I’m writing as someone who’s walked into the nerve-wracking world of day trading myself. I explain things simply, share what I’ve learned, and—I hope—make this journey feel less terrifying and more empowering.

Table of Contents

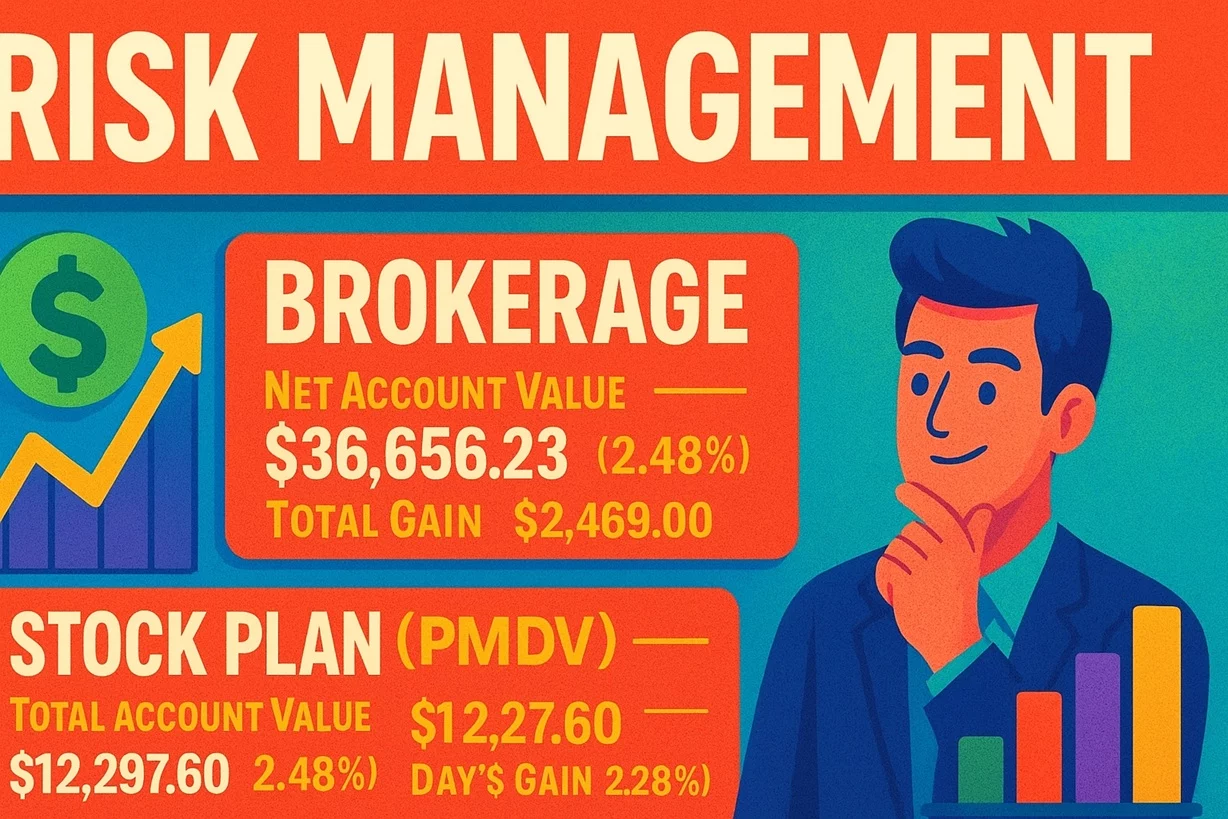

Why Risk Management Matters to Me (and to You)

I want to begin by saying this: without a solid plan to manage risk, I’d likely lose money fast. Risk management isn’t optional; it’s the foundation that keeps me sane and solvent. So if you’re starting out, you absolutely must build that foundation before you place even one trade.

1. Define Your Risk per Trade—Stick to It

I set a rule: I risk no more than 1 % of my trading account on any single trade. That rule keeps me cautious, prevents emotional over-reach, and helps me take losses without panicking.

