances.

Capital Efficiency and Risk Management Benefits

The beauty of debit spreads lies in their capital efficiency for small accounts.

Typically, you can establish meaningful positions with just a few hundred dollars per trade.

Moreover, this allows for proper diversification across multiple positions without overextending your account.

Risk management becomes much simpler when your maximum loss is defined upfront.

Subsequently, you can easily calculate position sizes using percentage-based risk rules. For example, if you risk 2% per trade on a $5,000 account, you can allocate exactly $100 to each debit spread position.

Choosing the Right Strikes and Expirations for Maximum Success

Strike selection significantly impacts the success of your debit spread trades. Generally, I recommend choosing strikes that are close to the current stock price for better probability of profit. Additionally, the spread width determines your maximum profit potential, so consider this carefully when designing your trades.

For call debit spreads, buying slightly out-of-the-money calls often provides the best balance of cost and profit potential. Similarly, put debit spreads work well when you purchase slightly out-of-the-money puts. However, the exact strikes depend on your market outlook and risk tolerance.

Expiration timing plays a crucial role in debit spread success. Typically, I prefer 30 to 45 days until expiration because this timeframe provides sufficient time for the stock to move in your favor. Nevertheless, shorter expirations can work for more aggressive traders willing to accept higher risk.

Liquidity Considerations for Small Account Traders

Liquidity becomes especially important when trading with smaller accounts because wide bid-ask spreads can significantly impact your returns. Therefore, stick to highly liquid stocks and ETFs with tight option spreads. Furthermore, avoid thinly traded options that might be difficult to exit profitably.

Popular ETFs like SPY, QQQ, and IWM typically offer excellent liquidity for debit spread trading. Additionally, large-cap stocks with high option volume provide good opportunities for beginners. Meanwhile, avoid small-cap stocks or recently listed companies until you gain more experience.

📹 Recommended Video

Learn Advanced Debit Spread Techniques

Check out the SuccessfulTradings YouTube channel for detailed video tutorials on options trading strategies.

Their comprehensive approach to explaining complex concepts makes them perfect for beginners looking to master debit spreads with small accounts.

Real-World Examples: Profitable Debit Spread Setups

Let me walk you through a practical call debit spread example using a popular ETF.

Suppose SPY trades at $450, and you expect it to move higher over the next month.

Therefore, you could buy the $452 call and sell the $457 call, both expiring in 35 days.

If the $452 call costs $3.50 and the $457 call costs $1.50, your net debit equals $2.00 per contract.

Consequently, your maximum risk is $200 per spread (since each contract represents 100 shares).

Meanwhile, your maximum profit potential is $300 (the $5 spread width minus the $2 debit).

This setup provides a 1.5:1 reward-to-risk ratio, which becomes profitable if SPY closes above $454 at expiration.

Moreover, you can often close the position for a profit before expiration if the stock moves in your favor quickly.

Additionally, this trade requires only $200 in capital, making it accessible for small accounts.

Put Debit Spread Example for Bearish Scenarios

Put debit spreads work similarly but profit from downward price movement.

For instance, if you expect SPY to decline from $450, you might buy the $448 put and sell the $443 put.

Subsequently, this creates a bearish position that profits when SPY moves below your breakeven point.

The mechanics remain the same: your maximum loss equals the net debit paid, while maximum profit equals the spread width minus the debit. Furthermore, proper position sizing ensures that even if the trade moves against you, the loss won’t significantly impact your account.

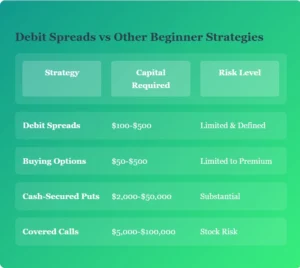

Debit Spreads vs Other Beginner Strategies

Common Mistakes Beginners Make (And How to Avoid Them)

One of the most frequent mistakes I see beginners make involves choosing inappropriate expiration dates. Specifically, many new traders select expirations that are either too short or too long. Consequently, they either don’t give their trades enough time to work or pay excessive time premium for longer-dated options.

Another common error involves poor position sizing relative to account balance. Unfortunately, some traders risk too much on individual trades, which can lead to significant account drawdowns. Therefore, I recommend never risking more than 2-3% of your account on any single debit spread trade.

Additionally, many beginners fail to have a clear exit strategy before entering trades.

Subsequently, they hold losing positions too long or exit winning trades too early.

Furthermore, emotional decision-making often replaces systematic trading rules, leading to inconsistent results over time.

Timing and Entry Point Optimization

Market timing significantly impacts debit spread profitability, especially for small account traders who can’t afford many losing trades.