I also set a fixed dollar-amount stop-loss. For example, I limit myself to a $100 loss maximum per trade. That level of discipline protects my account even when markets zig and zag unpredictably.

2. Use Stop-Loss and Take-Profit Orders Strategically

I never let a trade run without a defined exit plan. A stop-loss locks in maximum loss, and a take-profit order locks in gains automatically. Balanced together, they ensure I don’t let hopes or fear control my reaction.

As one wise source put it, “stop-loss and take-profit orders serve as watchdogs that protect a trader’s portfolio” .

3. Understand and Use Risk-Reward Ratios

Every trade I enter has a risk-reward profile. I aim for setups offering at least 1:2, meaning I’m willing to risk $100 to potentially make $200. Over time that tiny edge compounds, even if I lose more often than I win.

4. Diversify Your Strategy—Don’t Bet Your Whole Account on One Idea

I discovered the hard way that putting all my capital on a single strategy or stock is reckless. I now diversify: I use momentum setups, breakout plays, and occasionally news-driven trades. This buffers me when one method stalls.

5. Size Your Positions Wisely

I learned that position sizing is power. Rather than going “all-in”, I scale my entry so each trade remains a small fraction of my account. That method keeps me in the game even after a bad streak.

6. Have a Back-Up Plan Before Entering Any Trade

I plan for things to go sideways. If a stop-loss fails or volatility spikes, I have a “plan B”—such as exiting midsession or cutting daily losses early. As Brian Shannon advises: “You must have a backup plan… before you enter every trade”

7. Keep a Risk-Management Journal

After every session I review my trades, assess where I got reckless, and adjust. Writing down mistakes and successes helps me refine rules, tighten discipline, and keep emotions out of my next decisions.

Summary of Risk Management Strategies

- Why Risk Management Must Be Your First Rule

- How I Set My Risk-Per-Trade Rules and Stick To Them

- Why Stop-Loss and Take-Profit Orders Save Traders

- How I Use Risk-Reward Ratios to Stay Ahead

- Diversifying Trading Methods to Reduce Exposure

- Smart Position Sizing: The Trader’s Secret Weapon

- Why Having a Plan B Saves Your Capital

- How Journaling Keeps Your Risk in Check

Video Recommendation

This video from a reliable YouTube source offers a complete guide to risk management, including the crucial 1 % rule strategy.

My YouTube Channel Video on Risk Mangement

It complements the advice I’m giving here and gives you a clear framework to implement your own trading discipline.

FAQs

Q: Why risk only 1 % per trade?

Because risking more can wipe out my account in just a few bad setups. Keeping risk small gives room to learn and recover calmly.

Q: Won’t I miss out on big opportunities if I use tight stops?

Not necessarily. Tight stops reduce potential drawdown, and you still capture opportunities through proper setup selection and size. The key is strategy precision.

Q: How do I pick the right stop-loss level?

I set stops at technical support or resistance levels, or based on volatility bands.

Therefore, always base them on logic, not emotion.

Q: What if I hit my daily loss limit early?

Then I stop trading for the day.

That rule prevents revenge trading or emotional breakdowns. It protects your account long-term.

Q: Can I automate risk management?

Yes, trading platforms allow automatic stop and take-profit orders.

Consequently, most traders use them to enforce discipline and avoid human errors, especially during rapid moves.

Conclusion – Keep Risk Your Best Friend

I’ve excited you with strategies, now let me leave you with this: I manage risk because I value staying alive in the markets more than hitting home-runs. Discipline, proper planning, modest position sizing, and constant refinement keep me trading another day. So take that lesson to heart, apply it consistently, and let smart risk management guide your success.

Hold a Master Degree in Electrical engineering from Texas A&M University.

African born – French Raised and US matured who speak 5 languages.

Active Stock Options Trader and Coach since 2014.

Most Swing Trade weekly Options and Specialize in 10-Baggers !

YouTube Channel: https://www.youtube.com/c/SuccessfulTradings

Other Website: https://237answersblog.com/