Generally, I prefer entering call debit spreads during market pullbacks when implied volatility is elevated.

Conversely, put debit spreads work best during market rallies when complacency creates opportunities.

Technical analysis can improve your entry timing considerably when combined with fundamental market awareness.

Moreover, waiting for confirmation signals rather than trying to catch falling knives often leads to better trade outcomes.

Nevertheless, don’t over-analyze to the point of missing good opportunities.

Advanced Tips for Maximizing Small Account Growth

Compounding returns becomes crucial when working with smaller trading accounts because absolute dollar profits start relatively small.

Therefore, reinvesting profits consistently can accelerate account growth significantly over time.

Additionally, maintaining detailed trade records helps identify your most profitable setups and market conditions.

Diversification across different underlying assets and expiration dates helps smooth out returns and reduce overall portfolio volatility.

Furthermore, focusing on high-probability setups with favorable risk-reward ratios leads to more consistent long-term performance than chasing home-run trades.

Consider scaling into larger position sizes only after demonstrating consistent profitability over several months.

Meanwhile, continue learning about market dynamics and options pricing to improve your trade selection and timing.

Subsequently, your growing experience will naturally lead to better trading results.

Tax Considerations for Small Account Traders

Understanding the tax implications of options trading helps optimize your after-tax returns.

Which becomes especially important for smaller accounts.

Generally, short-term capital gains rates apply to most options trades held for less than one year.

Therefore, consider the tax impact when planning your exit strategies and holding periods.

Additionally, proper record-keeping becomes essential for accurate tax reporting and strategy evaluation.

Furthermore, consult with a tax professional who understands options trading.

This should ensure compliance and optimize your tax situation based on your specific circumstances.

Frequently Asked Questions

What’s the minimum account size needed to trade debit spreads effectively?

Most brokers allow debit spread trading with accounts as small as $2,000, though I recommend starting with at least $5,000.

This provides sufficient capital for proper diversification and position sizing while maintaining adequate buying power for multiple trades.

How many debit spreads should I have open simultaneously?

For small accounts, I suggest limiting yourself to 3-5 positions maximum to avoid overconcentration.

Additionally, ensure each position represents no more than 2-3% of your total account value to maintain appropriate risk management.

Should I hold debit spreads until expiration?

Generally, I recommend closing profitable debit spreads when they reach 25-50% of maximum profit rather than holding until expiration.

Such approach reduces risk and frees up capital for new opportunities while maintaining good risk-adjusted returns.

What’s the best time frame for debit spread expirations?

For beginners, 30-45 days until expiration provides the optimal balance between time decay and price movement potential.

Shorter expirations increase risk, while longer expirations cost significantly more premium.

Can I adjust losing debit spreads to reduce losses?

While possible, adjusting debit spreads often increases complexity and risk management for beginners.

Instead, focus on proper initial setup and predetermined exit rules.

Accept small losses as part of the learning process rather than trying to fix every losing trade.

Which underlying assets work best for debit spreads?

Liquid ETFs like SPY, QQQ, and IWM offer excellent opportunities for beginners due to tight bid-ask spreads and predictable behavior.

Large-cap stocks with high options volume also work well, but avoid small-cap or thinly traded securities.

Conclusion: Your Path to Debit Spread Success

Debit spreads offer an excellent starting point for beginners with small trading accounts who want to participate in options trading without excessive risk.

Throughout this comprehensive guide, we’ve explored the fundamental concepts, practical applications, and strategic considerations that can help you succeed with limited capital.

Remember that consistency and proper risk management matter more than hitting home runs when building a small account.

Therefore, focus on high-probability setups with favorable risk-reward ratios rather than chasing dramatic profits.

Additionally, continue learning and refining your approach as you gain experience and confidence.

The key to long-term success lies in treating trading as a business with systematic rules and disciplined execution.

Moreover, maintain realistic expectations while remaining committed to continuous improvement and learning.

Subsequently, your small account can grow steadily over time through the careful application of debit spread strategies.

Start small, trade consistently, and let the power of compounding work in your favor.

With patience, discipline, and the knowledge you’ve gained from this guide, debit spreads can become a valuable tool in your trading arsenal for building wealth over time.

Hold a Master Degree in Electrical engineering from Texas A&M University.

African born – French Raised and US matured who speak 5 languages.

Active Stock Options Trader and Coach since 2014.

Most Swing Trade weekly Options and Specialize in 10-Baggers !

YouTube Channel: https://www.youtube.com/c/SuccessfulTradings

Other Website: https://237answersblog.com/